The influx of Bitcoin ETFs accelerates the impact of institutional investors on the market and restructures the supply dynamics and overall structure of BTC. As these ETFs flooded the space, many view this wave of institutional participation as an unprecedented change in the Bitcoin narrative. But what if the institution’s data could be used not only to observe the market, but also to outweigh Bitcoin itself?

Who really buys a Bitcoin ETF? Define “institutional”

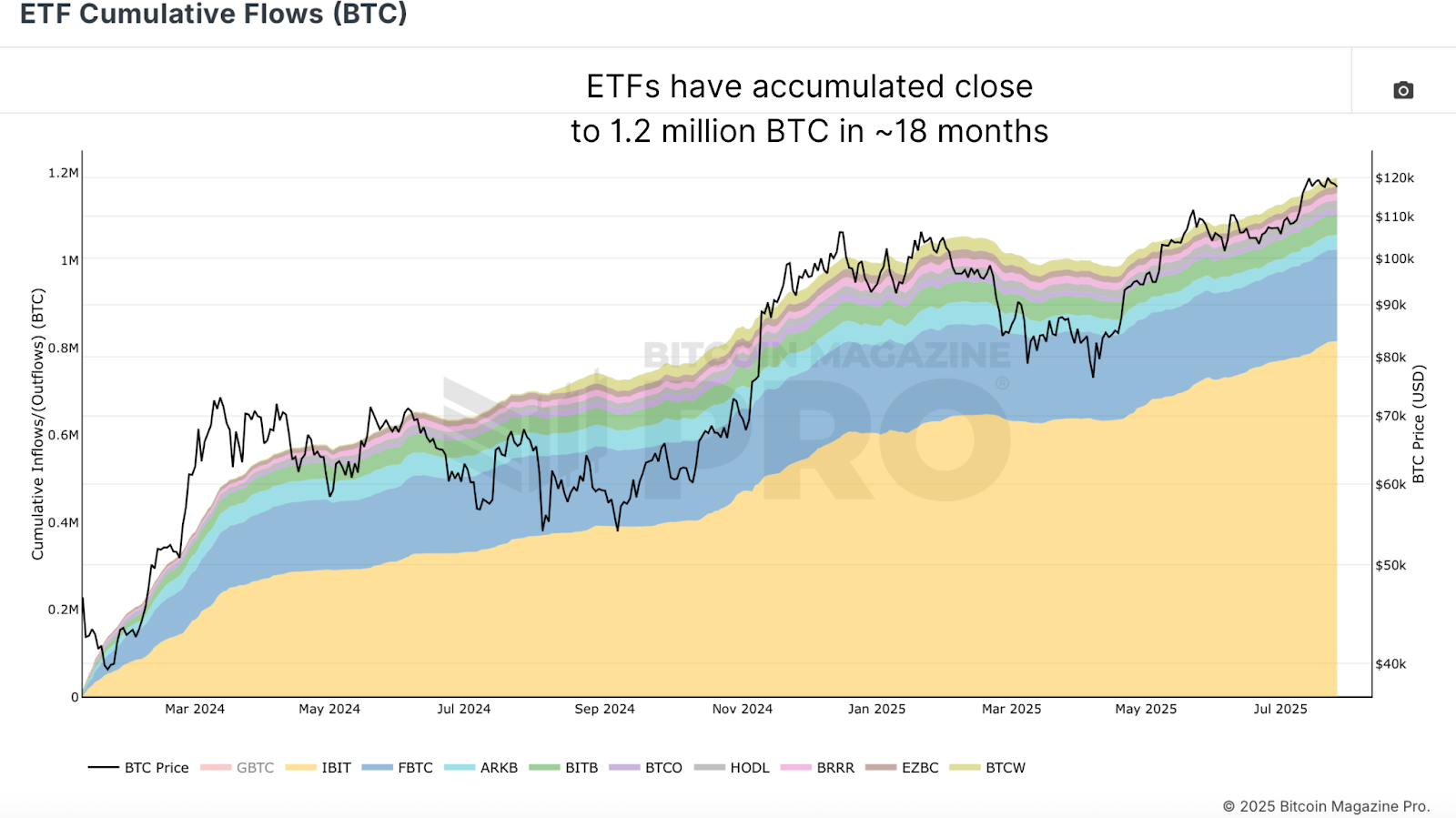

The term “institution” is frequently used as a shorthand for ETF buyers, but in practice these influxes represent a mix of funds from the wealthy, family offices, and actual institutions. Perhaps only 30-40% consider true institutions. Anyway, ETF cumulative flows have grown exponentially to almost 1.2 million BTC since January 2024. This is a transformative volume and will undoubtedly remove meaningful supply mass from the open market indefinitely.

Figure 1: Exponential growth of cumulative ETF flow rates since January 2024. View live charts

This type of accumulation has permanently altered Bitcoin’s liquidity profile, especially when combined with long-term holding actions from finance companies and potentially states. These coins will not re-enter the circulation.

