Tradfi’s relationship with Bitcoin continues to evolve, with 34 public companies currently exceeding $72 billion, with 699,387 BTC combined. MicroStrategy remains an indisputable leader, holding only 555,450 BTC.

Some Bitcoin financial strategies are considered bullish catalysts, but the data tells a more nuanced story. Adding BTC to the balance sheet is not a guaranteed inventory booster. Outliers like Metaplanet have skyrocketed over 3,000% since BTC’s entry, but many others have seen much more modest profits.

Metaplanet Inc.

Metaplanet is a Japanese public company that quickly transformed from one of Asia’s most aggressive Bitcoin-centric companies, traditional business (traditional businesses involved based on hotel operations). The transformation shows how some TRADFI players are modelling around digital assets.

Since launching its Bitcoin revenue generation strategy in late 2024, the company has pivoted sharply towards crypto, coming from Bitcoin Options Premium Harves, with 88% of its first quarter revenue (770 million yen ($5.2 million)).

Metaplanet first added Bitcoin to its balance sheet in April 2024 and currently holds 5,555 BTC worth around $576.8 million. Since that first move, the company’s shares have skyrocketed above 3,000%, with the recent application showing a 15x increase in stock prices annually.

Metaplanet price analysis. Source: TradingView.

The company’s aggressive BTC accumulation strategy (targeting 10,000 BTC per year end) attracted increased investors’ profits and expanded its shareholder base by 500% in a year.

Despite the short-term valuation losses due to price fluctuations in Bitcoin, Metaplanet reported 13.5 billion yen in unrealized BTC profits as of May 12, showing strong confidence in long-term crypto positioning.

