As Bitcoin assets have seen a slight uptick, several whales have poured millions into long Bitcoin positions on HyperLiquid. Will it be enough to catapult BTC back to the $110,000 level?

summary

- Whales have invested millions of dollars in USDC to open large leveraged long positions in Bitcoin, with long positions currently accounting for 51.98% of the market, indicating growing bullish sentiment.

- Bitcoin is consolidating below its 30-day moving average near $108,200, and continued whale accumulation could trigger a breakout towards the $115,000 to $118,000 resistance range.

On October 22nd, Lookonchain detected a wave of on-chain whale activity, an increase in funds deployed in long positions. According to the latest post on the on-chain analytics platform, one whale deposited $9.6 million in USDC, used about $8.5 million to buy BTC, and opened a 6x long position with 133.86 BTC worth $14.47 million.

Another whale deposited $1.5 million in USDC (USDC) hours before increasing its long Bitcoin (BTC) position worth $49.7 million based on current market prices. Meanwhile, the whale starting at 0x8Ae4 deposited approximately 4 million USDC and used the funds to initiate long positions across three assets: BTC, ETH (ETH), and SOL (SOL).

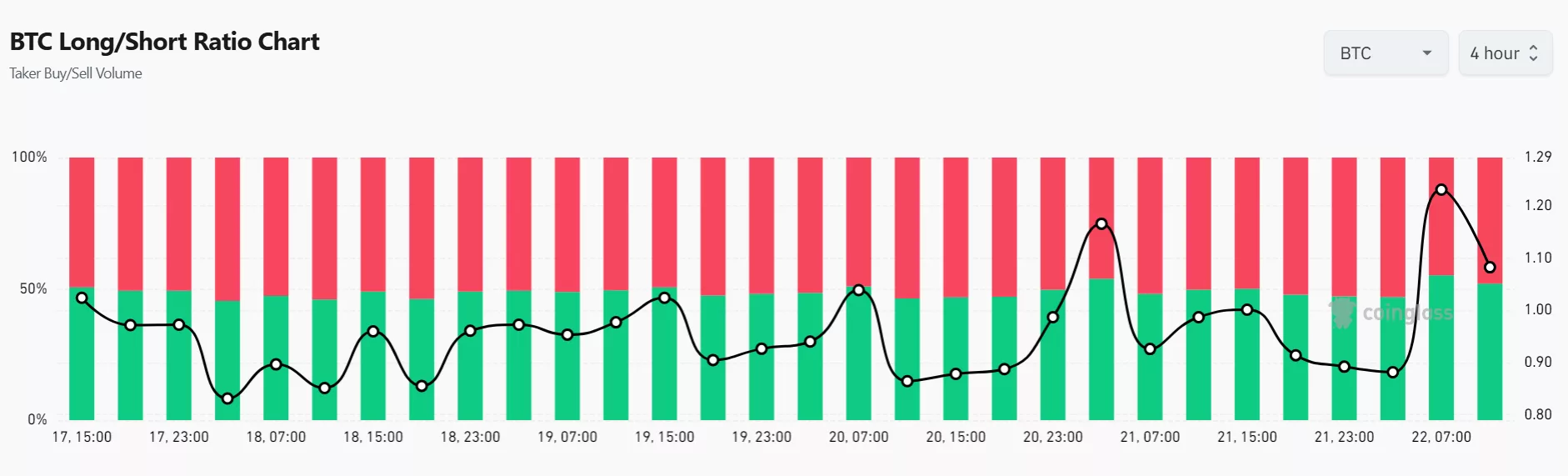

Bitcoin longs dominate the market by 51.98% | Source: Coinglass

You may also like: Whale short-sells XRP, DOGE, PEPE ahead of Powell speech

Similarly, the whale known as “God is Good” recently opened a long Bitcoin position worth nearly $50 million. The move comes shortly after Whale made a $1.24 million profit from a successful short selling campaign. The liquidation limit for whale positions is currently $102,300.

Long positions in Bitcoin are dominating the market, with four-hour volume reaching $6.14 billion, according to data from Coinglass. At the time of writing, long positions account for approximately 51.98% of the total BTC market, while short positions remain at 48.02%.

Many traders suspect that continued long whales are a sign that the market is gearing up for a bullish rally. One X account commented that long positions indicate a “definitive bet” is being made on the asset.

“Whales will never move more than $20 million into a 6x leveraged DEX unless they are at the front of a story or make a move they think is imminent,” User X said.

Bitcoin price analysis

As of October 22, Bitcoin is trading at around $108,200, slightly below its 30-day moving average of $109,322. According to TradingView data, BTC price tried to recover towards the $112,000 to $113,000 range but faced a rejection, leading to a short-term decline.

This price movement suggests that while the bulls are showing buying intent, Bitcoin is still struggling to maintain momentum above key resistance zones. The moving average is currently acting as a short-term resistance zone, and a decisive move above it could signal new upward strength.

The relative strength index is around 45, just below the neutral 50 level. This means that Bitcoin is neither overbought nor oversold, but is still in indecision territory. Traders are likely waiting for confirmation of the asset’s next move.

Bitcoin is in a correction phase and has room to rise | Source: TradingView

If the RSI manages to sustain above 50, it could signal that bullish pressure is returning, especially if the move is supported by strong buying volume or whale accumulation.

The recent increase in long whale positions is consistent with this consolidation phase. Historically, when large holders open significant long positions during sideways or slightly bearish movements, it often signals accumulation before a potential breakout.

Whales tend to buy when retail sentiment is uncertain, preparing for the next bull market. If these long positions persist and are supported by on-chain outflows, supply could tighten, creating upward pressure on prices.

If the whale buying continues, BTC could cleanly break above the 30MA and reach the $110,000 level. This could send BTC rocketing up to the next resistance level of $115,000 to $118,000. However, if it fails to break above $107,000, this decline could trigger a retest of the downside support near $104,000.

You may also like: Bitcoin treasury accounts for 66% of market capitalization, according to Hyperscale data