Turn ETF flow data into a profitable Bitcoin trading strategy

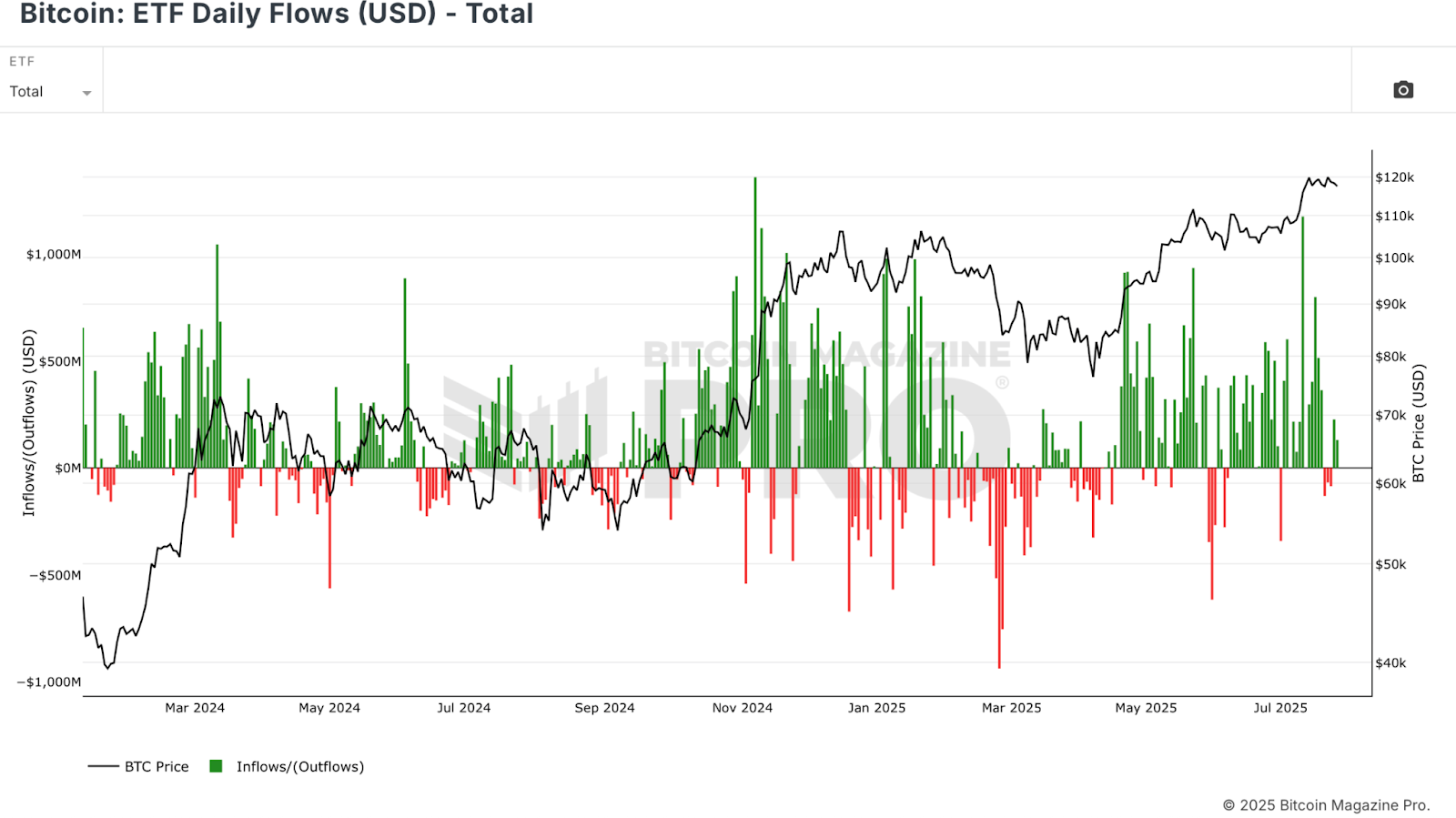

Many consider these ETF participants to be the epitome of smart money. But the data tells a different story. An analysis of the ETF Daily Flows (USD) chart reveals a flock-like behavior that buys large quantities of local tops and surrenders at the bottom of the local area.

Figure 2: ETF Daily Flows chart shows optimal performance from institutional traders. View live charts

