This is a segment of the breakdown newsletter. To read the complete edition, Subscribe.

“Macroeconomics in this original sense has been successful. The central problem of depression prevention has been solved.”

– Robert Lucas, 2003

I’m old enough to remember when people think the recession is no longer a thing.

By the early 2000s, economists like Robert Lucas and Alan Greenspan argued that the traditional recession, where cyclical declines in demand were shrinking the economy, was becoming an endangered species.

This was known as “great moderation,” but it seemed to have been discredited by the “great recession” as the idea had been catching up.

There were no moderates regarding the 2008 recession. From the peak to the trough, US GDP fell 4.3%, the largest decrease since World War II.

However, it should not have been trusted with the paper of moderation. This is because the Great Recession is more accurately known as the Great Financial Crisis. This is financial self-acquisition that has little to do with macroeconomics.

Almost 20 years later, the United States has yet to experience a recession in the “original meaning.”

The last traditional business cycle recession was back in 1991 when Gred Chair Greenspan raised interest rates to 10.5% and unemployment rates rose to 7.8%.

In the next 34 years, we only had three recessions, but they were all caused by non-cyclical shocks: the 2001 dot combust and the 9/11 financial crisis in 2008, the 2020 community pandemic.

Like last week, we inevitably looked towards the fourth.

But this week, the market came together with a rising consensus to avoid avoiding it again.

What can we do if a sudden trade war cannot prevent an aging population towards a recession?

Is the only pandemic and bank accidents that are causing the recession right now?

Probably not.

But likewise, Greenspan was probably right that the recessions we have were not too frequent and not too serious.

His hypothesis was primarily based on the belief in “better monetary policy.” That seems to be backed up.

Another reason Greenspan cited for optimism is the ongoing “transition from manufacturing to service,” which may now be demonstrated. Market actions this week appear to suggest that even a 10-fold increase in tariff rates will not derail the US economy.

“The more flexible the economy,” concluded Greenspan, “the more the ability to self-correct in response to inevitable and often unexpected obstacles, and the greater the magnitude and ability to contain the outcome of cyclical imbalances.”

He explained that the US economy is becoming more flexible with automated stabilizers, just-in-time logistics, deregulation and “increasing financial market depth and refinement.”

With a more sophisticated market, policy makers provide better information and better information. And of course, the best information is provided in the form of a chart.

So let’s take a look at what they’re saying.

