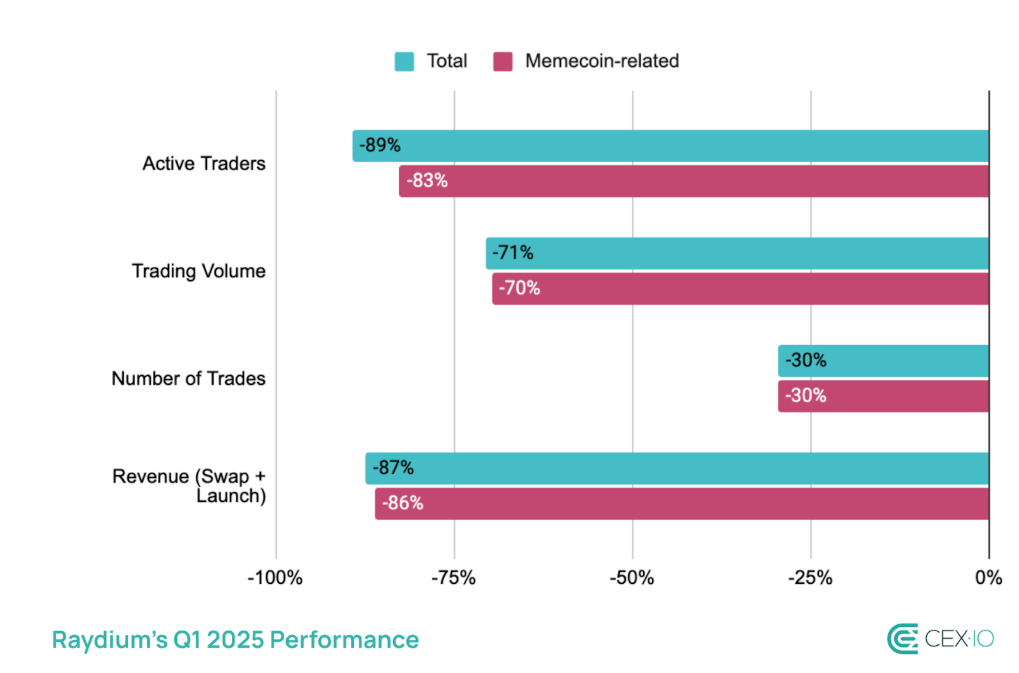

Raydium’s dominance in Solana-based Memecoin trading has increased to 83% over the past three months, even if overall Memecoin market activity has declined.

According to MemeCoins in its Q1 2025 report by CEX.IO, Raydium saw Memecoin trading volume skyrocket to 83% despite the Memecoin market activity and market capitalization shrinking.

Memocoin was on a speculative high-run in January following famous political launches like Trump (Trump) and Melania (Melania) tokens. According to a CEX.IO report, MemeCoins accounted for 11% of total crypto trading volume on January 20th. However, by April 1, Memecoin’s market capitalization had plummeted 58% from its January high, with its trading volume share falling to just 4%.

Source: Memecoins in Q1 2025 Report by cex.io

Despite a decline in overall activity in the Memecoin market, Raydium’s share of Memecoin trading volume rose from 77% to 83% in the first quarter of 2025. This is the direct result of Exchange’s informal partnership with Pump.Fun. Once these Memecoins reached a market capitalization of $69,000, they were automatically listed in Raydium.

You might like it too: Pump.Fun reportedly is testing an internal amm that can replace Raydium

However, with Pump.Fun recently launching its own Dex for Memecoin, it is unclear how this will affect Raydium’s position in the Memecoin Trading Ecosystem. Despite the launch of LaunchLab, Raydium’s own Memecoin Launch platform, much of its past revenue came from Memecoin, which moved from Pump.Fun. Experts point out that the success of launchpads like Pump.Fun is driven primarily by community and lore.

In summary, Raydium’s share of Memecoin trading volume increased in the first quarter, but much of that growth was driven by the Pump.fun token migration. Now that Pump.Fun has introduced its own Dex, Raydium could be hit hard by trading volume. The extent of its decline may depend on the success or failure of its own LaunchLab platform.

You might like it too: Raydium fired Pump.fun clones and industry reception split