You may need small XRP The amount of Capital inflows to reach a market capitalization of $1 trillion.

With the momentum behind XRP Exchange Traded Funds (ETFS) being built in 2025, discussions regarding the impact of such products on XRP evaluations are currently relevant.

especially, Recent analysis by Xai’s Grok suggests that XRP can be achieved Market capitalization of $1 trillion A relatively modest capital inflow. but, analysis I’ll assume There is a big Multiplier effects and persistent institutional interest.

Currently, XRP holds a valuation of $140 billion and is trading at $2.39 with a distribution supply of approximately 58.555 billion tokens. The potential for the US spot XRP ETF raises questions about how much capital it will need to push XRP’s market capitalization into the trillion dollar range.

Capital inflow required for XRP to reach a market capitalization of 1T$1T

Grok, an AI chatbot developed by Xai, answered this question using a multiplier model of market capitalization. This assesses how capital inflows can lead to increased asset valuations.

Grok’s analysis shows that XRP has a high market response to influx. It belongs mainly Its liquidity and trading volume. For example, on April 12, 2025, XRP experienced an influx of $12.87 million. the result With an increase of $7.74 billion in market capitalization.

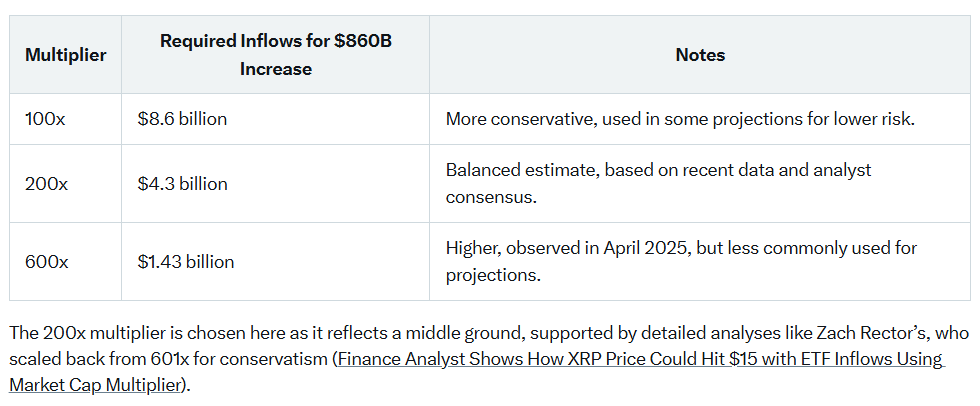

this It is converted to a multiplier effect of about 601x. However, Grok used a 200x multiplier in its estimate to ensure a more conservative and realistic forecast.

meanwhile, XRP To reach $1 trillion in market capitalization, an additional valuation of $8600 billion is required. The capital needed to harness the 200x multiplier and welcome this additional valuation of $860 billion will be around $4.3 billion in net inflows.

Predicted XRP Inflow Requirements | Glock

What’s important is Actual The multiplier will be $8.6 billion when the inflow requirement doubles due to low market dynamics. Meanwhile, if XRP continues to maintain a high multiplier similar to its past performance, a low inflow of $1.43 billion would be enough to push it to $1 trillion, converting it to a price of $17.

Interestingly, JPMorgan estimates that once the XRP ETF is approved, it can attract between $4 billion and $8 billion in its first year. This range is consistent with Grok’s $4.3 billion estimate. Create potential trillion dollar milestones within reach When investors are highly interested.

XRP ETF prospects

Meanwhile, several recent developments have added momentum to XRP ETF prospects. April 8th, Teucrium Investment Advisors Release NYSE Arca Exchange Teucrium twice the length of XRP ETF (XXRP).

The leveraged product debuted with a trading volume of $5 million and ranks in the top 5% of ETFs in US history. Teucrium has already announced plans to introduce reverse products to meet investor demand.

Plus, pro share It is set Launch 3 XRP futures-based ETFs May 14, After receiving regulatory approval. especially, Proshares is also applying for the Spot XRP ETF, which remains an SEC review.

Internationally, Brazil has become The first country to approve the Spot XRP ETF. Specifically, HashDex’s XRPH11 began trading on the B3 stock exchange on April 25th. The fund holds approximately $40 million in managed assets and allocates at least 95% of its holdings to XRP or XRP-linked products.

In the United States, optimism about regulatory approval is growing. Nine Selection subject Asset managers such as Grayscale, Bitwise, Franklin Templeton and 21Shares have submitted applications for Spot XRP ETF.

The main decision date is approaching, and Grayscale’s May SEC deadline twenty two, Franklin Templeton We are hoping for a verdict by June 17th. Analysts now predict that approvals could arrive Later of the yearprobably by the fourth quarter.

now, With ripples I’m calmed down A long-term legal battle with Seconds, And the current administration, which has adopted a procrypted attitude, is seeing market participants see future obstacles.