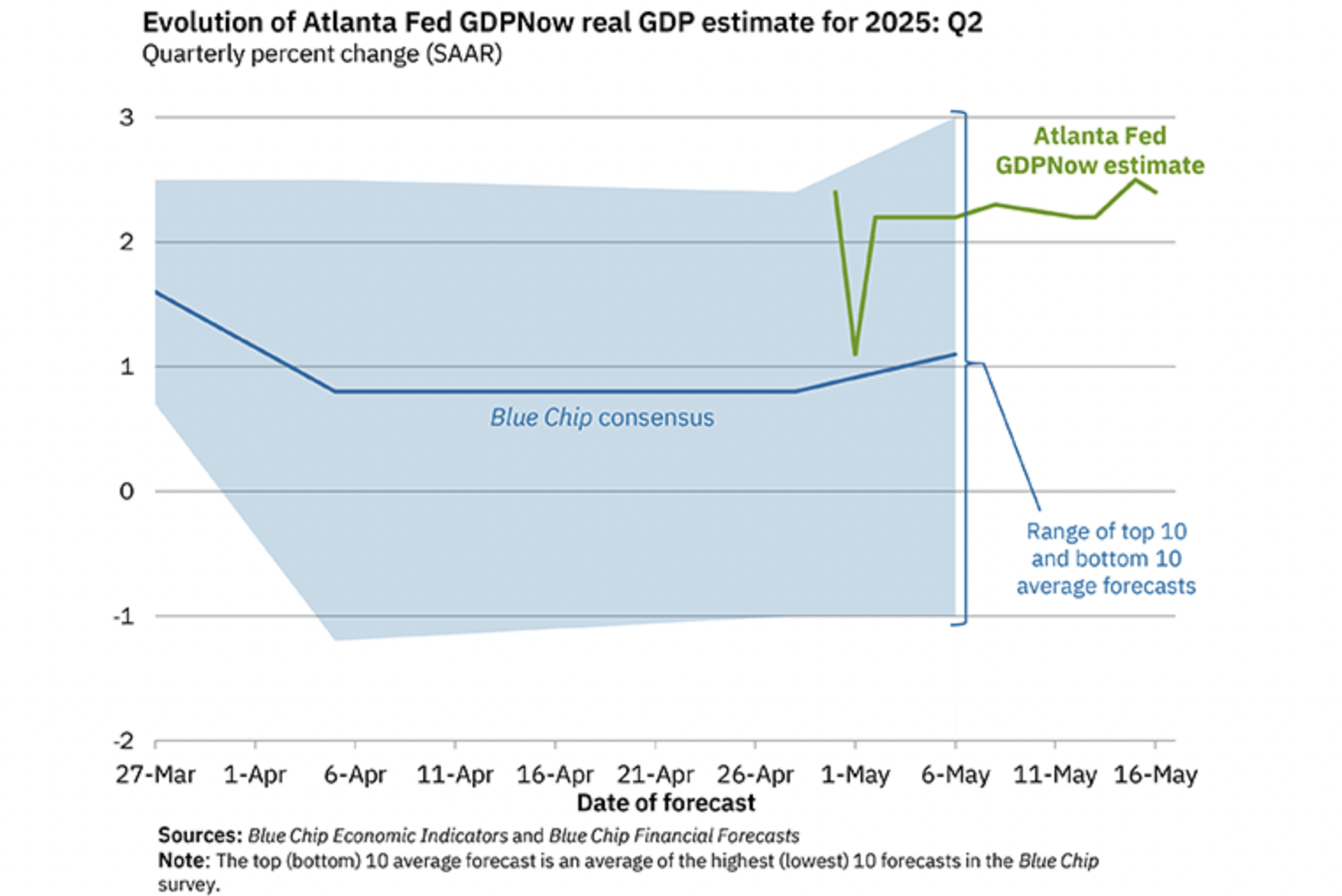

This is not this quarter:

Suddenly, the next recession seems as far away as ever. The Atlanta Federal Government’s GDPNOW model believes the US economy is up 2.4% in the current quarter.

It’s unlikely in the third quarter or Q4:

The poly-local odds of the 2025 US recession have fallen to 36%.