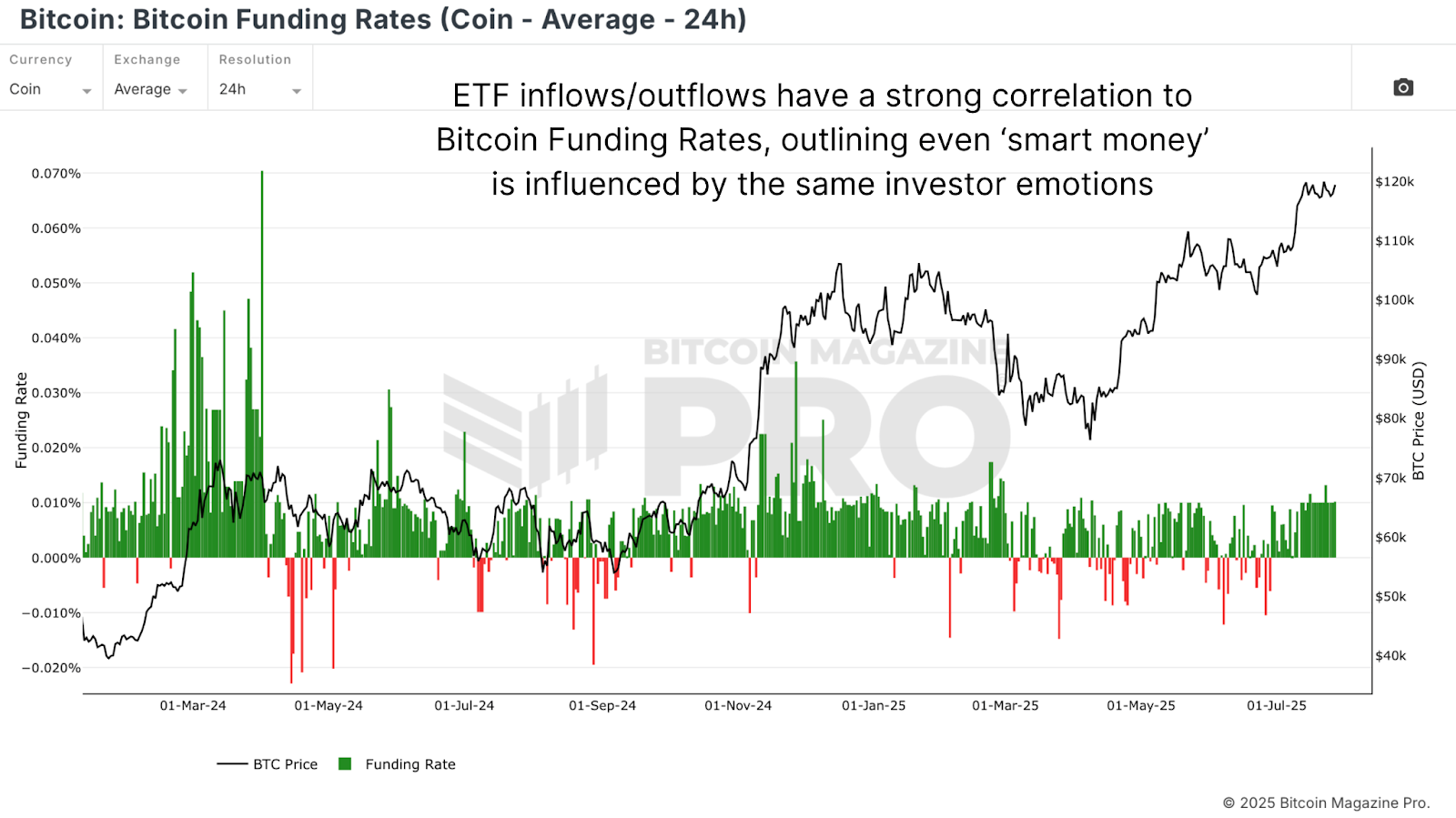

A comparison of ETF flow and Bitcoin funding rates and retail sentiment barometers shows eerie synchrony. The institution is essentially buying and selling at retail stores and is moving ahead. This is not surprising. Human psychology, cognitive bias, and FOMO should not affect people just because they manage large amounts of money. Even the large corporation’s Treasury ministries often end up buying themselves in bullish euphoria.

Figure 3: As depicted in this Bitcoin funding rate data, the behavior of ETFs on previous charts reflects retail sentiment. View live charts

