Bitcoin was relatively stable close to its main support level on Monday, despite President Donald Trump bringing fiery rhetoric on social media regarding trade tariffs and the Federal Reserve policy, and driving new debates about BTC’s role in macroeconomic uncertainty.

Trump accused China of unfair tariff retaliation (cited a 34% increase), and claimed that there was “no inflation” despite recent market turmoil, but Bitcoin has found its foothold.

After falling below $75,000 early Monday (hitting a low of nearly $74,434), BTC climbed back to a deal of around $76,561 at the time of reporting. The entire crypto market has exceeded $100 billion since April 1st due to fear of tariffs.

Trump’s “no inflation” claim and pressure on the Fed can boost Bitcoin

Trump has said in his post that oil, food and interest rates are falling, claiming there is no inflation. At the same time, he pressured the Fed to cut fees accordingly. “The slow-moving Fed should cut interest rates!“He wrote because the United States denounced China for unfair retaliation, despite the fact that it brought billions each week from existing tariffs.

His politically charged statement has genuine economic implications. When the Fed puts pressure on it, liquidity can surge, and that’s exactly where Bitcoin can make money.

Historically, Dovish currency pivots have fueled the desire for risky assets, and the crypto market is no exception. Traders are now re-adjusting their strategy, sweeping out the recent total market capitalization of over $100 billion in Crypto due to macro horrors and tariff shocks. The looming question is whether emergency rate reductions or quantitative easing will help Bitcoin recover from the current slump.

What do you say about BTC support on-chain data?

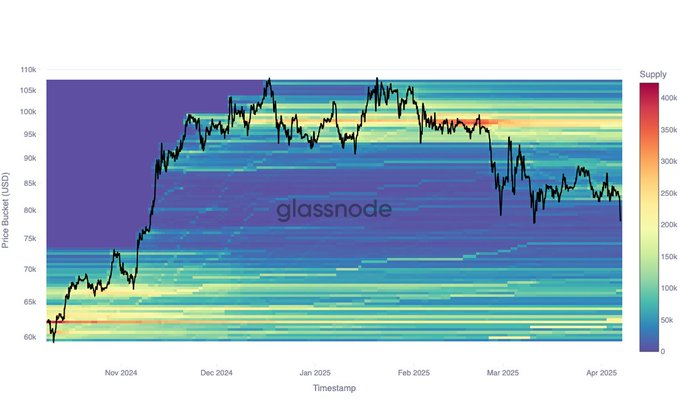

For now, it seemed BTC had found support for $74,000. This coincides with the first major supply cluster below $80K and above $74.2K, over $50,000. GlassNode discovered that investors who had been active for five months were usually held at this level, steadily increasing costs until March 10th.

sauce: Glass Node

As market participants speculate about Trump’s next course of action, Bitcoin could become one of the key beneficiaries if inflation remains calm and credibility hits.

While Wall Street navigates the chaos, Bitcoin holders are keeping an eye on the Fed’s next move. With rate reductions coming, Bitcoin’s next bull run may not be that late.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.