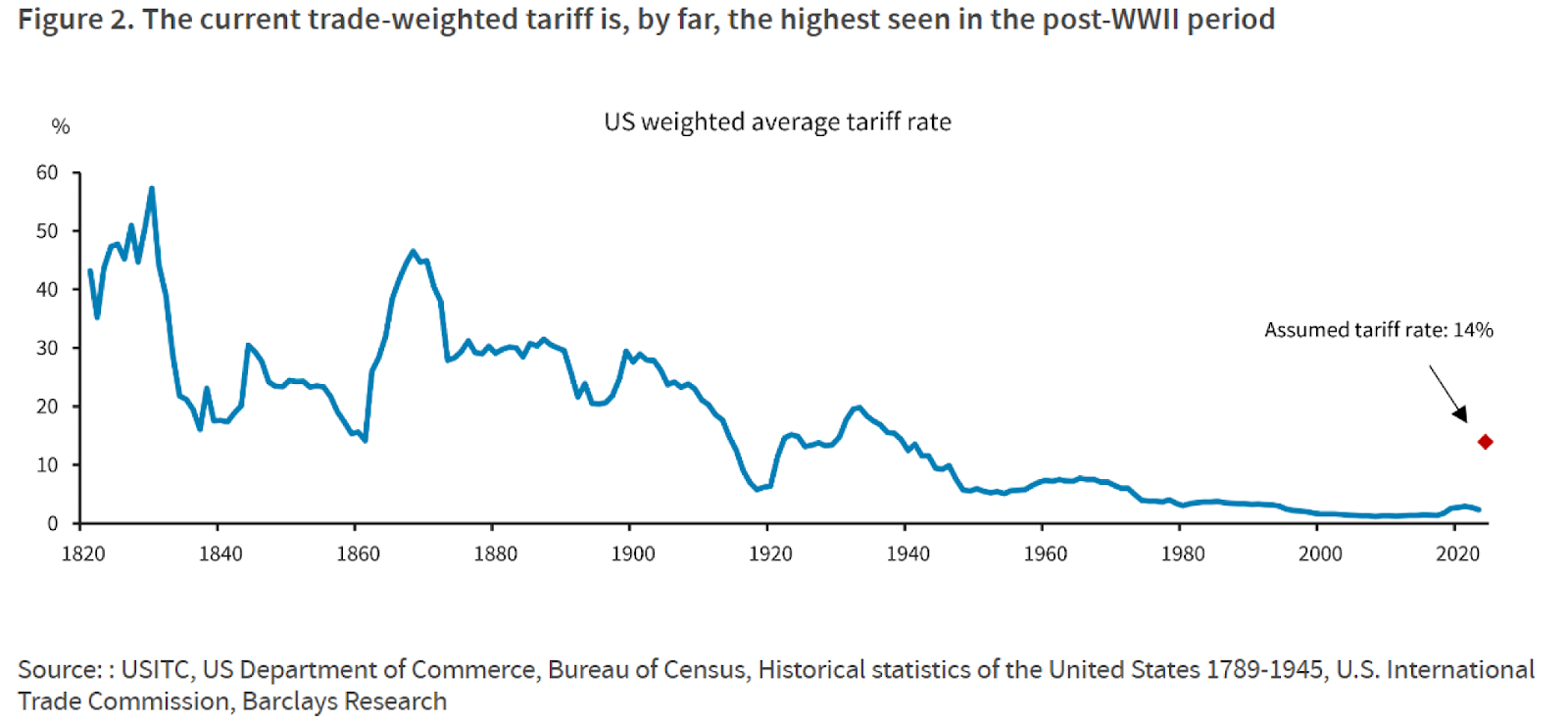

Are customs duties now priced?

A Barclays survey (via Odd Lots Newsletter) estimates the current US trade-included tariff rate is around 14%, with Goldman Sachs analysts saying “it will likely continue to rise for a foreseeable future.” That’s lower than expected just a few weeks ago, but we may not have left the woods yet. President Trump said today that he will unilaterally decide tariff rates over the next two or three weeks, as there are too many countries to negotiate.

