Bitcoin (BTC) recently ended its two-week downtrend. Despite the recovery, Bitcoin still faces sales pressure from long-term holders (LTHS), which could make it vulnerable to potential price corrections.

The crypto market remains unstable, and Bitcoin’s next price movement will depend on these factors.

Bitcoin sales raise concerns

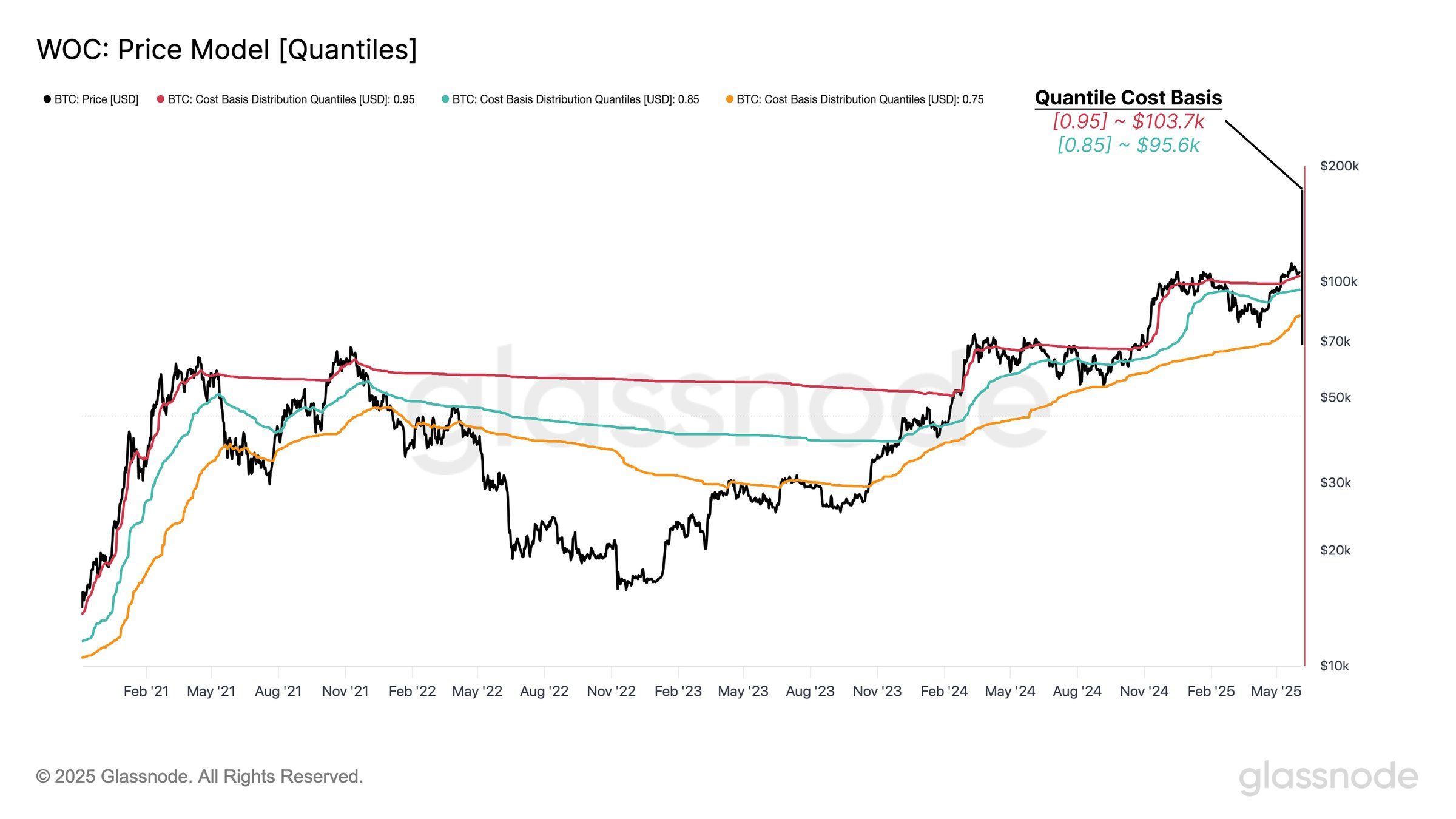

Bitcoin’s cost basis quantile highlights key support levels that may be of importance in the short term. 0.95 SSD (expendable supply distribution) indicates that 95% of the circulating Bitcoin supply was purchased for less than $103,700.

This suggests that only 5% of Bitcoin is acquired above this level, with $103,700 becoming a strong support zone.

