Circle, the company behind USDC Stablecoin, introduced a new international payments network in April 2025, aiming to make global payments faster, cheaper and more transparent. This guide categorizes how the Circle Payments Network (CPN) works, its key features, real-world use cases, and how it stands in the broader cross-border payment sector.

In this guide:

- CPN vs. traditional cross-border payments

- What is Circle Payments Network (CPN)?

- Key Features and Innovations of CPN

- Circle Payment Network: Actual Use Cases

- How does CPN work?

- Positioning regulations and compliance across major regions

- CPN Issues and Limitations

- Will CPN revolutionize cross-border payments?

- FAQ

CPN vs. traditional cross-border payments

What is Circle Payments Network (CPN)?

Sending money abroad ideally should not take days or sacrifice a large sum of money. However, this is almost always done when using traditional cross-border banking.

International bank transfers can take more than a day to resolve, and often involve high fees due to intermediaries, currency conversions and compliance layers. These inefficiencies have hit developing countries the most violently.

Circle’s new platform, Circle Payments Network (CPN), aims to provide a viable alternative to traditional banking routes. It is designed to connect financial institutions for payments across nearby borders using Stablecoins such as USDC and Euro Coin (EURC).

The result is a fast, transparent, programmable payment that feels as instantly as domestic relocation. With Circle, this is just as easy to make money as email.

“Since we founded, our vision for our circle has been to make money as simple and efficient as sending emails. CPN is a key step to making that vision a reality for businesses around the world.”

– Circle co-founder, chairman and CEO Jeremy Allerle (via Circle Press Release)

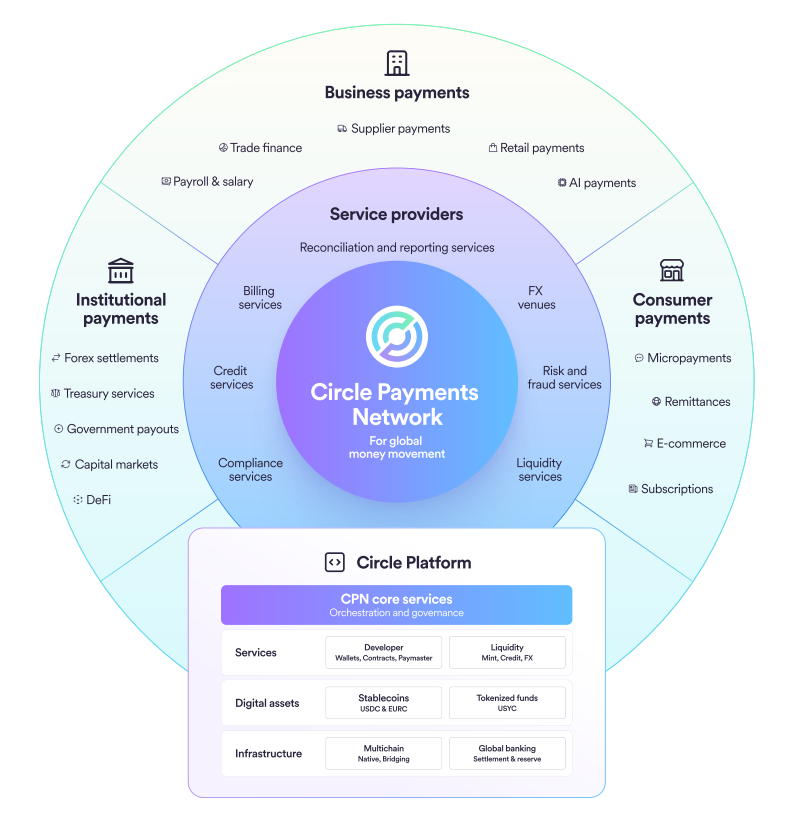

Circle Payment Network Overview: CPN Whitepaper

Key Features and Innovations of CPN

CPN introduces several promising features aimed at transforming cross-border payments.

➤Stablecoin-driven forwarding: CPN uses regulated stub coins such as USDC and EURC as exchange media. These coins are fully backed by Fiat’s reserves, maintaining a 1:1 peg in each currency. This eliminates volatility in currency during transit and provides transparency on the chain.