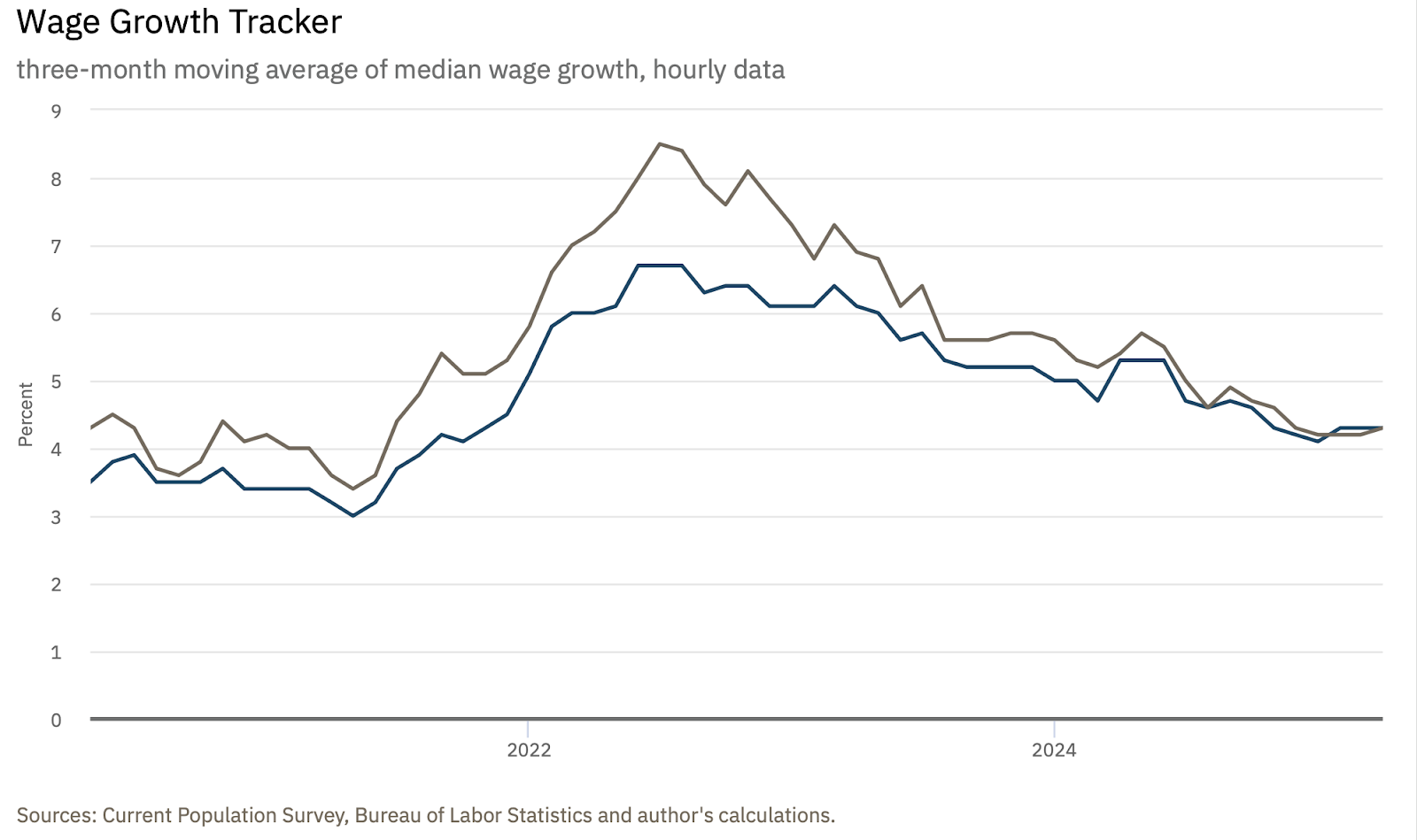

Wages > Inflation, yet:

According to the Atlanta Fed, US wages are still growing at 4.3%. This is well beyond the CPI, which fell to just 2.3% in April. The top row above is the wage growth of recruitment switchers. This could potentially drop even further. The Wall Street Journal said this week it believes two-thirds of US workers are overpaid.