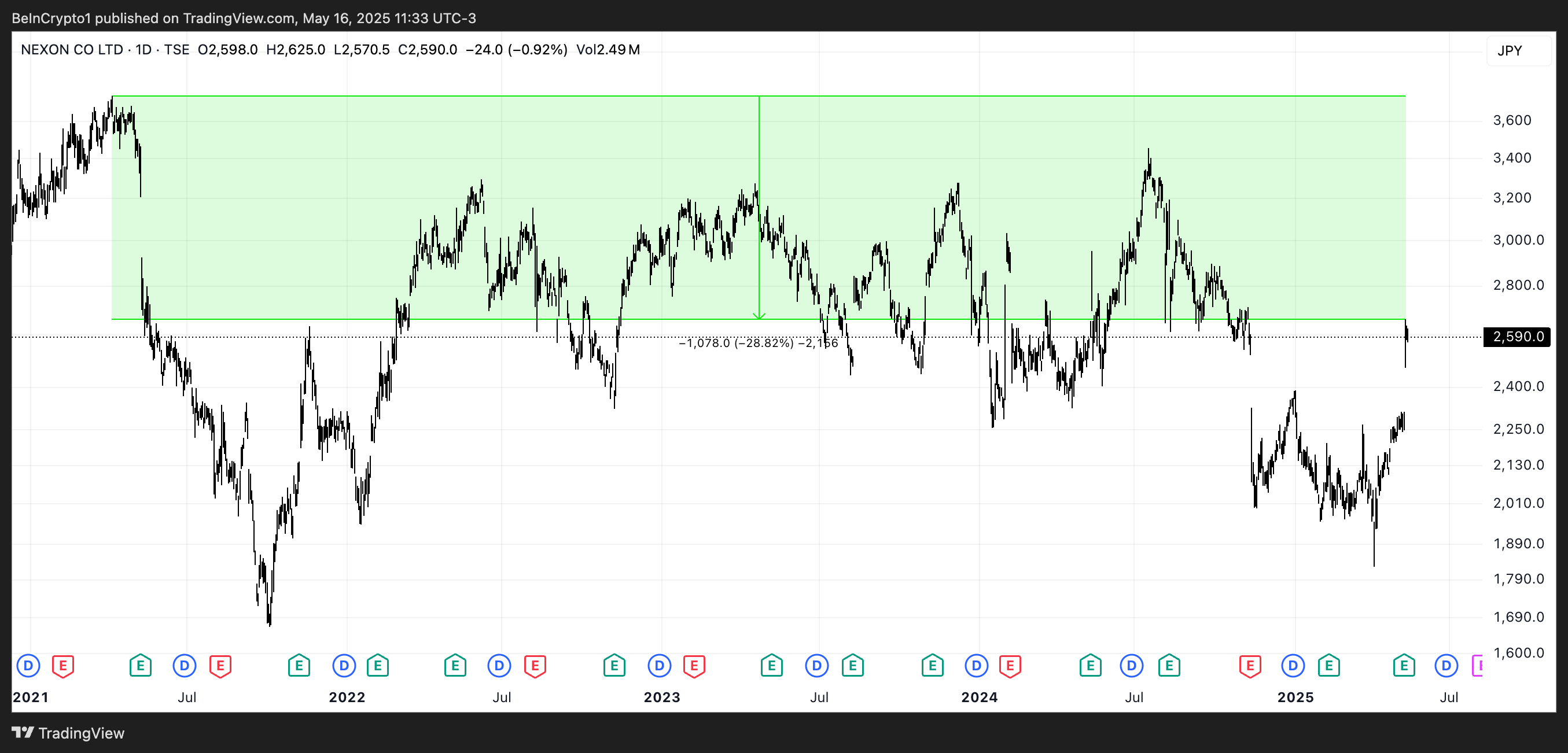

Nexon

Nexon, the leading Japanese gaming company behind global hits such as Dungeon & Fighter and Maplestory, added Bitcoin to its balance sheet in April 2021, and currently owns 1,717 BTC.

Despite this substantial allocation, Nexon’s shares have fallen nearly 29% since their purchase, so the move has not paid off in terms of market performance.

Nexon price analysis. Source: TradingView.

Unlike other companies that saw major investors’ enthusiasm from Bitcoin exposure, Nexon’s value is more closely tied to the performance of the gaming franchise.

In its first quarter 2025 revenue report, Nexon rose 113.9 billion yen, up 5% year-on-year, to 43%, to 41.6 billion yen, reaching core titles and low-cost performance.

Semler Scientific (SMLR)

Semler Scientific bought its first Bitcoin in May 2024 and currently holds 1,273 BTC, worth around $132.2 million.

Since adopting Bitcoin as a major Treasury reserve asset, the company’s shares have risen by more than 55%.

Although it is smaller in size compared to the owners of the Top Crypto Treasury, Semler’s aggressive accumulation and performance positions it as a prominent player in Bitcoin’s corporate adaptation narrative.

SMLR Price Analysis. Source: TradingView.

In its first quarter 2025 revenue call, Semler Scientific reported complex performance. Revenues from the decline in the healthcare segment fell 44% year-on-year to $8.8 million, while operating losses increased to $31.1 million, at a cost of $39.9 million.

The net loss of $64.7 million was primarily due to an unrealized loss of $41.8 million due to price fluctuations in Bitcoin.

Despite these set-offs, the company reaffirmed its commitment to expanding its BTC holdings through its $500 million ATM program and a $100 million convertible note.

