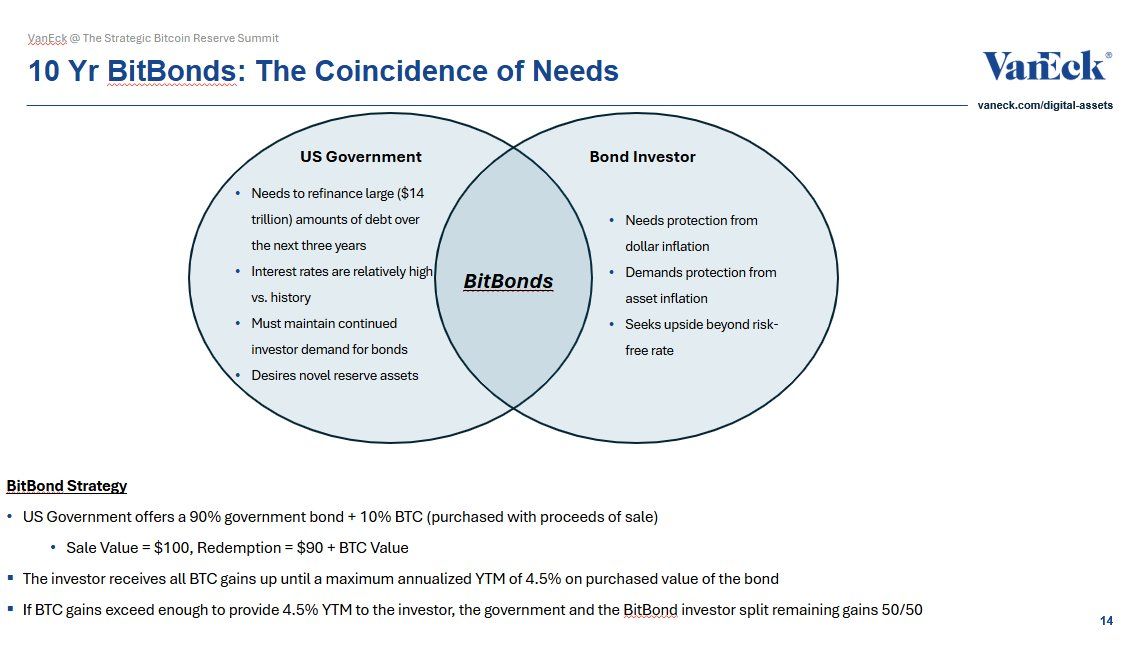

Matthew Sigel, head of digital assets research at Vaneck, proposed a new financial product called “Bitbonds” to manage the US government’s looming $14 trillion refinance obligation requirements.

The decade-long financial products combine traditional US Treasury with Bitcoin (BTC) exposure. This provides a potential solution to the country’s financial concerns.

Will Bitcoin-backed bonds help resolve the US debt crisis?

According to Sigel’s proposal, Bitbonds’ investment structure allocates 90% of its funds to lower and lower risk Bitcoin, combining stability with higher return potential. Additionally, the government will purchase Bitcoin with revenue from bond sales.

Vanek’s proposed structure for Bitbonds. Source: X/Matthew Sigel

Investors receive all Bitcoin profits up to 4.5% of their annual yield. Additionally, investors and the government will divide additional profits equally.

“A matching solution for incentives for discrepancies,” Sigel said.

From an investor’s perspective, Siegel emphasized that bonds will offer break-even Bitcoin annual growth rate (CAGR) between 8% and 17%, depending on the coupon rate. Furthermore, if Bitcoin grows at a CAGR of 30%-50%, investors’ returns could skyrocket.

“A convex bet – if you believe in Bitcoin,” he added.

However, the structure is not without risk. Investors have suffered the drawbacks of Bitcoin and are partially involved on top of it. If Bitcoin is below performance, low-coupled debt could lose appeal.

Meanwhile, the Ministry of Finance’s shortcomings are limited. Even a complete collapse of Bitcoin’s value will lead to cost savings compared to traditional bond issuance. However, this is subject to coupons remaining below the break-even threshold.

“BTC upside down just sweetens the deal. Worst case: cheap financing. Best case: long exposure to the hardest assets on the planet,” Siegel said.

Sigel argued that this hybrid approach would adjust the profits of governments and investors over a decade. The government faces high interest rates and significant debt refinancing needs. Meanwhile, investors are seeking protection from inflation and asset collapse.

The proposal comes amid growing concern over the US debt crisis, which has been exacerbated by the recent increase in debt ceilings to $36.2 trillion, as reported by Beincrypto. In particular, the Bitcoin Policy Institute (BPI) has also endorsed this concept.

“Based on President Donald J. Trump’s March 6, 2025 executive order establishing strategic Bitcoin reserves, this paper proposes that the US adopt innovative financial tools to address multiple key goals using Bitcoin-enhanced US Treasury debt (“₿ bonds” or “bitbonds”) as an innovative financial tool.”

In the paper, co-authors Andrew Hohns and Matthew Pines proposed that by issuing $2 trillion Bitbonds at a 1% interest rate, it could cover 20% of the Treasury’s 2025 refinancing needs.

“Over the decade, this represents a nominal savings of $700 billion and a present value of $544.4 billion,” the author writes.

BPI estimates that if Bitcoin achieves a CAGR of 36.6%, it could potentially invalidate federal debt of up to $50.8 trillion by 2045.

These recommendations are part of a broader conversation about the potential impact of Bitcoin on national finance. Previously, Sen. Cynthia Ramis argued that the US strategic Bitcoin reserve could cut national debt by halving. In fact, Vaneck’s analysis shows that such reserves will help reduce their $21 trillion in debt by 2049.