there is nothing

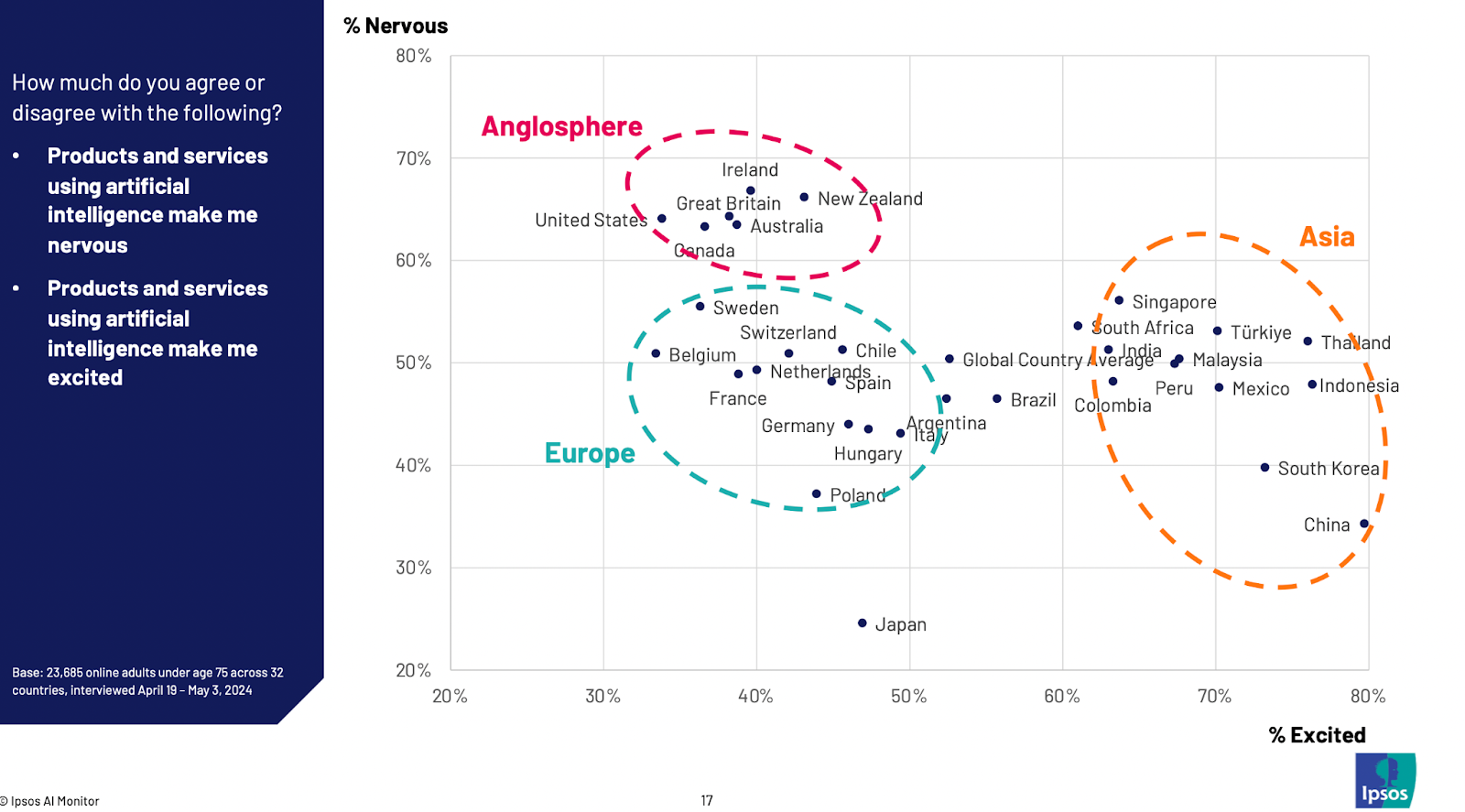

This has been around since 2024, but I only found it this week. An IPSOS study found that Asian (and some Latin America) countries were “excited” about AI while Europe and the UK were “tensing.” Check it in 10 or 2 years to see if it correlates with growth rates. (I think that’s what happens.)

Why Joe Rogan should be for free trade:

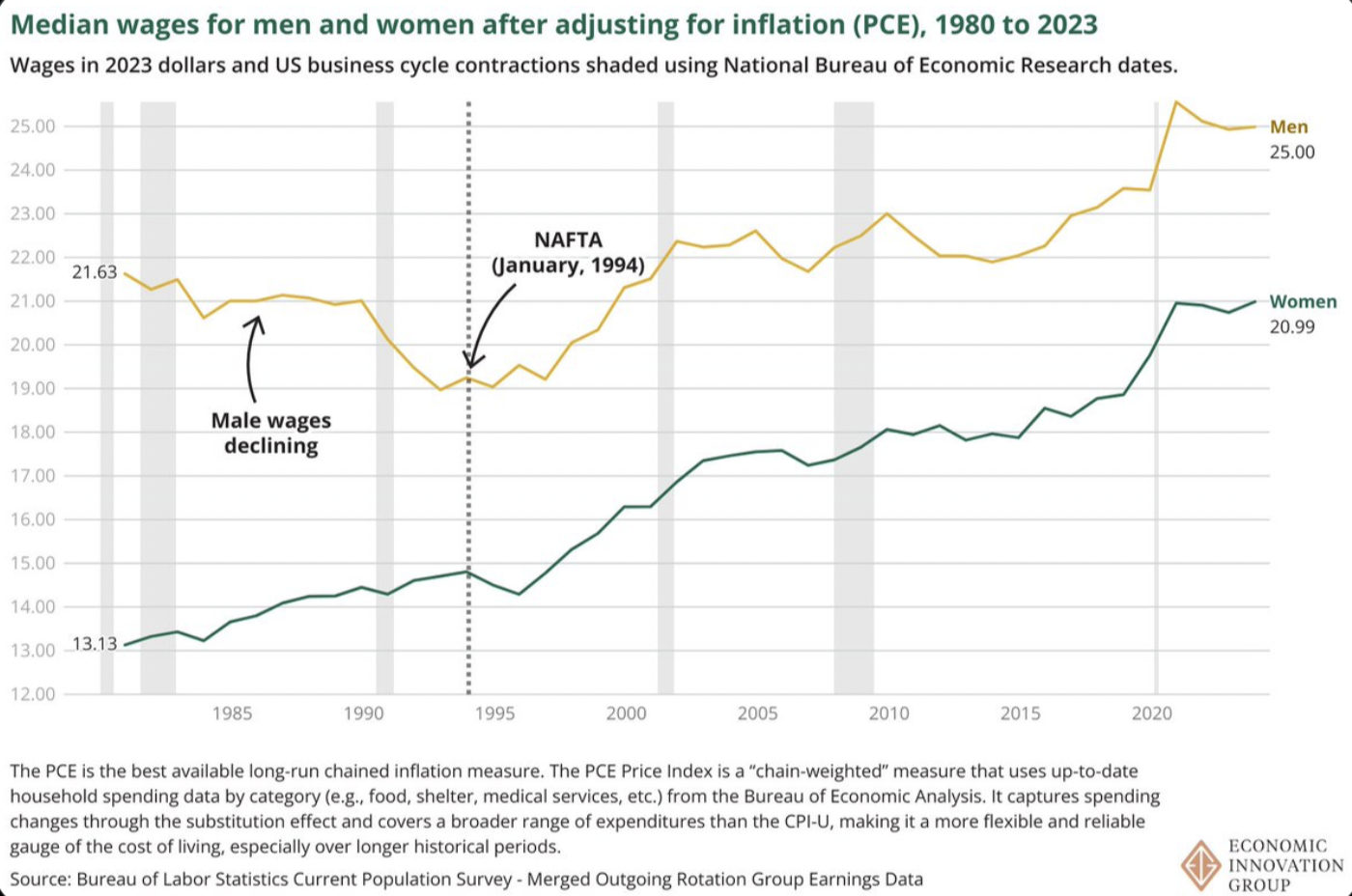

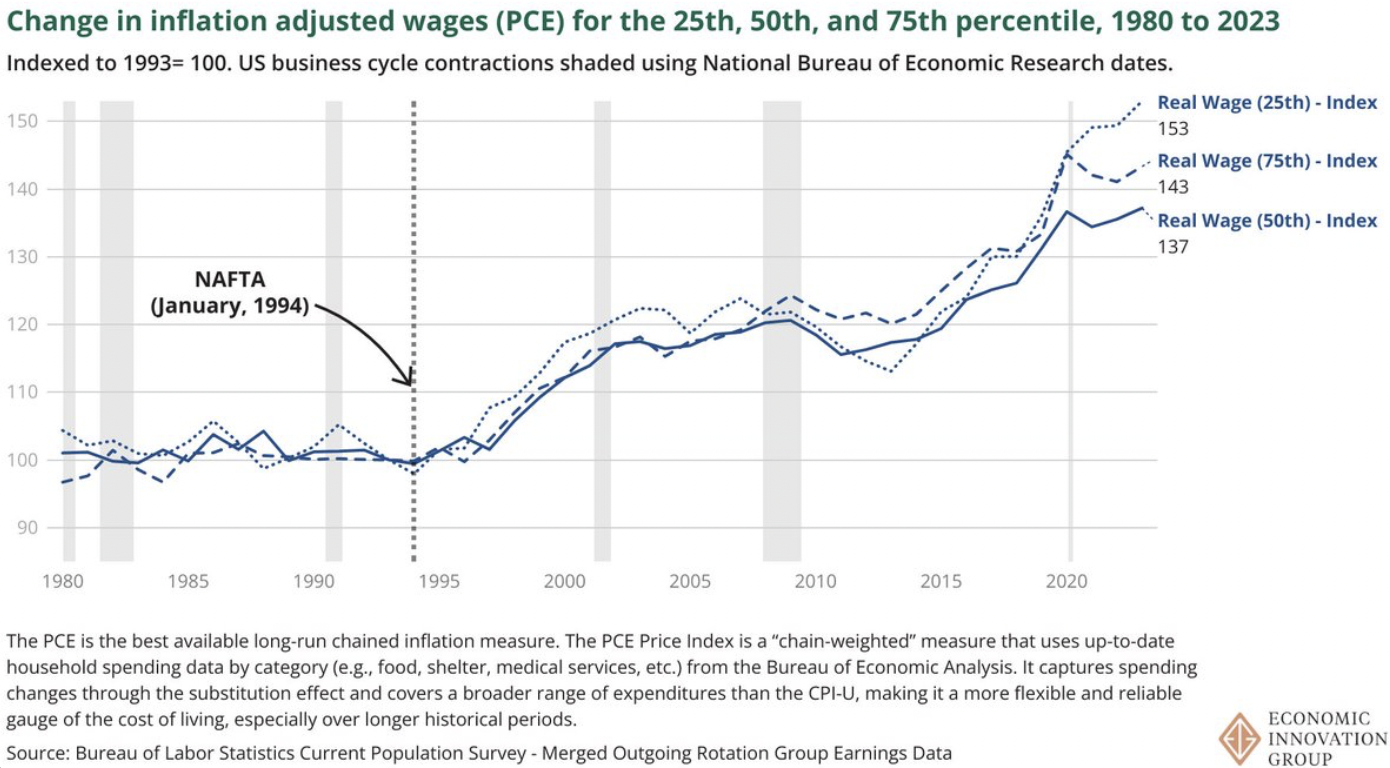

John Lettieri points out that the beginning of globalization (marked by the NAFTA in 1994) was consistent with a shift in male income trends.

