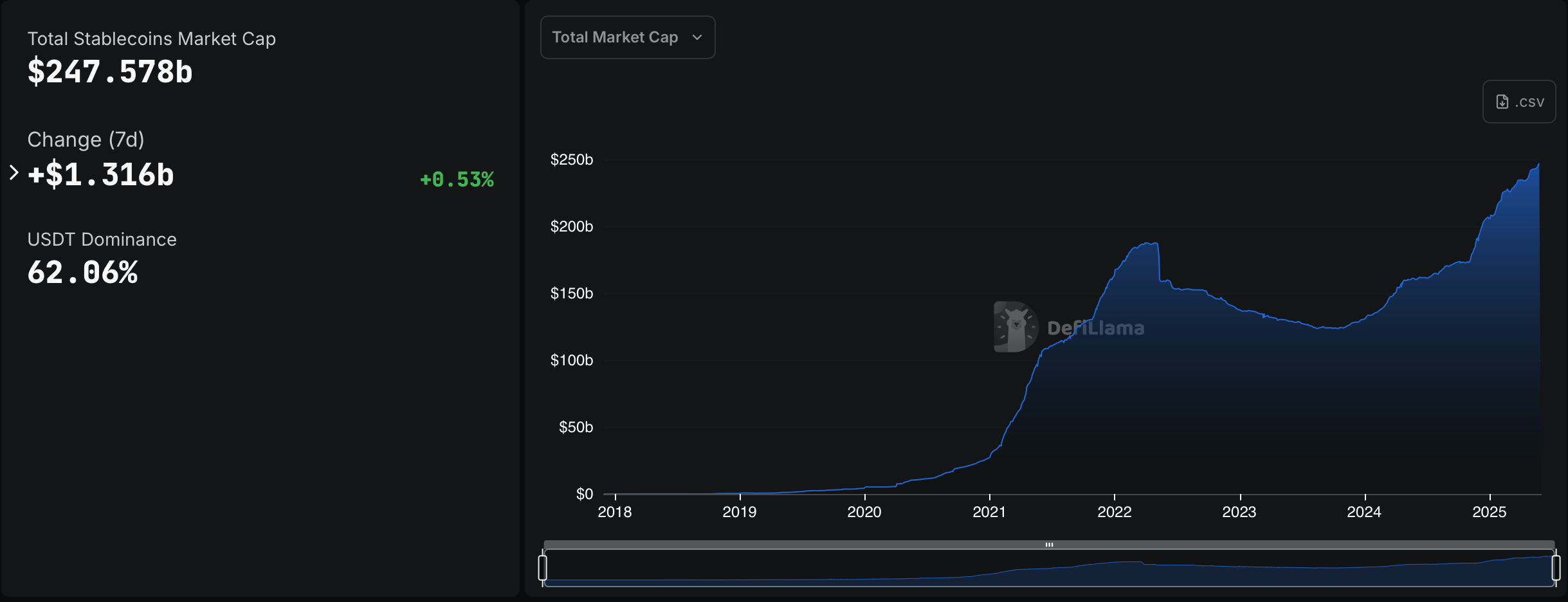

According to current data, the Stablecoin market has expanded by around $13.1 billion in the past week, increasing the total market capitalization of Fiat-related digital assets to $24.757.8 billion. This will bring the Stablecoin sector to a threshold of just $2.422 billion to just $2.422 billion.

Stablecoin Market closed for $25 billion, for just $2.42 billion

Fiat Peg’s token economy continues its upward trajectory, reaching a record high of $24.757.8 billion per Defillama.com metric as of this weekend. It won $13.1 billion in seven days, up $5.511.3 billion from May 1 (30-day stretch). Tether’s USDT leads the pack with a market capitalization of $13.3659 billion, accounting for 62.06% of the Stablecoin Market’s total.

According to data collected by Defilama.com, the Stablecoin economy.

Tether’s market capitalization has grown by 2.9% over the past 30 days to approximately $4.32 billion. In contrast, Circle’s USDC experienced a slight decline of 1.48%, slightly exceeding $909 million over the same period. As of this weekend, USDC holds a market capitalization of approximately $6.060.6 billion. Among the top 10 stubcoins, the standout performer was First Digital’s FDUSD, which increased 15.94% and added a value of $192 million.

Sky’s Dai and Ethena USDE continued to increase monthly by 14.44% and 14.78%, respectively, and sexed the second and third spots of top Stablecoin Gainers. USDE is currently ordering a $5.357 billion valuation, while Dai is catching up to just about $4.7 billion. Currently, the ten major stub coins are USDT, USDC, USDE, DAI, USDS, Buidl, USD1, USDTB, FDUSD, and PYUSD. Apart from USDC’s modest DIP, the only other decline in the group was Sky’s USDS, a 15.77% drop in the past month.

The shift balance between major stubcoins indicates a broader readjustment within the sector, suggesting evolving market preferences and liquidity strategies. As capital allocation continues to fluctuate, these movements may foresee deeper changes in user trust, issuer resilience, and protocol utilities. Market participants may search for signals in quiet readjustment within the Fiat Page Token economy and watch upcoming trends carefully.