Bitcoin has recently created a shooting movement, with prices vibrating between $83,000 and $86,000. Interestingly, popular crypto analyst Burak Kesmeci has identified key price levels for short-term actions.

Support at 82,800, resistance at 92,000 – But where is Bitcoin heading?

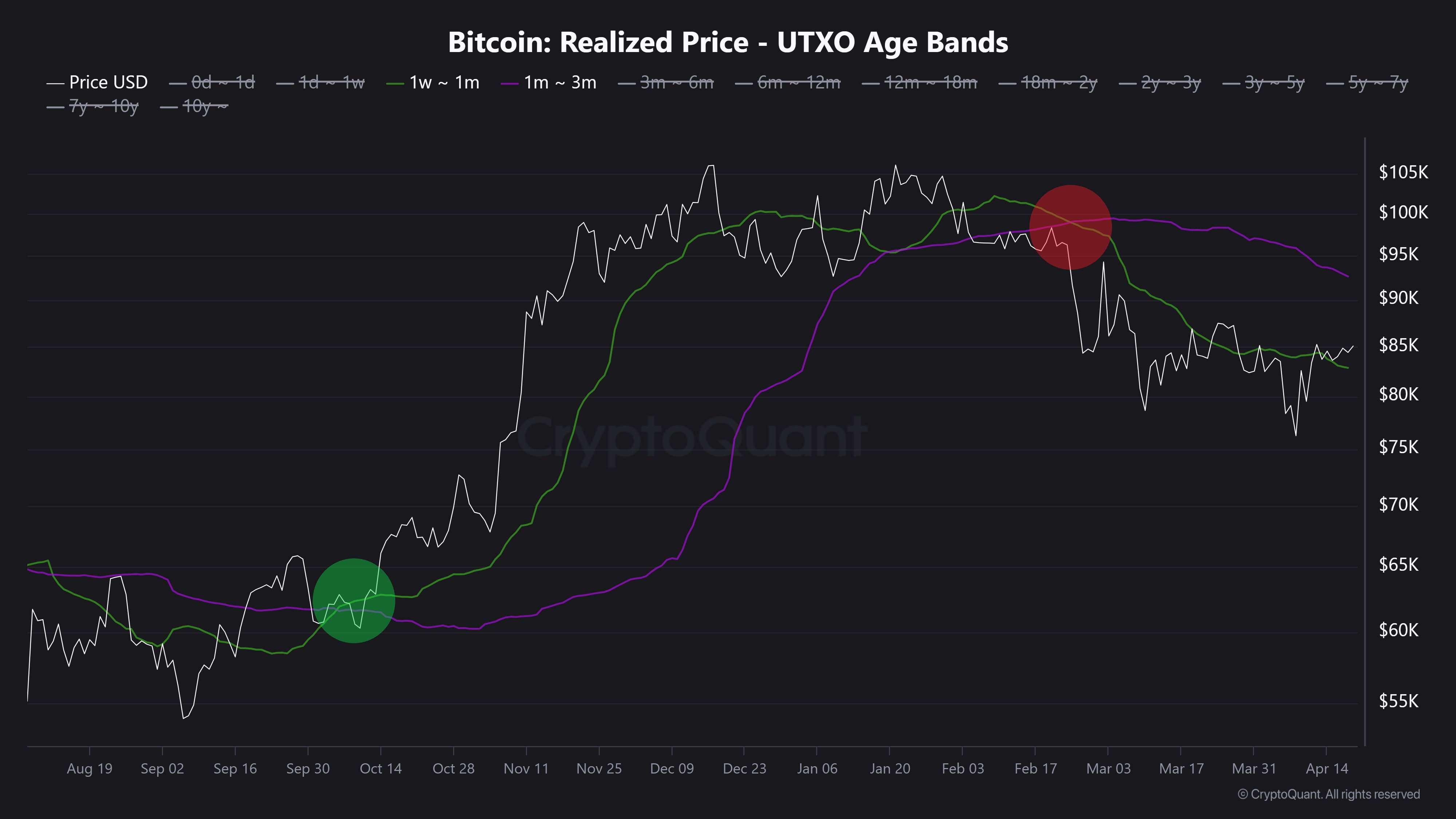

In a new post from X, Kesmeci shared an interesting on-chain analysis of the Bitcoin market. Using a short-term investor cost base, analysts have identified two important price levels that can be proven important for Bitcoin’s next major move.

First, Burak Kesmeci focuses on the average cost price of new traders over the past 1-4 weeks, which could most likely be responsive to price changes. The realised price for these traders is currently at $82,800, and many buyers are still increasing their profits these days, forming short-term support to demonstrate defending this level as a psychological floor.

Meanwhile, Kesmeci also highlights a price level of $92,000, which shows the average cost base for BTC holders for 1-3 months. This price range has emerged as an important resistance zone as investors are likely to exit the market if they break down. Additionally, the $92,000 price level is also marked by its confluence with various technical indicators.

These two levels of interaction are important. Historically, the short-term bullish trend for BTC tends to begin when the cost base of recent investors for 1-4 weeks exceeds the cost of 1-3 BTC holders. This shift increases confidence and motivation to buy at a higher level, and often burns wider gatherings.

However, the dynamics are currently unfolding in the marketplace. Currently, Bitcoin trades around 85,000, exceeding support at an average of $82,800 for one to four weeks, but below the $92,000 resistance for one to three months. Additionally, the cost-based levels for both have been declining over the past two months, reflecting hesitancy and lack of aggressive purchases from newcomers.

In particular, Kesmeci says that BTC should be seen above $92,000, with a strong bullish momentum in price reversals.

Bitcoin ETFS Offload 1,725 BTC

Other news reports that Ali Martinez has been struggling with the withdrawal of 1,725 Bitcoin over the past week, valued at $14692 million. This development has shown a high level of negative sentiment among institutional investors, increasing market uncertainty regarding the BTC market.

Meanwhile, Bitcoin is trading at $85,249, following a price change of 0.89% in the past day. The best cryptocurrencies also reflect a 0.58% loss on the weekly chart and a 1.06% increase on the monthly chart.

Adobe Stock feature images, TradingView charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.