Ethereum has struggled to break out of its recent integration range, with price movements below $2,681 and $2,476. Despite attempts to escape this range, ETH has returned to this zone and remained an investor.

However, as Ethereum continues to see considerable investor interest, optimism within the market is growing. This support from the rise in new wallet holders suggests a potential breakout in the near future.

Ethereum investors are confident in their profits

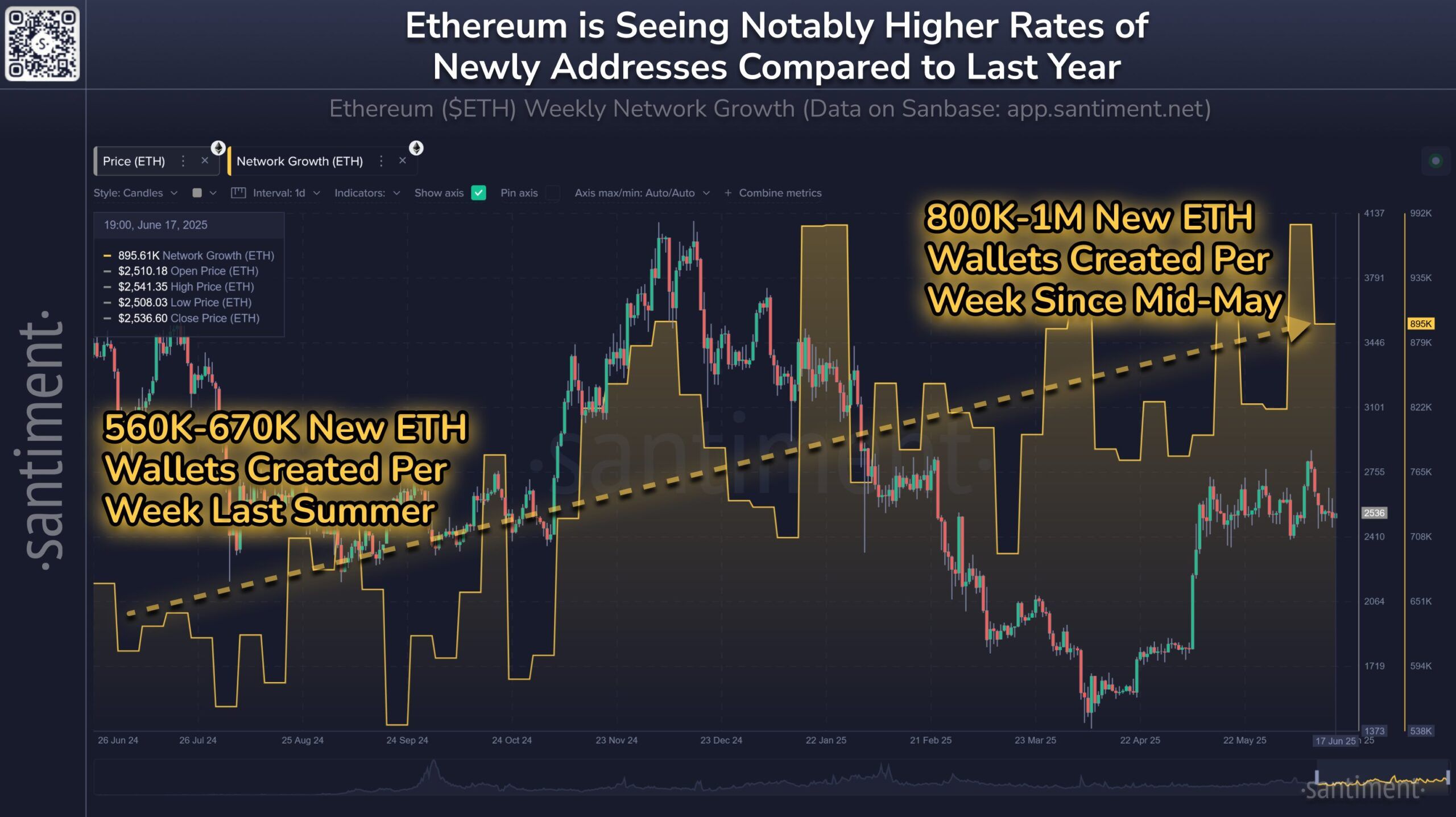

The number of new wallets on the Ethereum network is rising sharply, indicating strong investors’ trust. Since mid-May, the number of new wallets created each week has increased from 800,000 to 1 million.

This figure is significantly higher than the new wallets between 560,000 and 670,000 observed in the same period last year. Growth shows a high level of investor interest as many believe Ethereum will generate profits in the short term.

