President Trump is once again urging low interest rates after bullish US employment data. Some analysts hope that the new rate cuts will create positive momentum for Bitcoin.

But there is no indication that Powell will change his mind. If anything, that’s even less. Tariffs can cause unprecedented disruptions, and the economy doesn’t need speed reductions to survive now.

Can Trump force US interest rates?

Today, the U.S. Bureau of Labor Statistics released its latest employment report. This seems very bullish in the face of the fear of a recession.

Total non-farm payroll employment increased by 177,000, far exceeding expectations, but the unemployment rate remains stable and wages have risen. This has led President Trump to seek another round of cuts in interest rates.

President Trump has repeatedly asked Federal Reserve Chairman Jerome Powell to cut interest rates. The crypto industry is also frequently advocating for such moves, encouraging investment in risk-on assets.

But both Powell and the other Fed’s tops are very clear that tariffs are too unpredictable to allow further interest rate cuts.

Powell’s position is very consistent. Tariffs can seriously damage the economy, and the Federal Reserve must keep the powder drying to stop future collapse. If they cut fees after bullish news, the Fed has one potential tool in the event of a real crisis.

Trump even threatened to fire Powell over the issue of interest rate cuts, but relented after the market paniced. He cannot legally fire Powell. Ejecting such a prominent regulator would undoubtedly cause chaos.

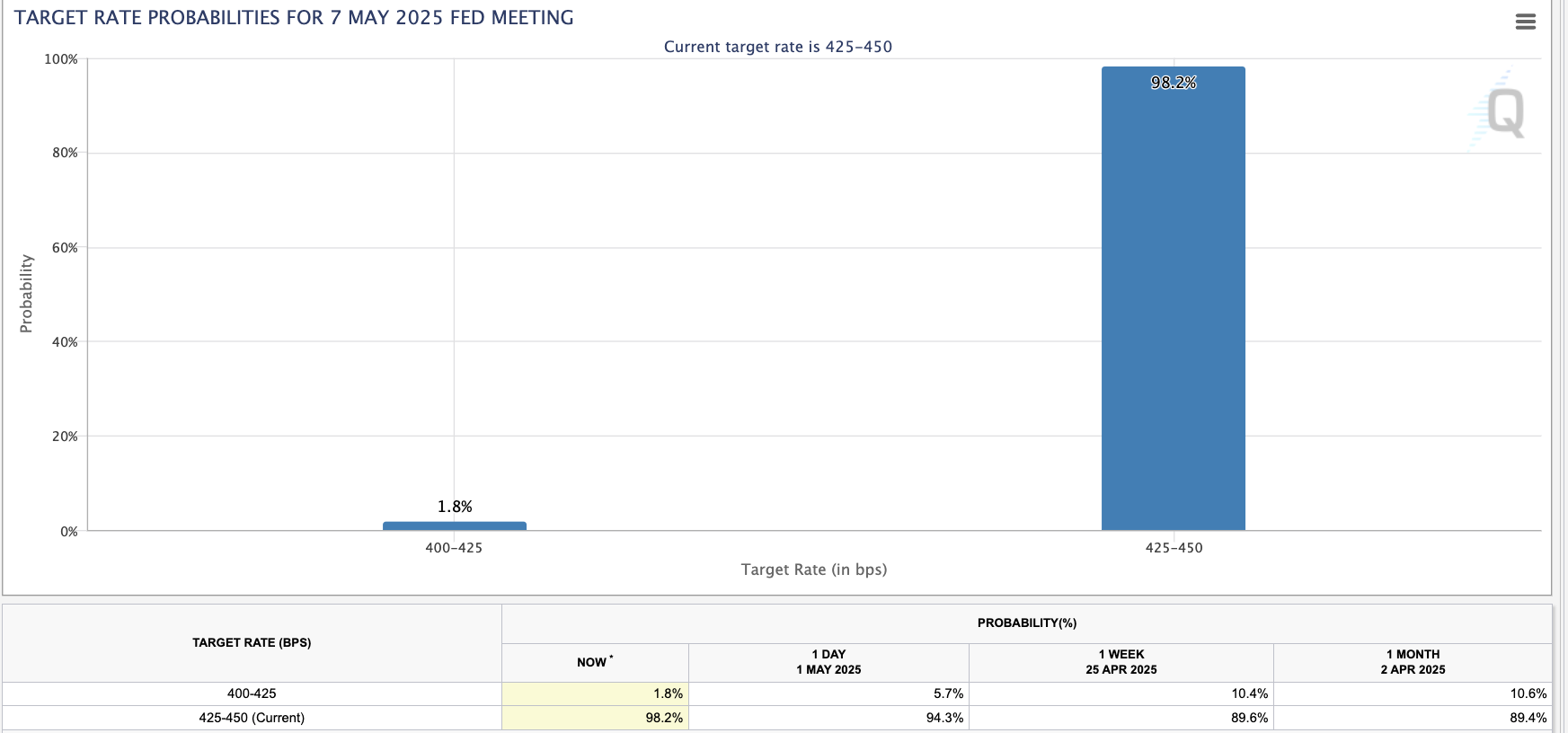

After the employment report was released, the market predicted a decline in interest rate cuts, and CME reported that adjustments for May were virtually impossible.

CME interest rate forecast. Source: CME Group

Frankly, it’s very unlikely that Trump will soon get the interest rate cuts he hoped for. University of Michigan economist Justin Wolfers explained why bullish reports actually reduce the likelihood of rate reductions.

“It’s almost certain that the Fed will be on hold at the next meeting. The real economy (so far) is strong enough to guarantee rate reductions. And all the big questions are over the horizon. Powell was clear.

President Trump wants to cut these rates, but he cannot force the issue without causing any bigger issues. Tariffs are so confusing and unpredictable that misrules have moved through the crypto market on several recent occasions.

Traders need to be cautious about speculations that seem too good.