Why should everyone be there for free trade?

Lettieri also found that wages for the minimum quartile of earners have risen, starting with NAFTA Faster More than the highest quartile wage. If, like me, you enjoy the violation of these kinds of stories, then his full thread on trade is a must-read.

Other deficit issues:

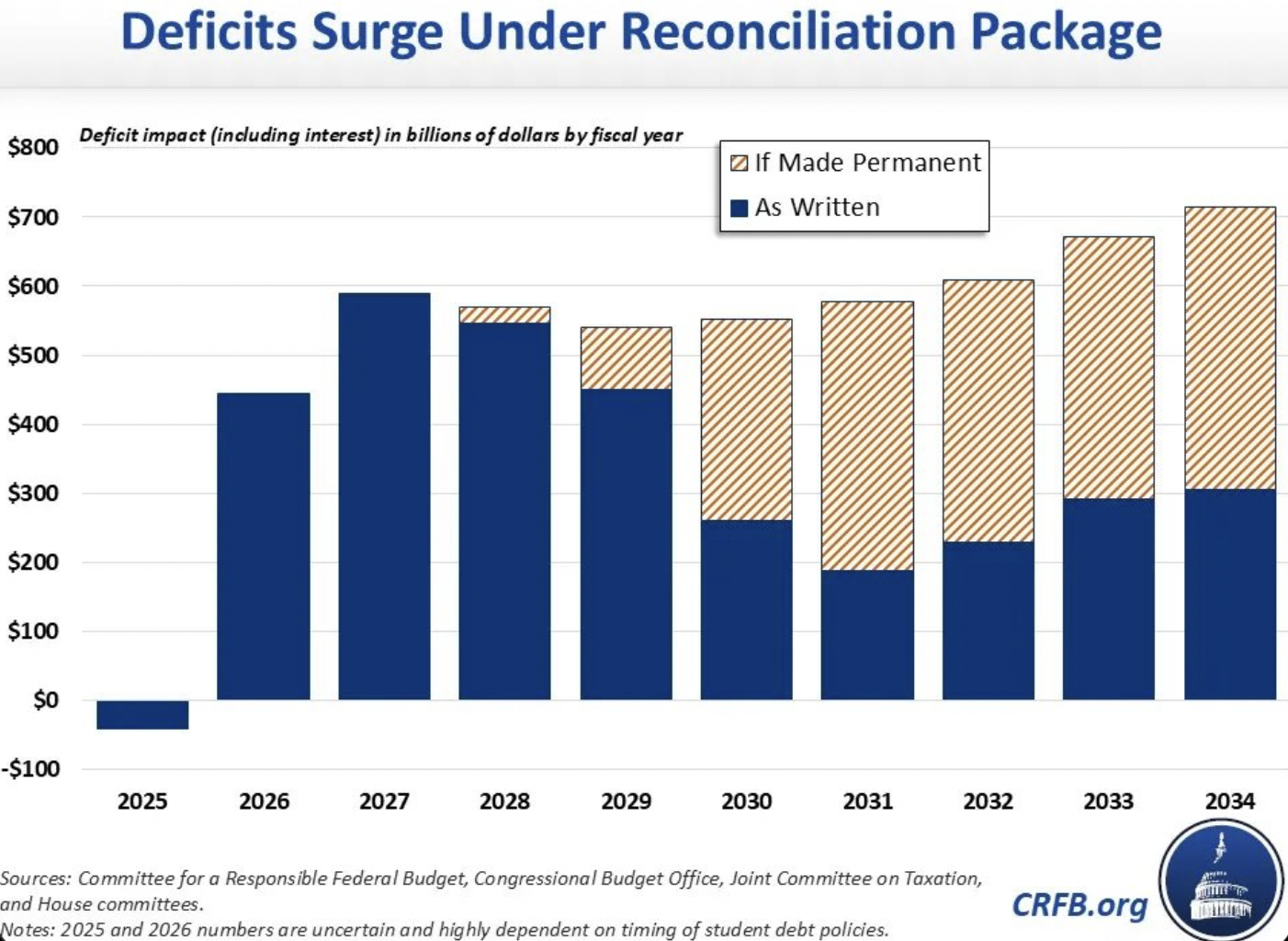

Current House budget proposals added 3.3 trillion dollars It will be in federal debt until 2034. It probably won’t pass the Senate, but in the end it seems like a safe bet that everything is only slightly responsible.

