Bitcoin (BTC) has earned its profits for the fourth consecutive month. But it ended the first red weekly candle in July.

Many analysts believe the Bull Run may not be over yet, but some signals begin to appear, suggesting possible price adjustments or consolidation.

Is Bitcoin taking a breather after 4 months of profit?

These warning signs do not necessarily mean that Bitcoin will reverse, but they serve as early indicators of demanding attention before stronger movements or greater volatility occurs.

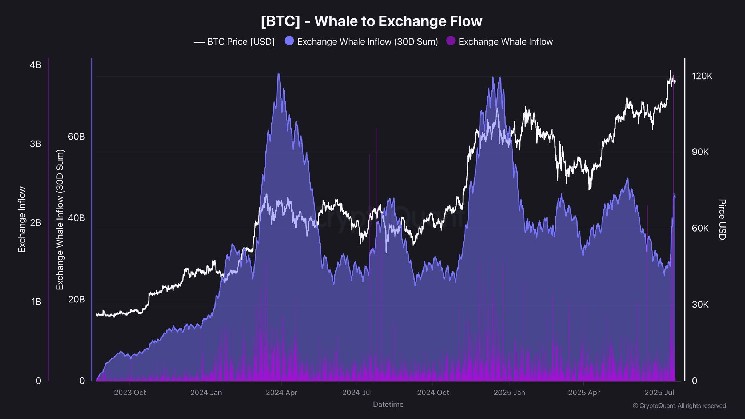

1. Whale exchange flow spike bitcoin

First, the flow data for exchanges from Bitcoin Zilla shows a significant increase in July. This metric reflects the amount that a large BTC holder (whales) sends to exchange, and usually means the intention to sell.

Exchange flow from Bitcoin Zilla – Source: Cryptoquant

At the last two market peaks, whales’ capital inflows exceeded $75 billion, marking the beginning of a revision or integration phase, according to analyst DarkFost. Between July 14th and July 18th, 2025, this figure has already reached $45 billion. This rapid rise shows an increase in activity from large investors.

“(This whale activity) needs to be monitored closely as it could put a significant sales pressure on whales, as they did at the last two tops,” DarkFost said.

The DarkFost view is consistent with recent observations of chains from LookonChain. Today, Lookonchain reported that a savvy bitcoin jilla had made a profit by sending 400 btc (valued by $47.1 million) to Binance, with a total recognition profit of $91.5 million.

