For years, major banks have treated cryptocurrencies primarily as a containable risk. That attitude is now being replaced by a more intentional form of engagement. Rather than debating the legitimacy of cryptocurrencies, banks are increasingly deciding where and how to integrate them into everything from regulated investment products to blockchain-based payment rails.

This shift is on full display in this week’s Crypto Biz. JPMorgan extends its USD deposit token to new blockchain infrastructure, signaling that tokenized cash is nearing production use within global banking.

Morgan Stanley, on the other hand, is in a position to offer exposure to Bitcoin (BTC) and Solana (SOL) could bring crypto investing to millions of wealth management customers through exchange-traded funds (ETFs).

Barclays is the first to bet on stablecoin infrastructure by backing a payments rail designed to connect regulated issuers and financial institutions.

And Bank of America has taken another step toward normalcy by allowing advisors to recommend Spot Bitcoin ETFs to their clients.

Taken together, these developments suggest that the banking sector is no longer content to sit on the sidelines.

JPM Coin joins Canton Network

JPMorgan has announced plans to issue JPM Coin (JPMD), a USD-denominated deposit token, natively on the Canton Network, marking another step for Wall Street towards production-ready blockchain infrastructure.

Canton Network developers Digital Asset and JPMorgan’s Kinexys will extend JPM Coin from existing rails to Canton’s privacy-focused Layer 1 blockchain, enabling the movement of regulated digital cash across interoperable networks.

According to an announcement shared with Cointelegraph, JPM Coin is billed as the first bank-issued institutional US dollar-denominated deposit token, represents a digital claim on JPMorgan’s dollar deposits, and is designed to facilitate faster and more secure movement of regulated funds on public blockchains.

“This partnership realizes our vision of regulated digital cash that can move at the speed of the market,” said Yuval Ruth, co-founder and CEO of Digital Asset.

Morgan Stanley enters the crypto ETF race

US investment bank Morgan Stanley is entering the crypto exchange-traded fund market with a product offering exposure to Bitcoin and Solana, following the strong debut of its spot crypto ETF in the US.

The bank has applied to the U.S. Securities and Exchange Commission to launch two investment vehicles, the Morgan Stanley Bitcoin Trust and the Morgan Stanley Solana Trust. These are designed to provide passive investment exposure to the performance of the underlying digital assets.

If approved, the funds would be available to more than 19 million clients within Morgan Stanley’s wealth management division, potentially significantly expanding access to crypto-related investment products.

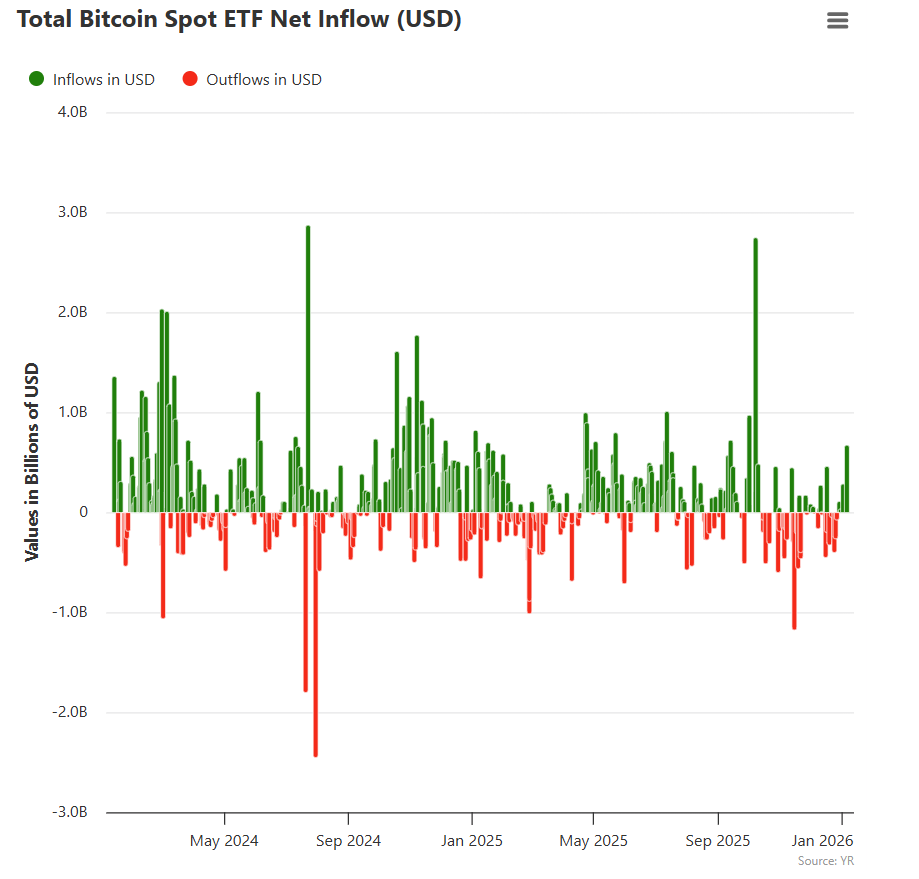

The Spot Bitcoin ETF ranks as one of the most successful ETF launches in history, with significant inflows in its first two years of trading. The momentum continued into the new year, with renewed investor demand and an influx of new money during the first trading session.

12 US Bitcoin Spot ETFs attracted more than 1.3 million BTCits value reaches approximately $120 billion. sauce: Vitobo

Barclays invests in stablecoin infrastructure

London-based banking giant Barclays has made its first investment in a stablecoin-focused company, demonstrating traditional finance’s growing interest in digital dollar infrastructure.

The bank announced an undisclosed investment in Ubyx, a US-based stablecoin clearing platform that connects regulated issuers and financial institutions to facilitate payments and interoperability. The move is also a notable change for Barclays, which has publicly highlighted the risks associated with digital assets in recent years.

“This investment is consistent with Barclays’ approach to exploring opportunities based on new forms of digital money, such as stablecoins,” the bank said in a statement.

Ubyx previously raised $10 million in seed funding with support from Galaxy and Coinbase. The company was founded by former Citibank executive Tony McLaughlin.

Bank of America Wealth Advisors Are Permitted to Recommend Bitcoin ETFs

U.S. investors could soon receive recommendations to buy Bitcoin ETFs from Bank of America’s private bank and Merrill Edge platform, providing further evidence of Bitcoin’s increasing integration into traditional finance.

The bank’s Chief Investment Office has approved coverage for four U.S. Spot Bitcoin ETFs, including products from Bitwise, Fidelity, BlackRock, and Grayscale. Collectively, these funds manage more than $100 billion in Bitcoin assets.

The move comes about a month after Bank of America reportedly advised its wealth management clients to allocate 1% to 4% of their portfolios to digital assets.

“For investors with a strong interest in thematic innovation and comfort with increased volatility, a modest 1% to 4% allocation to digital assets may be appropriate,” Chris Heisey, chief investment officer at Bank of America Private Bank, told Yahoo.

sauce: cointelegraph

Crypto Biz is your weekly take on the business behind blockchain and cryptocurrencies, delivered straight to your inbox every Thursday.