us US Sec has postponed its XRP ETF decision until June 2025.

With the possibility of an XRP futures ETF being released, the approval odds are 74%.

The world’s first XRP Exchange-Traded Fund (ETF), listed under the ticker XRPH11 on Brazil’s B3 stock exchange, has fallen nearly 10% in the past week, off to a rocky start.

The XRP Hash CI ETF concluded its May 5 trading session at R$19.30 ($3.47), reducing the day by 3.5%. In the past five trading sessions, ETFs have fallen 8.70% amid the volatility of the broader cryptocurrency market.

Despite its promising debut, ETF has struggled to gain momentum, facing headwinds from the relatively small Brazilian market, increasing sales pressure on XRP.

At the time of reporting, XRP had fallen by more than 4% in the last 24 hours, trading at $2.10. On the weekly chart, 8.75% closely reflects the losses seen in ETFs.

Spot ETFs don’t have momentum, but they monitor the XRP stage and XRP stage performance, especially when the US ultimately follows the lawsuit and approves similar products.

Spot XRP ETF approval in the US

In that memo, the Securities and Exchange Commission (SEC) recently postponed the decision proposed by Franklin Templeton on the Spot XRP ETF until June 17, 2025.

In particular, this new date comes just two days after the SEC is required to file a status update on Ripple’s partial legal victory appeal in 2023.

Legal analysts believe that timing could be strategic and could potentially give agents a room for the agency to resolve the lawsuit before final decisions are made in the ETF.

Additionally, the SEC is reviewing other XRP Spot ETF applications and is expected to be decided by mid-October 2025.

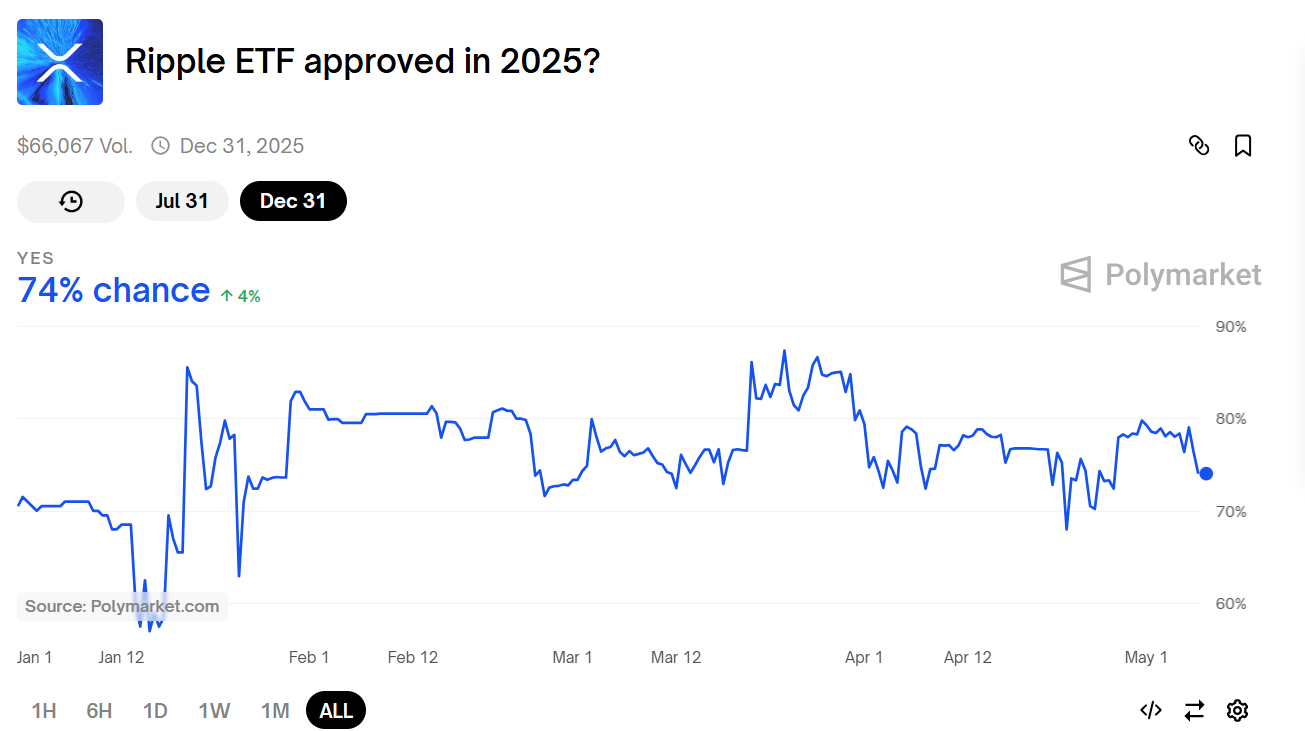

Meanwhile, market participants are confident that approval will occur by the end of the year. According to the forecast market PolymateAs of May 6th, the probability of approval for the XRP ETF was 74%.

The US spot XRP ETF remains unapproved for now, but the SEC is already lit in green with three XRP futures ETFs from ProShares. These were initially rumored to be released on April 30th. However, ProShares has revealed that the deployment is delayed and is currently scheduled for tentatively on May 14th, withholding final SEC approval.

Featured Images from ShutterStock