➤Integration with traditional finance: CPN connects banks, neobanks, payment processors, and wallets to local payment systems. It serves as a bridge between blockchain networks and traditional rails such as ACH, SEPA and more. Institutions can be plugged in through a single interface, avoiding the creation of multiple bilateral relationships.

➤24/7 Real-time payment: Regardless of weekend or bank times, transactions settle within seconds. This reduces the risk of liquidity and increases cash flow by eliminating the need to advance fund foreign accounts.

➤ Cost Reduction: CPN reduces fees and FX spreads by swapping multiple intermediaries and using blockchain. Transactions containing Stablecoins can avoid double conversion. This further increases transparency while reducing costs per transition.

➤ Transparency and Compliance: All transfers are recorded on the public blockchain, ensuring auditability. Only reviewed institutions with strict rules regarding licensing, AML/CFT controls and security protocols are participating.

➤ Programmerity: CPN is built on a smart contract infrastructure and supports advanced features such as escrow, automatic splitting payments, and condition-based transfers. Circle offers APIs to help FinTechs and developers integrate with CPN.

➤Security: Institutions maintain control of their assets using their own wallets or trustworthy custodians. The system avoids centralized failure points and incorporates bank-grade cybersecurity standards.

Circle Payment Network: Actual Use Cases

The launch of Circle’s international payments network could significantly reshape how money moves globally, especially in underserved regions.

If you’ve ever tried sending money abroad, you know pain, delays, high fees, and unclear tracking. Circle’s CPN aims to solve these issues and improve access to financial services. Possible effects include:

Faster and cheaper transfers

Remittances often cost more than 6%, reducing family income. With CPN, immigrants could send money to arrive in minutes at a much lower cost, even on weekends. This will help achieve the UN’s goal of increasing support for low-income households and reducing remittance fees.

Wider access via mobile wallet

Many people without traditional bank accounts still use smartphones. CPN connects to mobile apps such as coins.ph (Philippines) and Flutterwave (Africa) to allow people to receive money directly in local currency without the need to process crypto.

Small and Medium Business Boost

Small and medium-sized businesses often face high friction with cross-border payments. CPN allows you to quickly send or receive funds. This significantly reduces delays, reduces costs, and makes it easier to access global suppliers or customers.

Always on payment

The CPN works 24/7. This means payments can be sent or received during time zones and weekends, helping people and businesses access funds when they need them the most.

Emerging market integration

CPN’s partner network covers Africa, Latin America, Southeast Asia and more. By improving payment corridors in these regions, it will help connect the local economy to the global financial system.

How does CPN work?

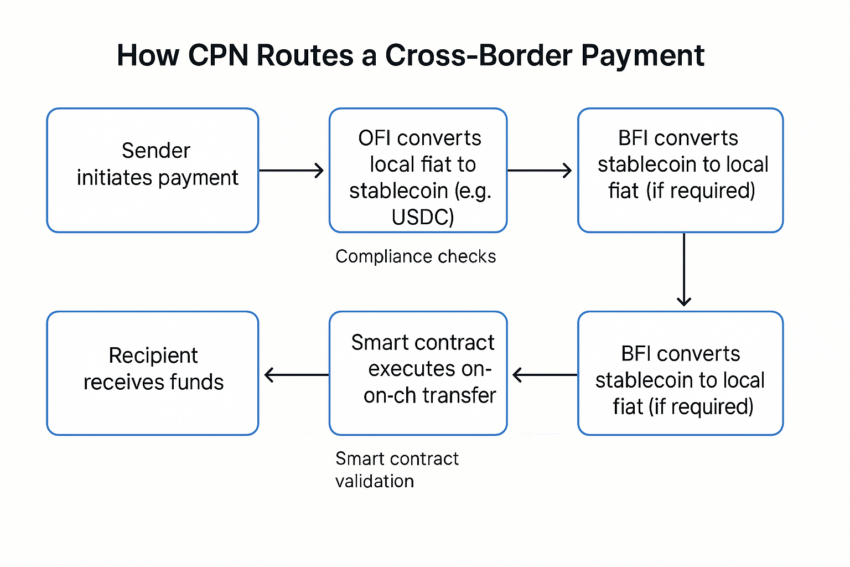

The Circle Payments Network (CPN) operates as a coordination protocol that allows licensed financial institutions to send, receive and settle payments using Stablecoins such as USDC and EURC.