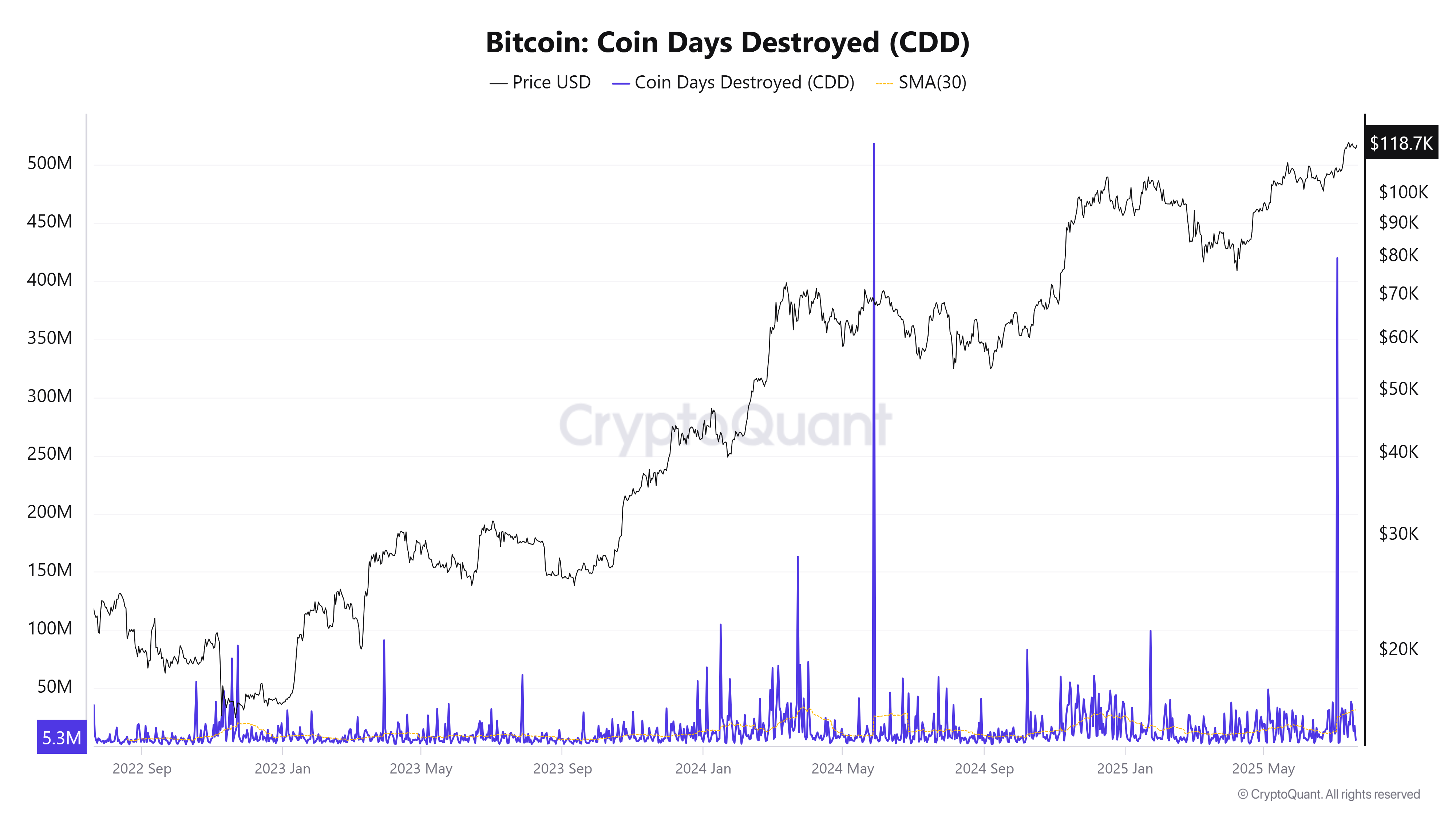

2. Bitcoin Coin Days Destroyed (CDD) hits high every year

Beyond the whale flow, on-chain data shows another signal. Bitcoin Coin Day (CDD) in July reached a year-long high.

The CDD measures the amount of time a coin was held before it moved. It reflects the feelings and behavior of long-term holders. High CDD values suggest that long-term holders are moving coins and are more likely to sell them.

Bitcoin Coin Days Destroy (CDD) – Source: CryptoQuant

According to Cryptoquant, the 30-day CDD average in July exceeded 31 million, the highest since April 2024. Previous reports from Beincrypto pointed out that the spikes in this indicator often precede major market corrections. On the positive side, however, it can also be seen as a redistributable to new investors.

