The US Dollar Index (DXY) has slipped violently, falling to around 98.50 after disastrous employment reports and political reforms in Washington convinced the Federal Reserve’s interest rate cuts are on the verge of nearing. The weak dollar directly boosted Bitcoin. This is currently trying to get back the key $115,000 level.

The dollar sale was kicked out to Highgear by a July non-farm salary report. Below forecast. Worse, the figures for the past two months have been revised with a massive 258,000 employment.

The sale deepened following President Trump’s firing of Labor Statistics Director Erica Mantelfer’s Office and the unexpected resignation of Federal Reserve Governor Adriana Kugler.

Related: Trump will name the new federal governor after Coogler resigns. BLS head fires

These developments have led to market volatility and have been spent on the first day’s losses since April. By Monday, the index showed signs of stabilization, but remained traded under pressure amidst sustained uncertainty.

From a technical standpoint, DXY remains below the main resistance level of 98.50. Analysts are checking if it’s a lower broken.

BTC vs. DXY. sauce: Bitcoin Magazine Pro

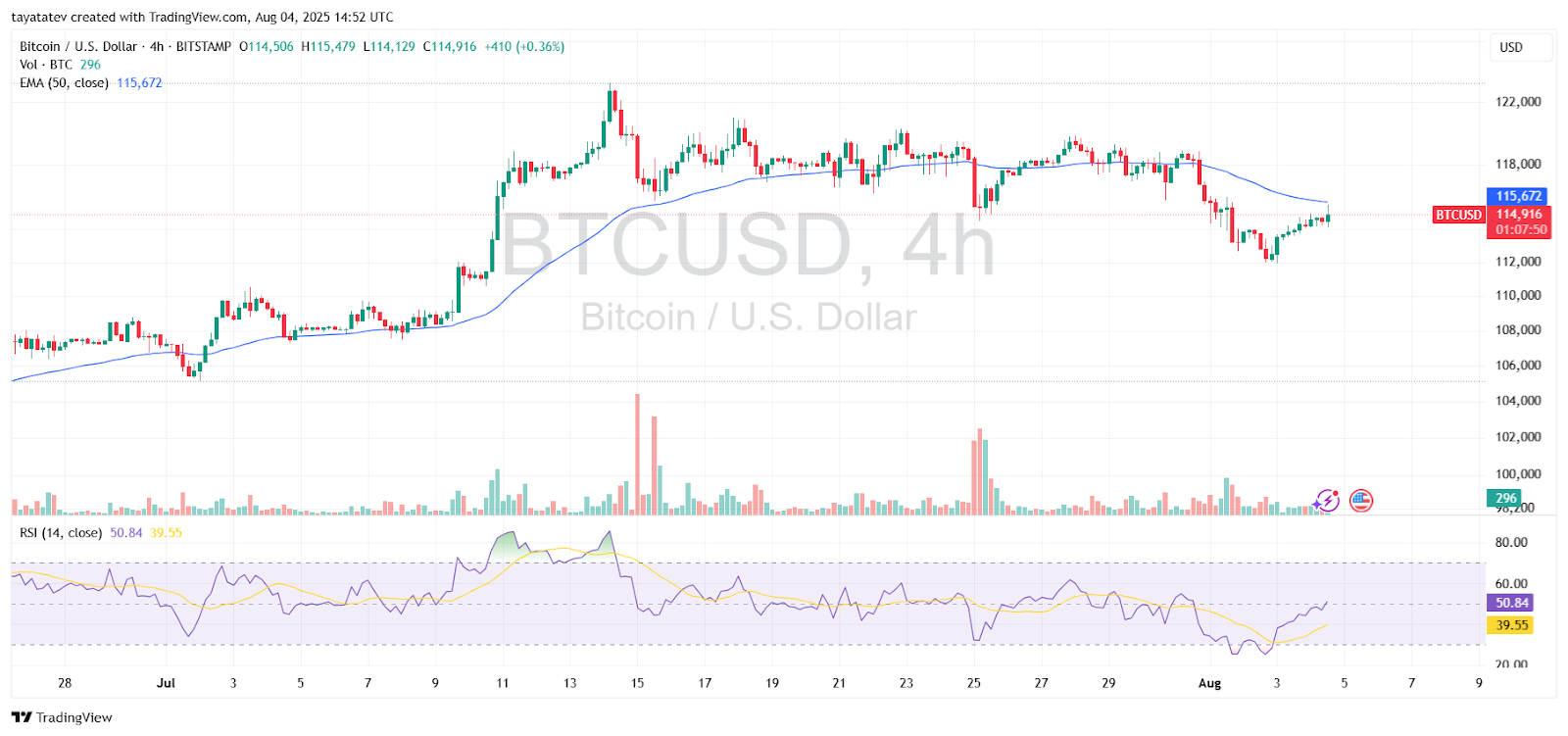

Bitcoin rebounds to $115,000 as RSI recovers and prices approaches key EMA resistance

As the dollar weakened, Bitcoin found its foothold and climbed to around $114,916 after a strong overnight session.

