Bitcoin (BTC) has grown more than 7% in the last seven days, holding the company above the $100,000 level, showing signs of continued bullish momentum. However, recent whale activity has been drawing more cautious pictures, with only a slight increase in large holders and mixed signals over the past month.

One-sided cloud and EMA metrics remain supportive, but also reflect markets that lack strong belief. With key resistance and support levels in focus, BTC’s next move can be determined if there is a risk of pushing towards a new high or returning to below six digits.

BTC whales increase inches, but confidence is still mixed

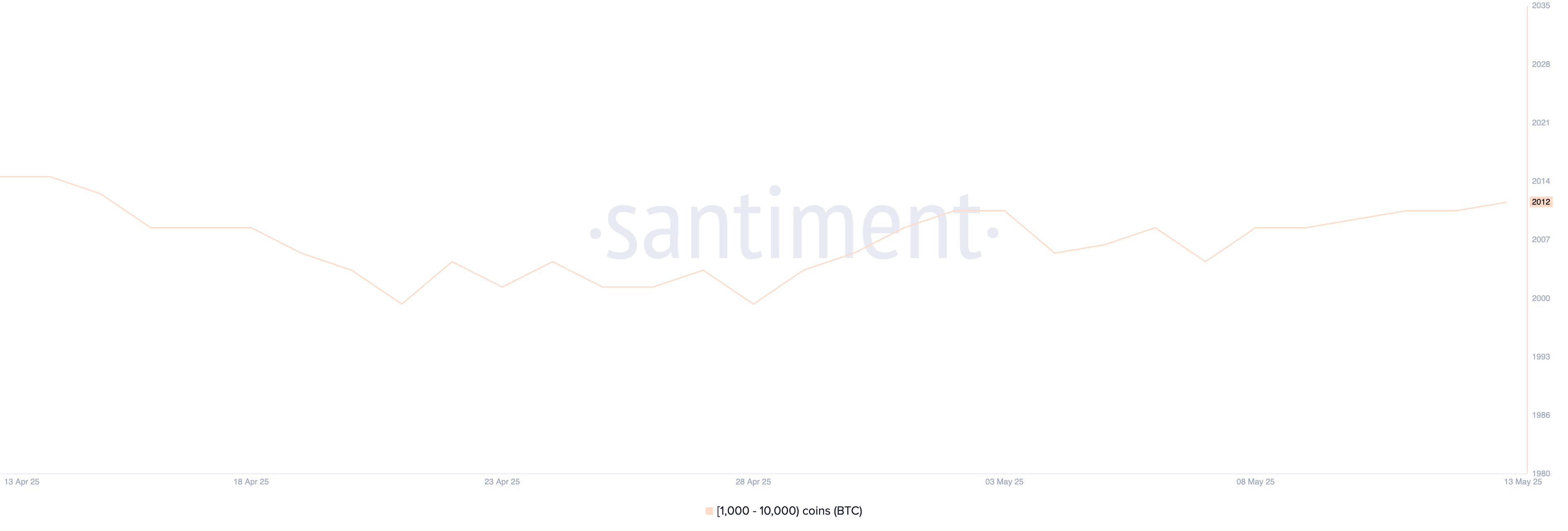

The number of bitcoin jellyfish (a small item holding 1,000-10,000 btc) increased slightly, up from 2,009 on May 9th to 2,012.

The rise may seem slight, but whales’ activity is closely monitored by analysts and investors. Because these large holders often influence the direction of the market through important transactions.

Whale accumulation usually reflects increased confidence in the medium to long-term outlook for Bitcoin, but reducing holdings can be careful or profitable.

Bitcoin jelly. Source: Santiment.

That said, the current pace of growth in whale numbers remains modest and their activities have remained stable over the past 30 days.

The mixed signal was shown last month, with whales alternating accumulation and distribution amid macro uncertainty and unstable price action. This is because all 12 Bitcoin ETFs have been holding back the red as the market shrinks from the $96 million exit in the last 24 hours, the largest daytime leak since April 16th.

This discrepancy suggests that despite the slightest increase in recent days, major players are still navigating the market carefully, rather than committing to a sustained buying trend, despite some analysts who say Bitcoin could soon reach a new all-time high.