Bitcoin ETF Flow Strategy and Purchases and Revenue: Results

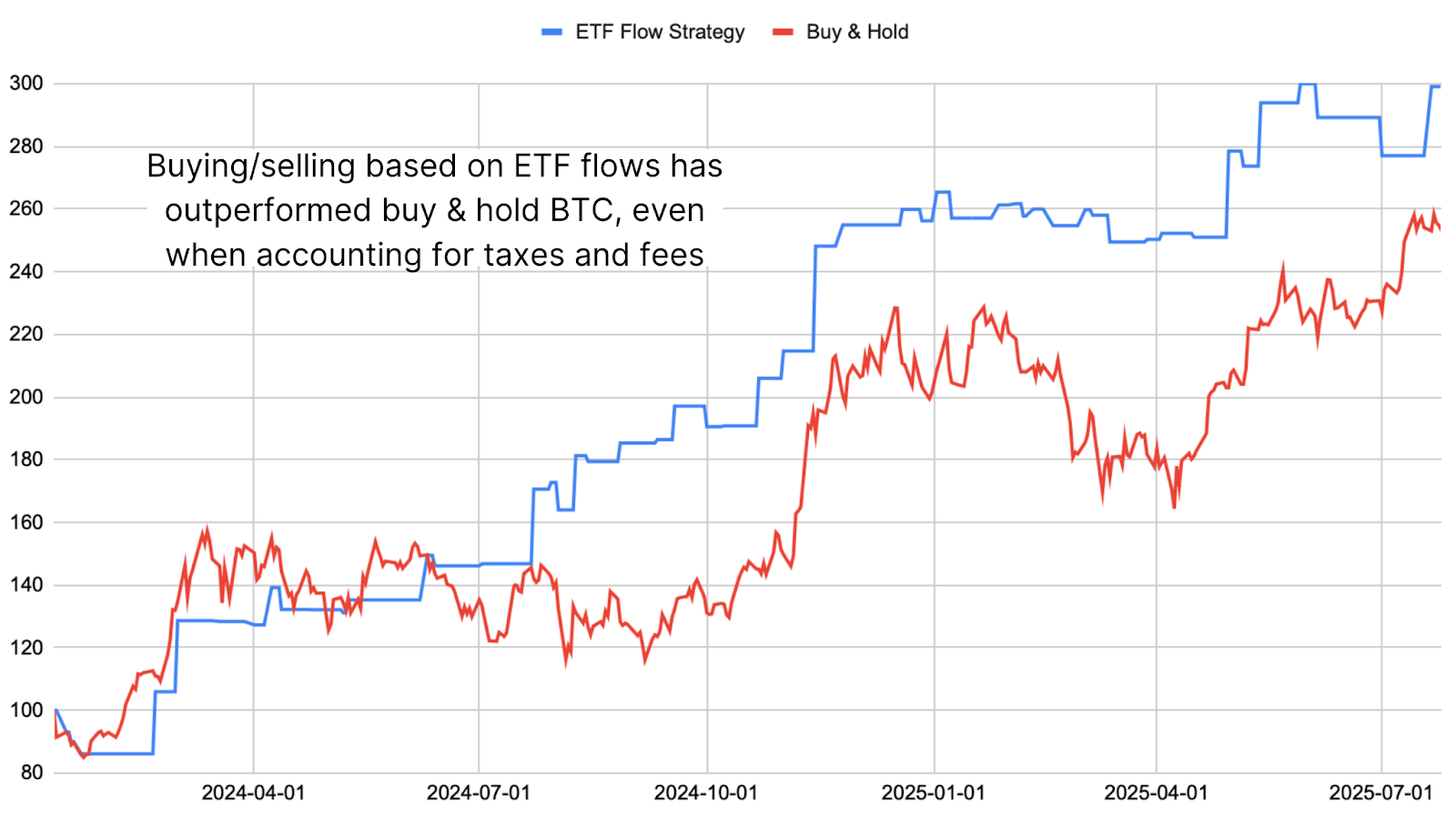

If ETF buyers simply follow the buying trends as prices rise and prices drop, then their inflow and outflow can be as a momentum indicator when interpreted correctly, as a potential entry/exit signal, or even better. To test this theory, we created a simple strategy using ETF flow data via the Bitcoin Magazine Pro API.

Figure 4: Using historical data, trading strategies based on paradoxical signals from ETF flows are purchased and maintained.

The logic is simple. Buy Bitcoin when an ETF indicates an inflow and sell it when it indicates an outflow. It’s not a perfect signal. Early transactions show drawdowns and noticeable misperformance compared to purchases and retention, but returns are impressive when this strategy is applied over a full span since the ETF was launched. For purchase and retention strategies, it’s about 155% versus about 200%. Even when considering nominal 20% tax rates in profitable transactions, the strategy was still excellent.

Should I use a Bitcoin ETF flow strategy?

This type of tactical strategy is not the case for everyone. Many Bitcoiners are long-term holders who do not consider sales. However, for those willing to manage risk and gain edge in the market, this ETF-based strategy provides a way to leverage the behavior of large market participants.

So, will the next institutional flow give you an advantage? In itself, it is probably not consistent. It’s definitely impressive, but this has been working for a long time, but I personally wonder why this works in multiple cycles. However, when combined with a wider market context, it becomes a useful tool for measuring trends and enhancing other signals into compound returns.

Have you noticed the dynamics of Bitcoin’s price in this deep dive? For more expert market insights and analysis, subscribe to Bitcoin Magazine Pro on YouTube!

Check out the latest Bitcoin analysis

For more in-depth research, technical metrics, real-time market alerts, and access to expert analytics, visit bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making an investment decision.

This post This Bitcoin ETF strategy is better than BTC Buy and Hold first appeared on Bitcoin Magazine and written by Matt Crosby.