Bitcoin prices have resumed their upward trend this week as they surpassed key resistance at $97,000 and reached their highest level since February.

Bitcoin (BTC) had traded about $96,500 on Saturday’s check. This is a 30% increase from the April low. In this article, we look into some of the top three reasons that could surge to the new all-time highs this year.

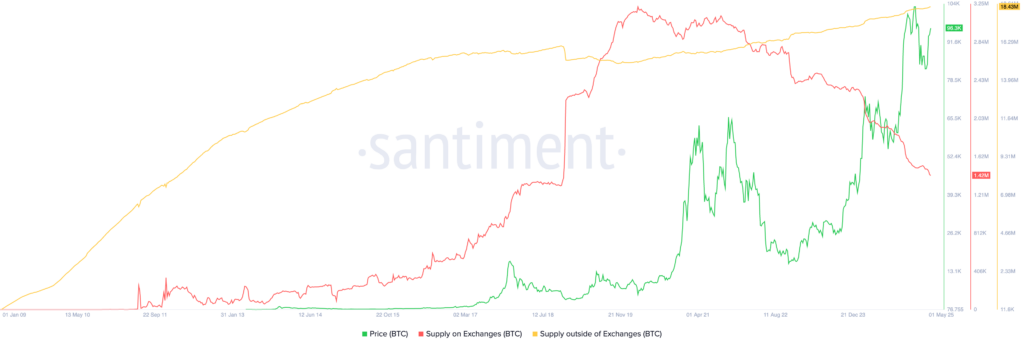

Bitcoin supply for exchanges is declining

The first major bullish side is that Bitcoin supply in exchanges fell to 1.42 million, the lowest level in over six years. Currently, there are 1.42 million coins in the central exchange, the lowest level since November 2018. The highest level in 2018 was 3.21 million.

More data shows that non-exchange Bitcoin supply has jumped to 18.43 million. These numbers mean that investors are not selling coins. This can lead to supply pressure as demand continues to rise.

Some of the top Bitcoin holders are not going to be selling them anytime soon. Michael Saylor’s strategy, which holds more than 2% of the total supply, continues to be purchased. Similarly, top companies like Coinbase, Tesla, Galaxy Digital and Block have not suggested selling.

Exchange BTC Supply | Source: Santiment

Retail and institutional demand is high

Another major reason for Bitcoin prices to continue to rise is the continued increase in retail and institutional demand.

One indicator of this is the inflow of Bitcoin exchange sales funds. Sosovalue’s data shows that Bitcoin ETFs have not been leaked for four months since they launched last January.

Bitcoin ETF inflow | Source: SosoValue

These funds have accumulated over $40 billion in assets. BlackRock’s IBIT has $6 billion in assets, while Fidelity’s FBTC and ARKB at ARK Invest have $20 billion and $19 billion, respectively.

The rise in ETF inflows is a sign of institutional demand in the US, and there are also signs that the next phase of demand will be brought from countries looking to diversify from the US dollar.

These supply and demand dynamics explain why analysts are so bullish on Bitcoin. Standard chartered analysts have seen the coin jump to $200,000, but Ark Invest expects it to jump to $2.4 million in 2030.

Furthermore, Bitcoin demand is expected to rise as trade tensions ease.

Bitcoin price technology analysis

BTC Price Chart | Source: crypto.news

Finally, Bitcoin prices have strong technology and can be much higher in the long run. Since August 5th last year, it has surpassed the ascending trendline.

Bitcoin is above key resistance levels at $88,690, the neckline of the double bottom pattern. It also surpasses the exponential moving averages of 50 and 100 days.

So there are signs that it’s gaining momentum, and it will first push beyond $100,000 and then to the highest ever.

read more: Melania Meme Coin Team abandons 9.99m tokens in 8 days and so far has netted 170K Sols