On the four-hour chart, BTC has bounced from its recent lows from nearly $112,000, buying volumes. Prices are currently approaching the immediate resistance, the 50th period’s index moving average (EMA) at $115,672.

BTCUSD 4-hour chart. sauce: TradingView

The RSI, an important momentum indicator, bounced violently from the “oversold” level of 30 and is now back to neutral 50.84. This indicates that strong sales pressure from the beginning of this week has been eased for now. If Bitcoin can be broken and held above EMA, the next target will be a resistance level of nearly $118,000, seen at the highs in late July.

Related: Bitcoin price charts fell 4%, but on-chain, holder demand has increased by 160,000 BTC

Volume data also indicates an increase in activity during recovery, reinforcing short-term bullish emotions. However, if the EMA fails to recover, the BTC range could be held between $112,000 and $115,000 as traders await further confirmation from macroeconomic factors and dollar movements.

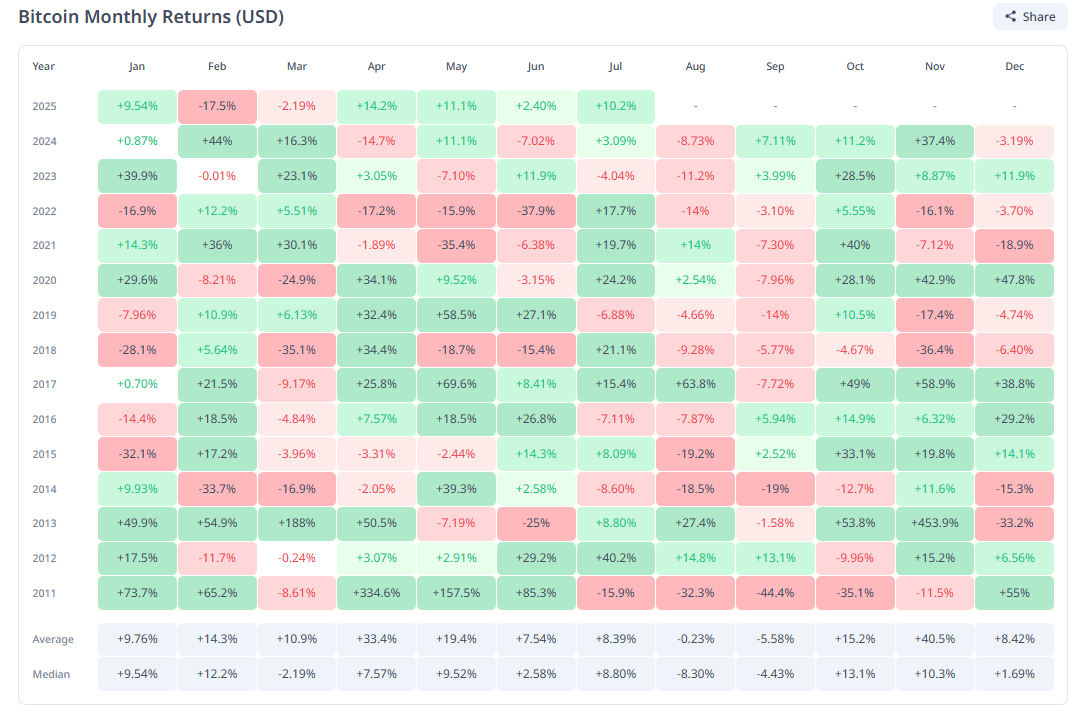

Bitcoin vs. DXY inverse correlation

The broader crypto market has benefited from the growing expectations of easy money from the Fed, with Ethereum, XRP and other major Altcoins profiting. Bitcoin’s price action is closely tied to the dollar price action, as DXY coincides with historically stronger crypto performance.

Traders want to know if the US dollar will collapse or stabilize further.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.