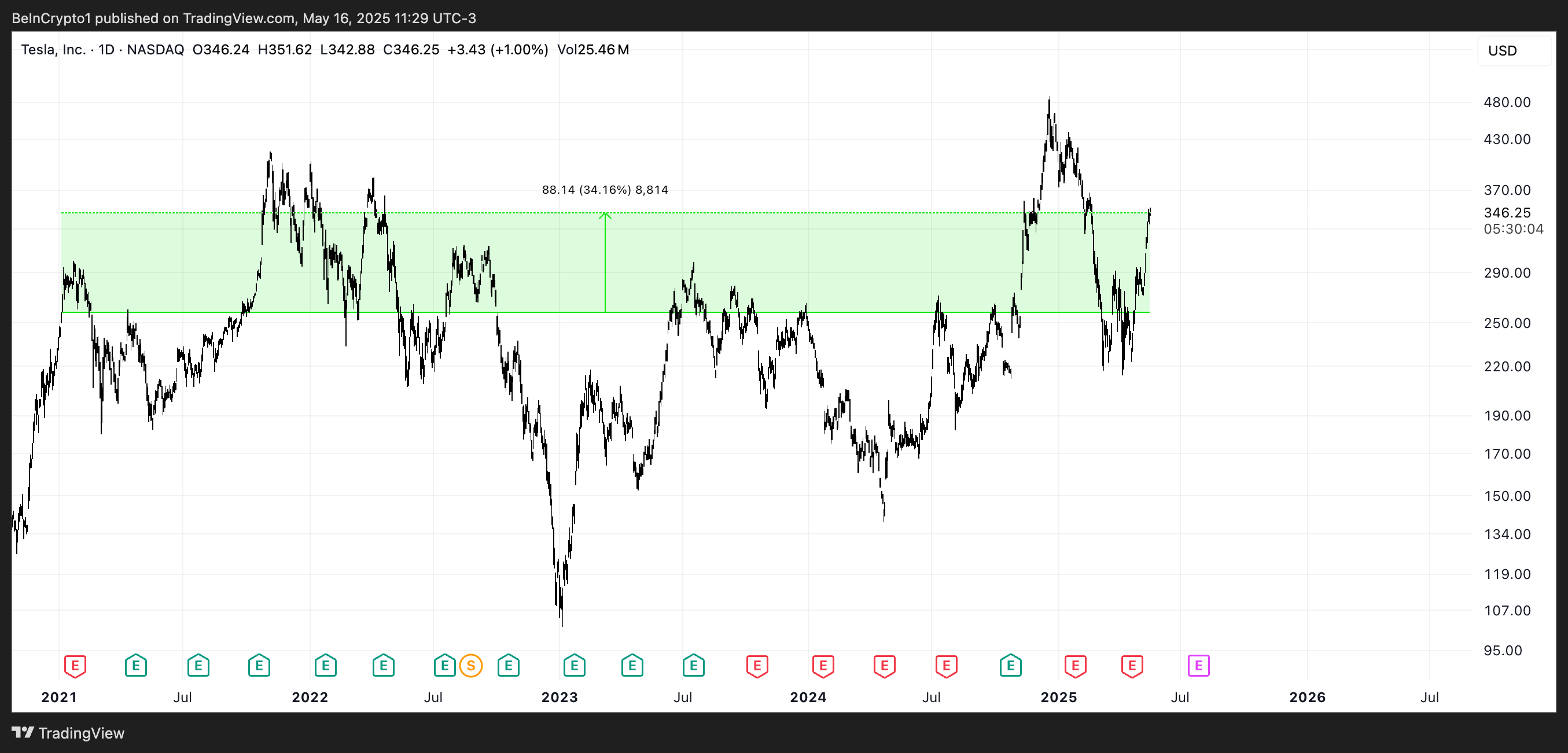

Tesla (TSLA)

Leading by Elon Musk, Tesla has been building a complex, headline grabbing relationship with Bitcoin since it added to its balance sheet in January 2021.

Musk, a longtime crypto enthusiast, has influenced market sentiment, both through Tesla’s actions and his personal commentary on digital assets such as BTC and Dogecoin. Tesla stocks have grown 34% since the initial Bitcoin purchase, but before it fell below $107 in late 2024, the pass was volatile.

Despite the swing, Musk’s Bitcoin advocacy and Tesla’s early exposure to cryptos helped position the company as a positive for institutional adoption of crypto. That journey reflects the volatility and complexity of crypto exposure within large Tradfi companies, as BTC has increased by 212% over the same period.

TSLA price analysis. Source: TradingView.

However, in revenue for the first quarter of 2025, Tesla recorded a disappointing result. Auto revenue fell 20% year-on-year to $14 billion, and total revenue fell 9% to $19.34 billion.

Net profit plummeted from 71% to $49 million, while operating profit margin collapsed to 2.1% as production upgrades, price cuts and political uncertainty, including rising tariffs, fell sharply on performance.

Amid a decline in delivery and increased global competition, Tesla highlighted advances in energy storage and AI infrastructure.

Still, as stocks have fallen 41% since the start of the year and further scrutiny is underway as mask political involvement increases, investors are cautious as they prepare for the possibility of the launch of Robotaki in June.