Bitcoin is held above the cloud, but slows down momentum

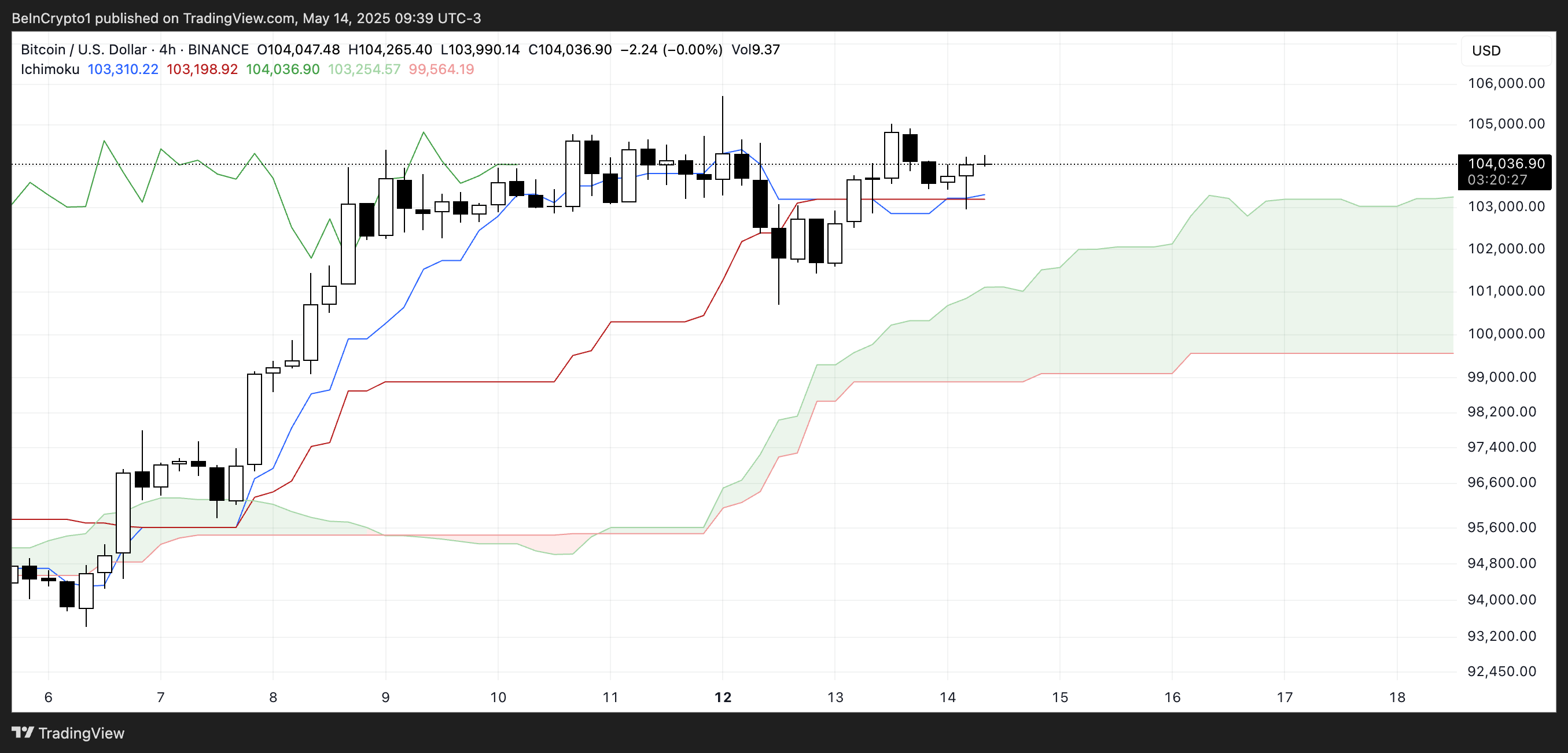

Currently, the Limb Cloud Chart for Bitcoin shows a relatively neutral to vulnerable setup. Price candles are just above the Kijunsen (red line) and Tenkansen (blue line), indicating that short-term support is retained for now.

The cloud (spider) is bullish, with Senkouspan A (green cloud boundary) located above Senkouspan B (red cloud boundary) reflecting positive trends.

btc icchimoku cloud. Source: TradingView.

Chiko’s span (the delay in the green line) surpasses prices since before the 26th period, showing careful bullish sentiment.

Prices still lie above the bullish zone of cloud, but there is a narrow gap between lateral action and the indecisiveness of Tenkansen and Kijunsen’s show.

For the uptrend to gain strength, blue lines must cross clearly above the red lines, forming thicker, steeper clouds and forming ahead.

Important Levels to Watch: Bitcoin’s Next Move After Holding $100,000

Bitcoin prices have steadily held a major psychological level of $100,000 over the past six days, with its EMA line showing a clear upward trend. The average for shorts is above the long term, showing sustained bullish momentum.

If BTC can outweigh the immediate resistance at $105,705, we could raise another leg to $107,038.

BTC price analysis. Source: TradingView.

A strong continuity will push the price to another $109,312, with a potential breakout of $110,000, marking a historic milestone.

However, if the current trend loses steam, Bitcoin could face pullbacks towards its first significant support of $101,296.

Below that level, turning the price back below $100,000 opens the door to a deeper correction at $97,766, potentially $93,422.