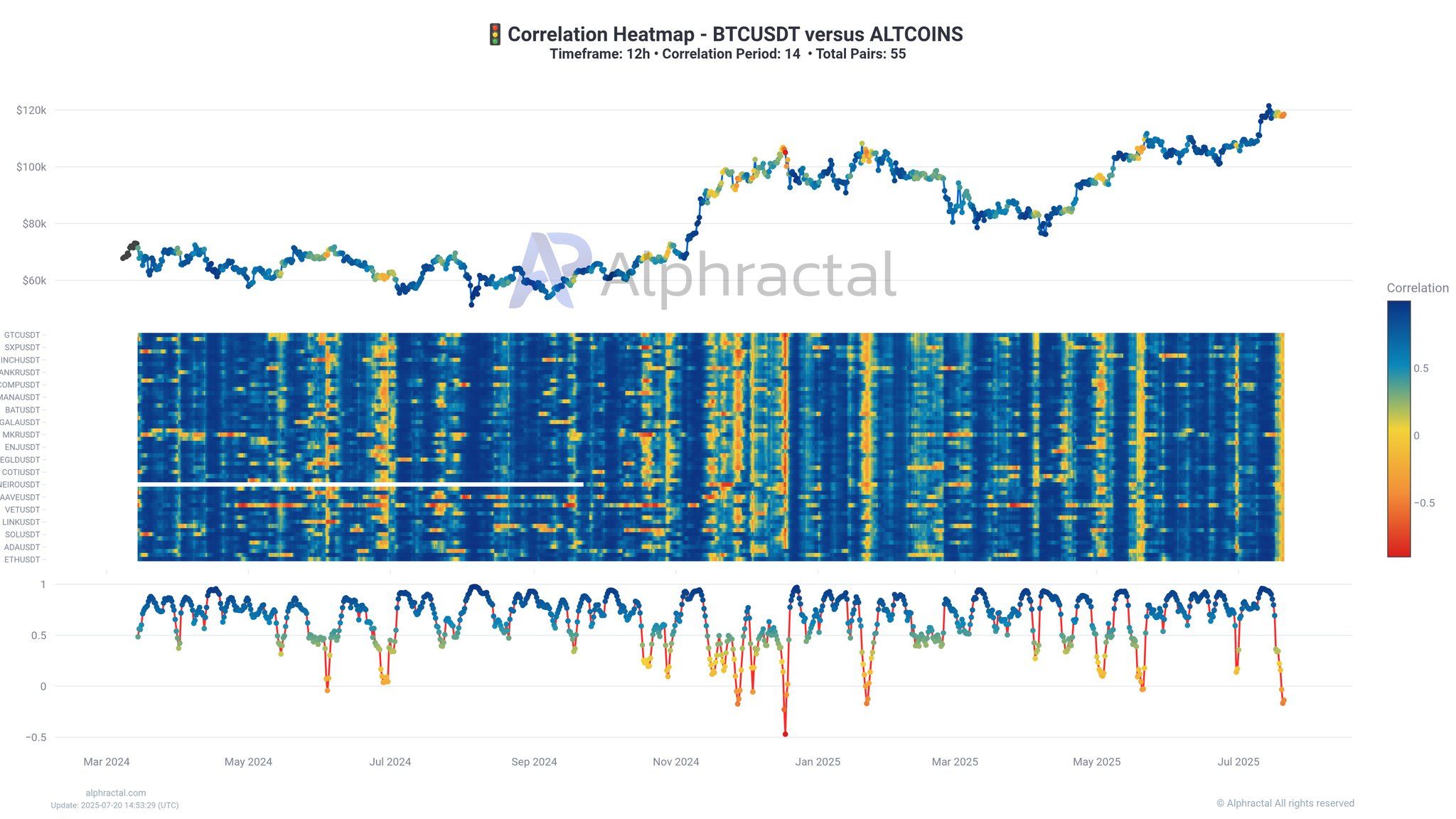

3. Altcoin-Bitcoin correlation changes to negative

Finally, the changing correlation between Altcoins and Bitcoin has sparked even more concern.

According to Alphractal, the Altcoin-Bitcoin correlation heatmap has recently fallen below zero. This shift means that Altcoin has outperformed Bitcoin recently.

However, historical data shows that the low correlation between Bitcoin and altcoin is often the red flag.

Altcoin-Bitcoin correlation heatmap. Source: Alphractal

Since its launch in 2025, the indicator has been negative three times. It was first in January, and then Bitcoin prices fell from $110,000 to $74,900. The second time was in May, with BTC falling from $112,000 to $98,500. Now we are seeing the third outbreak.

“Historically, the low correlation is the red flag. Often precedes a period of high volatility and mass liquidation, whether it’s shorts or long,” Alphractal warned.

A recent report from Beincrypto also highlighted another report on the signal. Coinbase Premium is detached from Kimchi Premium. This cut suggests a non-uniform bull run across the global region, driven primarily by strong US institutional demand.