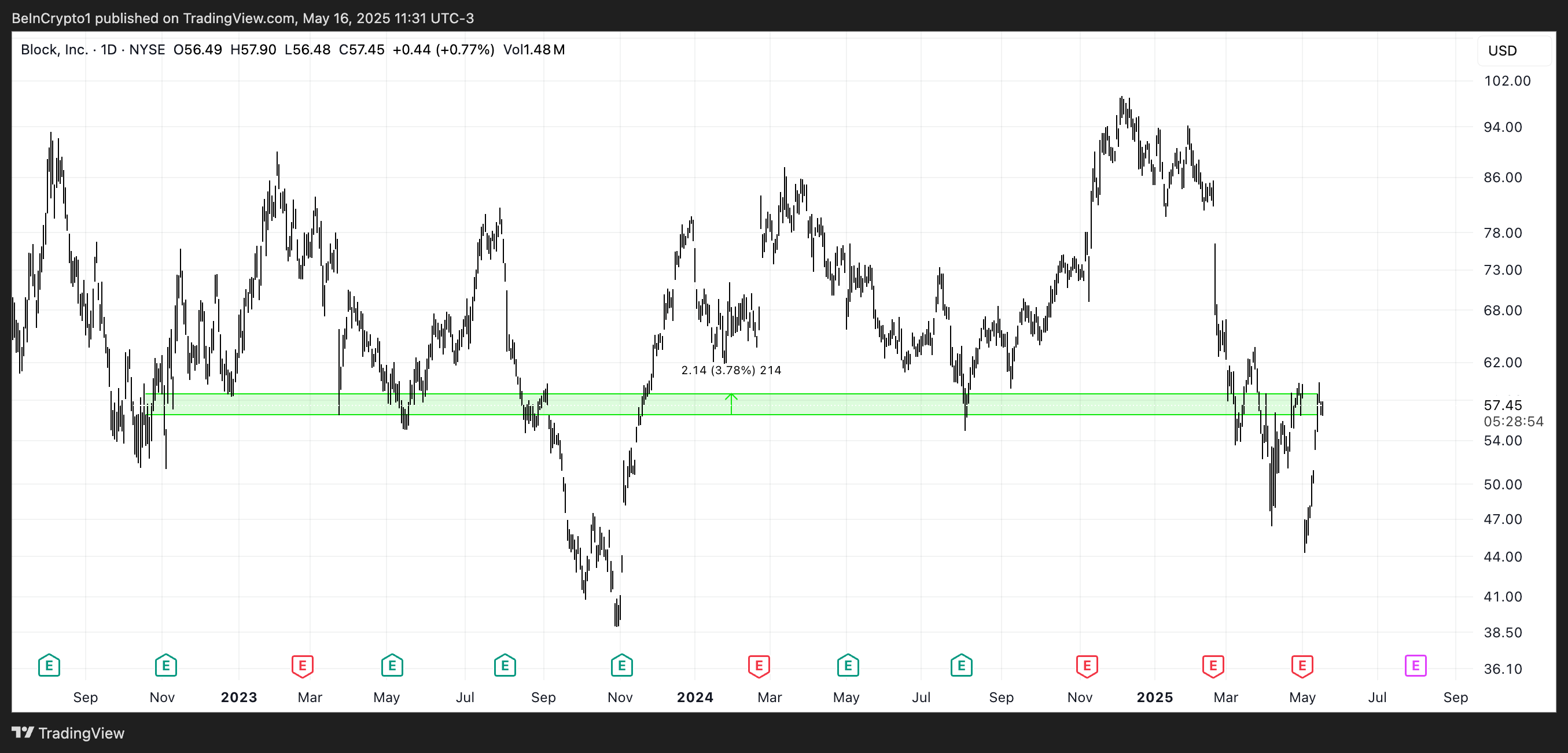

BlockInc. (formerly square)

Co-founded by Jack Dorsey, Block Inc. added Bitcoin to its balance sheet in October 2022 and currently owns 8,485 BTC, worth around $881 million.

Known for its early adoption of Bitcoin and crypto integration via the Cash app, Block has established itself as one of the most notable corporate Bitcoin holders.

Since the first acquisition of BTC, stocks have grown just 3.8%, reflecting a turbulent journey of over $100 in December 2024, but in November 2023 it reached $38.5 amid wider volatility and macroeconomic headwinds.

XYZ price analysis. Source: TradingView.

Block’s first quarter 2025 revenue revealed various photos. The company missed both revenue and profit expectations, recording revenue of $5.77 billion against the expected $6.2 billion.

Despite a 9% increase in gross profit to $22.9 billion, the remaining guidance for the year has been reduced due to macro uncertainty, including the impact of new tariffs.

Cash App’s total profit rose 10% to $1.38 billion due to the launch of Afterpay’s Buy-Now-Pay-Later feature and the expansion of its lending program under FDIC approval.

However, total payments have increased, and international exposures currently account for 18% of total volume.

Block lists its most profitable quarter to date, but stocks have fallen 31% since the start of the year, and investors are cautious as they prepare to offer their first Bitcoin mining chips later this year.