Growth of the Ethereum network. Source: Santiment

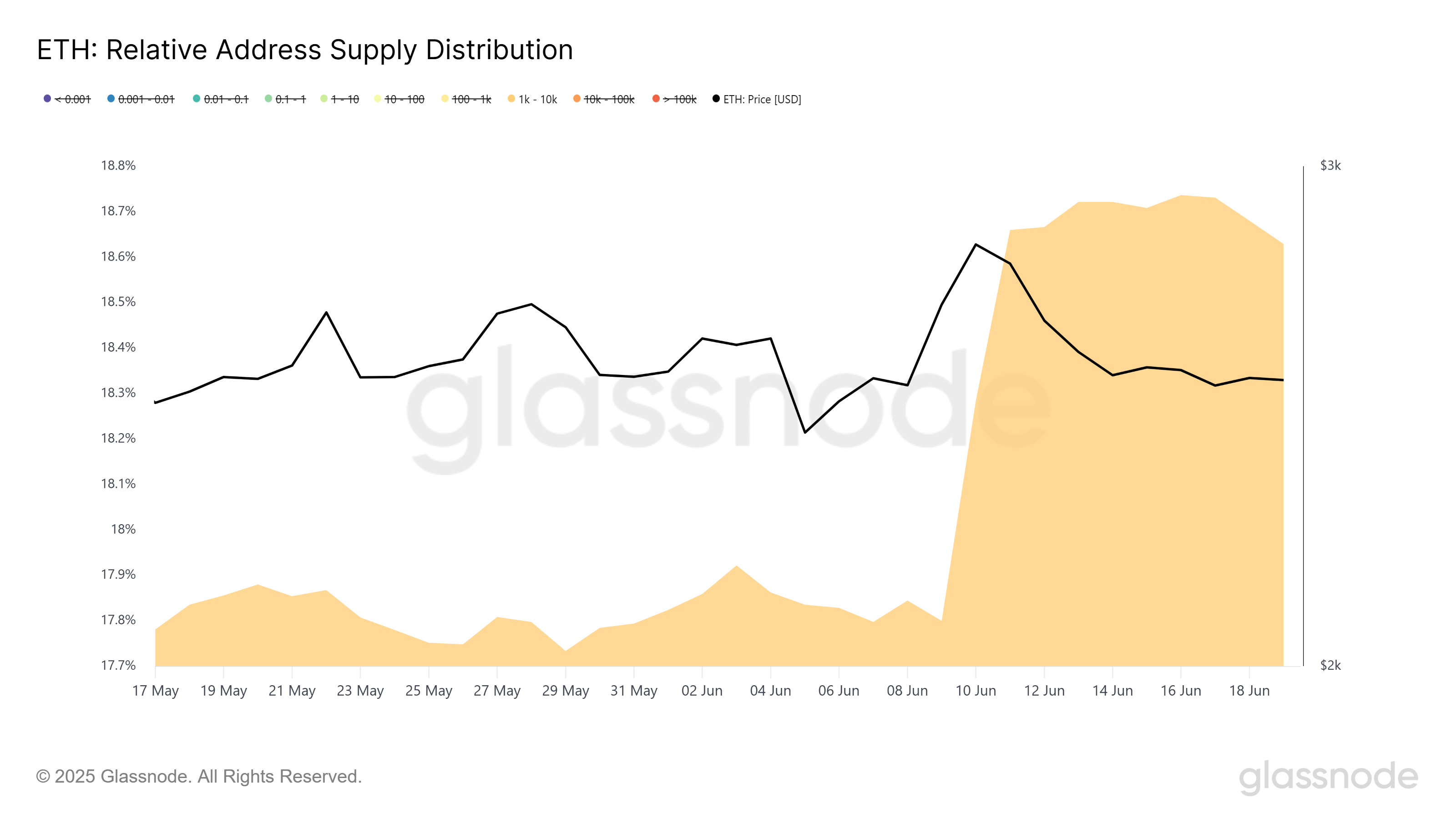

The momentum of the macros in Ethereum also shows positive signs. The recent surge in whale activity is a particularly noteworthy development. At addresses with ETHs between 1,000 and 10,000, shares have increased sharply, increasing to 14.3 million ETH, or approximately 18.6% of the total circulation supply.

Increased concentrations of ETH in whale hands reflect confidence in the long-term potential of Ethereum. This is often seen as a precursor to a price recovery, as whales tend to have a significant impact on price movements.

Ethereum supply distribution. Source: GlassNode

Can ETH Price find a way?

Ethereum is currently trading at $2,564 and is stuck within the combined range of $2,681 to $2,476. Despite recent volatility, ETH has not been able to free itself from this price range. Prices are likely to remain within this tight range until they can move above $2,681, with sharp movements quickly flipping in either direction.

However, based on the network’s activity and growing whale accumulation, Ethereum may be ready for a breakout. The successful violation of the $2,606 resistance and the subsequent move above $2,681 indicates that the integration phase is over. Once these levels are confirmed, Ethereum prices could rise to new highs.

Ethereum price analysis. Source: TradingView

On the other hand, if the broader market situation does not match investor optimism, Ethereum could continue to consolidate within its current scope. Below the $2,476 support, it shows a beard and potentially sends a low ETH. This could challenge Ethereum’s bullish outlook and delay the expected breakout.