Additionally, another important support level is $95,600, with a 0.85 SSD matching. This level represents the point where 85% of circular Bitcoin lowers the acquisition price and becomes another potential hub for Bitcoin price.

If Bitcoin is facing more sales pressure, these levels could serve as a strong barrier to deeper declines.

Bitcoin quantile cost basis. Source: GlassNode

Despite sales pressure from LTHS, Bitcoin’s macro momentum suggests a positive outlook over the long term.

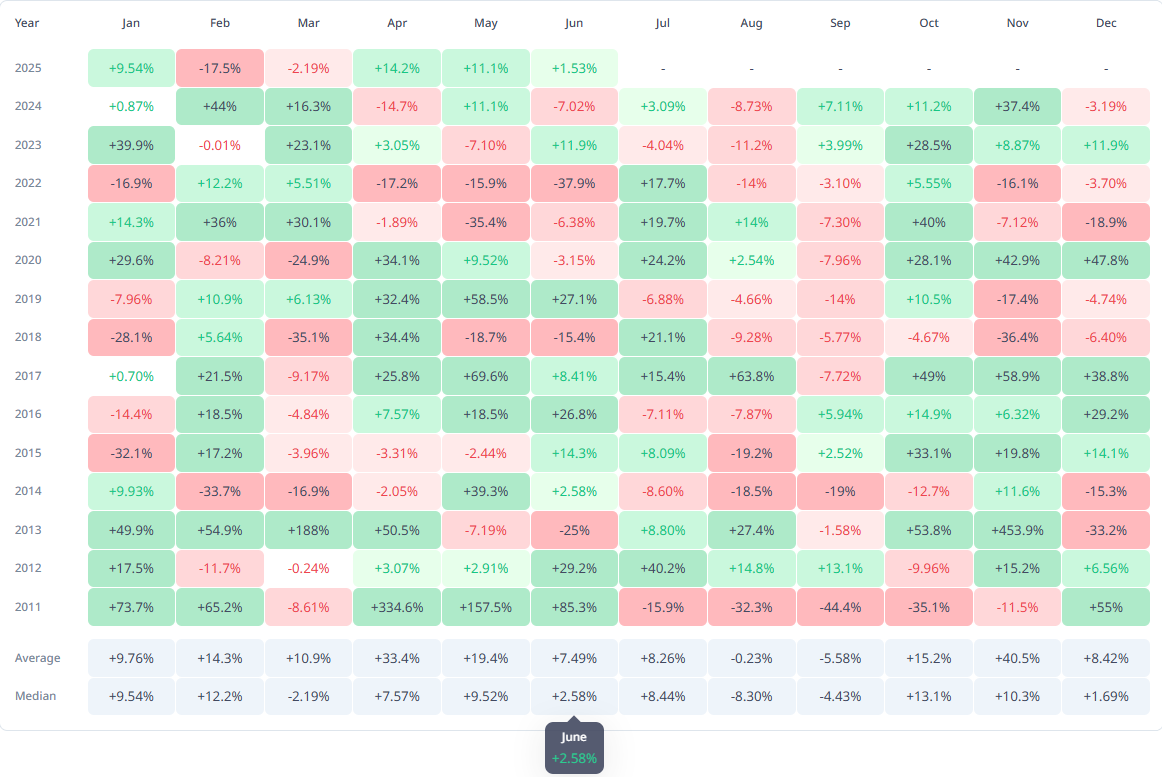

Bitcoin’s historic monthly return data shows that June is a positive month for assets, with a median increase of 2.58%. This shows that while Bitcoin could face short-term fixes for sales, broader market trends can support price recovery.

Historical trends suggest that correction Bitcoin from LTH sales is likely to be temporary. Bitcoin prices indicate long-term growth potential, so the market could quickly turn into bullish sentiment, especially if the broader market situation improves.

Historic monthly Bitcoin returns. Source: Cryptorank

BTC price has support

Bitcoin prices have recently risen 4.7% over the past three days, trading at $106,263. However, cryptocurrency remains just below the $106,265 resistance level.

Given current market sentiment and key support levels, factors during play suggest that Bitcoin could potentially decline in the short term.

If Bitcoin fails to maintain its $106,265 level and is facing additional sales pressure, it could fall into $105,000 support and move to $103,700.

This level could provide great support, as identified on a quantile cost basis. In a bearish scenario, Bitcoin can even slide to the next support for $102,734.

Bitcoin price analysis. Source: TradingView

Meanwhile, the broader market is bullish and against the impact of LTH sales, Bitcoin can push past the $106,265 resistance level.

A successful violation at this level could result in Bitcoin becoming even higher than $108,000, which will override current bearish papers and signal potential price increases.