The US Securities and Exchange Commission (SEC) has formally approved options trading at the Spot Ethereum ETF.

What does ETH ETF option mean?

This approval allows financial institutions to create and list optional agreements tied to spot Ethereum ETFs, provide investors with a way to hedge their positions, and to infer Ethereum price movements within a regulated US framework.

One important update to approved filings is the position and exercise limit set at exchanges like NASDAQ ISE at 25,000 contracts per investor. This relatively conservative limit is to balance market stability concerns with investor access, allowing critical transactions while reducing operational risk.

Related: “Buy stocks,” Trump says, “bad advice” tells Schiff: Who is right for tariffs?

The exchange pointed to ETH trading activities and broad investor base as evidence of support for list options. As of late 2024, the trust had over 93,000 shareholders, a market capitalization of over $1.1 billion, and an average daily trading volume (ADV) of over 5.3 million shares.

How did the price of Ethereum respond?

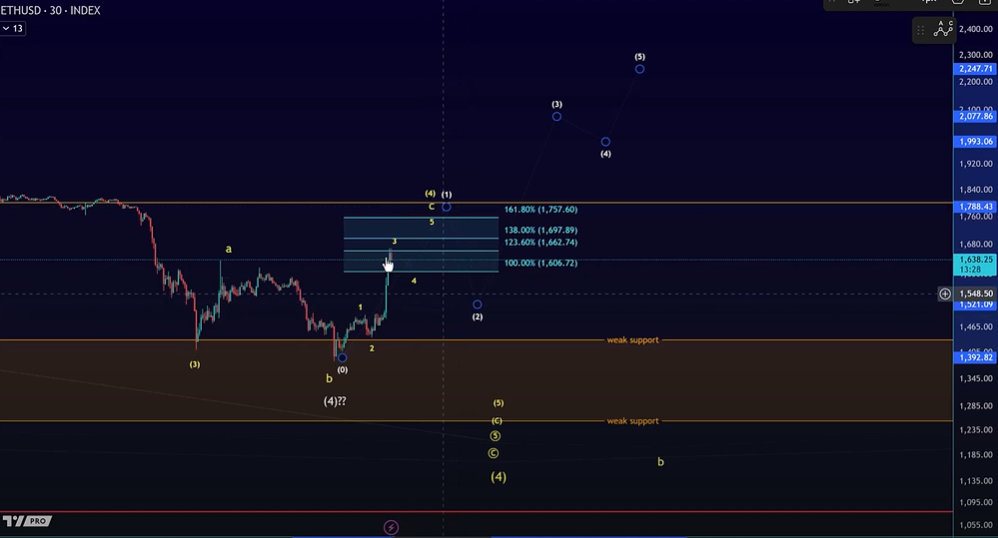

Ethereum saw a positive price response, winning 13% in the last 24 hours, with prices currently trading nearly $1,600. The rally appears to link both positive news of the SEC’s approval of options and broader market relief following President Trump’s temporary 90-day suspension on tariffs. These combined factors have contributed to improving market sentiment in recent years.

The rally pushed ETH past previous resistance, but the technical hurdles remain.

Source: MoreCryptoonLine

Related: Trump’s 90-day tariff suspension cannot waving Polymet’s 65% recession odds

Key resistance levels to monitor include $1,697 and $1,788. The main support zone appears to be between $1550 and $1611 (close to the recent low). Analysts have suggested that holding on top of this support is important for Ethereum to run towards a potentially important $2,000 mark.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.