In good times and bad times:

The really bad news about the US budget is not that it’s a big deficit, it’s a big deficit while the economy is booming. What will this chart look like in the next recession? (If there is one.) Also, if your goal is to decrease Trade Deficit runs at $1 trillion budget The deficit is year by year, um, not a way to do it.

But deficits are good for business:

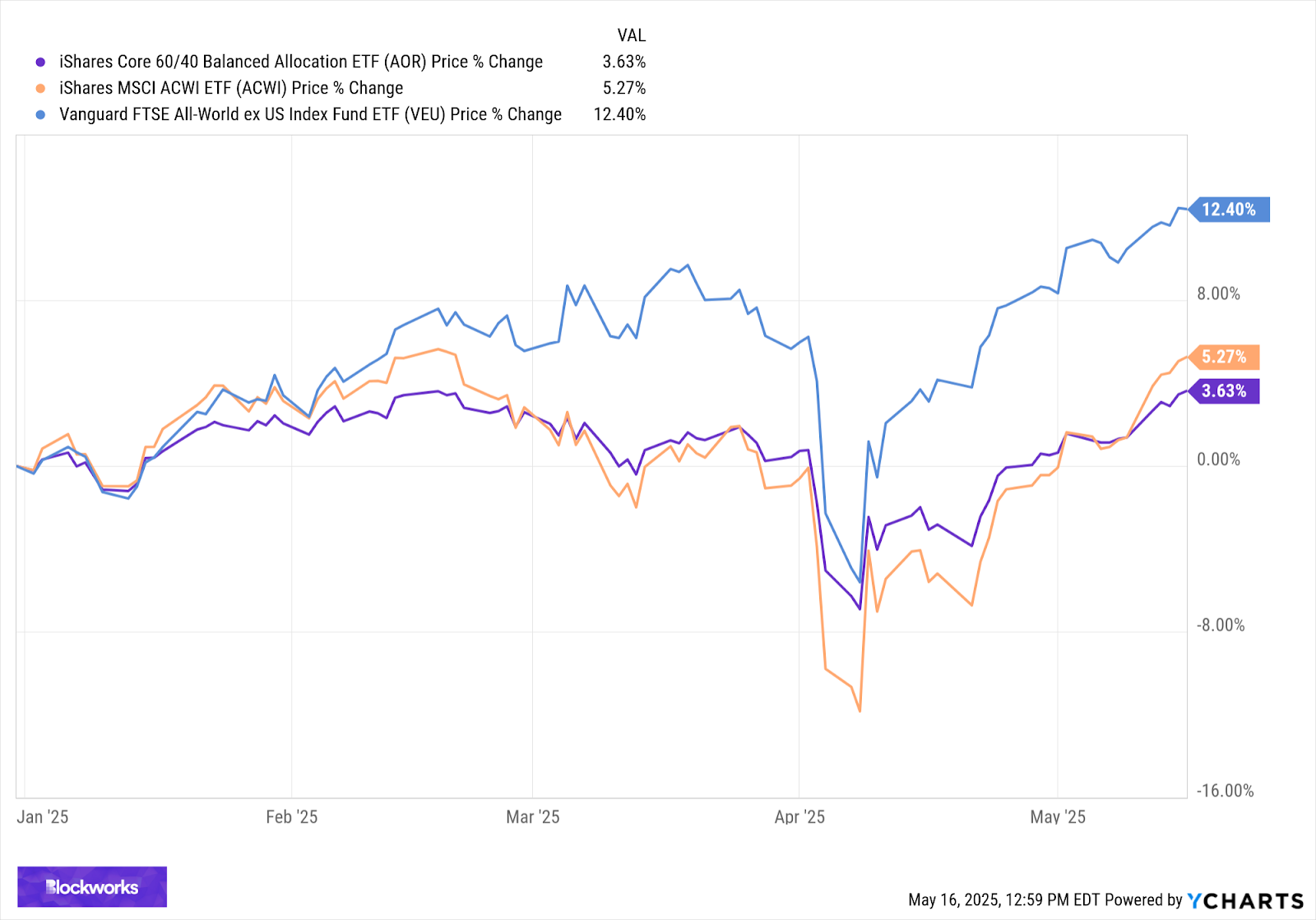

The 60/40 portfolio of global equities (orange) and global equities and bonds (purple) both created the highest ever highs today. Global Equities Ex-US (blue) has made its highest priced.