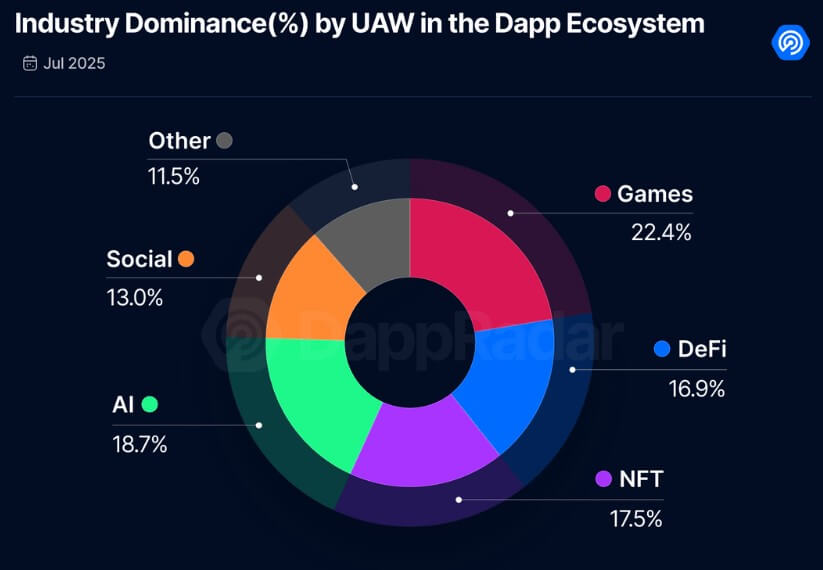

According to a Dappradar report on August 7, the NFT market showed a notable revival in July, surpassing Defi in terms of user activity.

This shift is a significant milestone and could indicate that NFTs are once again attracting public attention following the significant lull that has continued since the NFTs fell into the bear market in 2022.

Surge in NFTS volume in July

Dappradar’s data showed NFT trading volumes skyrocketed 96%, reaching $530 million in July. However, the total number of transactions fell by 4%, with 5 million NFTs changing their hands that month.

This trend reveals clear changes in buyer behavior, and while NFTs are less likely to change hands, they sell at significantly higher prices. In fact, the average NFT selling price has more than doubled, rising from $52 in June to $105 in July.

The platform that caters to power users and creators has grown the most over the period. Blur accounted for up to 80% of Ethereum-based NFT trading volume, driven by professional traders and their blend lending capabilities.

Meanwhile, Opensea, the largest NFT market, remained the most active in daily user count, with around 27,000 traders thanks to its long-term tail list and multichine support.

Meanwhile, Zora, a platform built for creators on the Coinbase-backed base network, has gained momentum with Layer 2 solutions and native Zora tokens, reducing NFT mint costs.

Dappradar concluded that these figures indicate a significant evolution within the NFT landscape, from early market hype to the growing utility of these digital assets.

According to the blockchain company, space is no longer limited to art and digital collectibles. Instead, they expanded to real use cases such as digital identity, event tickets, games, and actual asset tokenization.

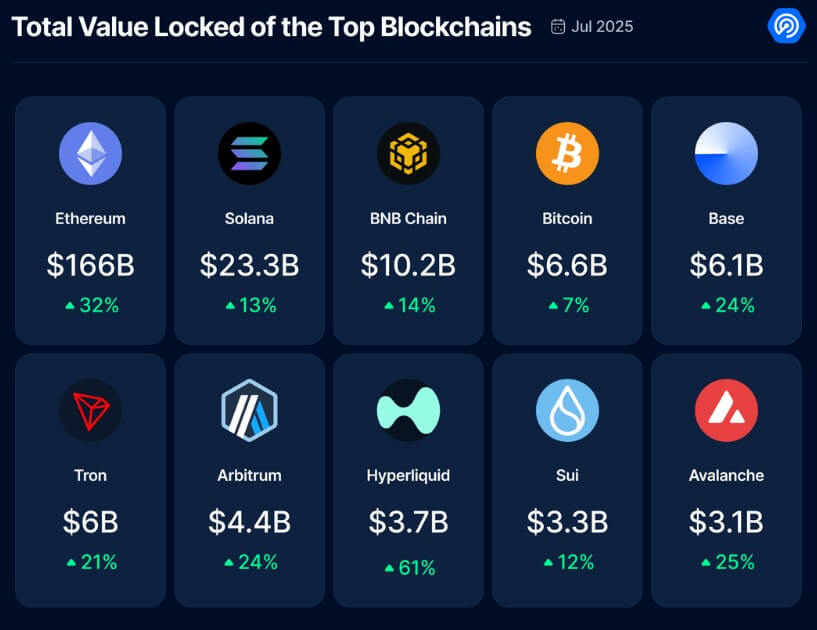

Defi also grows

The NFTS had a wave in July, but Defi continued to experience impressive growth. Dappradar reported that Defi’s total locked assets (TVL) had skyrocketed by more than 30%, reaching $259 billion by the end of the month.

In particular, the sector reached a new high of $270 billion on July 28th. This was driven by increased user demand and fresh liquidity injections across lending, trading and tokenized assets.

Defi’s outstanding trend, meanwhile, stemmed from tokenized inventory, with wallet interactions increasing from around 1,600 to over 90,000. This surge contributes to a 220% increase in the market capitalization of tokenized stocks, indicating that real-world assets (RWAs) are gaining substantial traction.

Beyond assets, Ethereum continues to lead Defi, leading a $166 billion TVL, far surpassing Solana’s $23 billion.

The big rise in ETH could be attributed to a surge in prices at nearly 60% in July. This could be attributed to the development of positive regulations alongside reaching APY of 29.4%.

At Solana, high lipids have emerged as key players, accounting for 35% of blockchain revenue in July. The platform has seen an increasing demand for derivatives, and now handles more than 60% of its 24-hour permanent trading volume, with $15.3 billion in public interest and $5.1 billion in USDC bridging.