Instead of processing payments directly, CPN coordinates how value between parties moves through blockchain payments and off-chain APIs. It connects financial institutions of origin (OFIS) and beneficiary financial institutions (BFIs) while maintaining compliance and speed.

Circle Payment Network Function: CPN

Off-chain orchestration meets settlements on the chain

CPN processes payments by splitting the process into two layers.

➤ Off-chain layer: This includes APIs and SDKs that help you discover available BFIs. All this happens before the transaction moves to the blockchain.

The institution uses the standard interface provided by Circle to perform these steps. Circles also facilitate service discovery by letting the institution broadcast supported currency and payment features.

➤ONCHAIN Layer: Once payment parameters are agreed, the system completes the transaction via smart contracts. These contracts validate the OFI’s credentials, match the transaction with the BFI, and ensure that the settlement criteria are met.

Smart Contract performs Stablecoin transfers from sender to receiver on supported blockchains. This hybrid model ensures flexibility while enabling programmable and auditable payments.

Stubcoin and Support Blockchain

CPN natively supports USDC and EURC for cross-border transactions. These tokens settle on public blockchains such as Ethereum, where Circle issued USDC.

The system is integrated with Circle’s Cross-Chain Transfer Protocol (CCTP V2) to allow agencies to move stubcoins based on different chains.

OFIS and BFI Matching

CPN allows each OFI to find the right BFI to complete payments in the desired FIAT currency. This system matches participants based on liquidity, currency support and availability of services.

For example, if OFI want to send a USDC to make a payment in Naira, Nigeria, the CPN can route that payment to BFI in Nigeria, convert and pay the funds locally.

These features turn CPNs into a structured market where institutions discover the best counterparties for a particular payment corridor.

Enforcement of compliance and eligibility

Only regulated financial institutions can access the CPN. All participants must meet the minimum license and operating criteria defined in the CPN Rule Book and enforceable through Circle’s network agreement.

Each transaction undergoes a check like this:

- Sender/Receiver KYC

- Travel Rules Compliance

- Jurisdiction license verification

- Sanctions Screening

CPN uses a combination of secure messaging and credential validation to coordinate this without revealing sensitive information.

The agency will exchange encrypted payloads for required disclosures and maintain an audit trail to meet local and international law. The circle does not touch the funds or holds custody, but acts as a coordinator and verifier.

Confidential payments and data processing

Some agencies may want to protect payment details from third parties. CPN supports sensitive transactions by allowing payment metadata to be private while verifying payments and credentials.

Participants can only share data with necessary verifiers such as regulators and auditors using zero-knowledge or threshold disclosure protocols (introduced in later versions).

This architecture ensures compliance without leaking unnecessary information across the network.

Smart contract function

The on-chain portion of the CPN uses smart contracts to adjust the final payments.

These agreements check sender and recipient credentials, check forex rates and fees, and forward stubcoins accordingly. The same infrastructure enables the following value-added logic:

- Time-locked forwarding

- Escrow payment

- Multi-party settlement (for example, paying multiple suppliers from one Stablecoin wallet)

- Pricing automation (split between OFI, BFI, and circles)

Institutions can also integrate their own smart contracts with CPN flows by building on Circle’s APIs and SDKs.

FX Translation and Routing Logic

CPN allows institutions to convert stubcoins to local Fiats through whitelisted conversion venues. These venues include private liquidity providers and OTC desks in the early stages. Over time, CPN routes translations via on-chain protocols such as distributed exchanges and automated market makers, subject to compliance approval.

Modular ecosystem integration

CPN focuses on core payment adjustments, but is designed to support third-party integration via modular APIs. Future add-ons include:

- Loans and Credit Scoring

- Invoice automation

- Subscription billing

- Yield generation

- Digital Identity Integration

Simply put, Circle acts as a technical and governance layer, while letting third parties build payment tools on top of basic protocols.

Positioning regulations and compliance across major regions

Circle ensures that CPN follows a strict “compliance-first” approach. Each partner must comply with local laws, as only licensed financial institutions are eligible to participate. This approach ensures that all transactions are subject to surveillance and align with evolving regulatory frameworks in the US, EU and Asia.

US

The CPN is consistent with the proposed stable law, implements reserve transparency and prohibits the profits of stable ones. Circle already meets most requirements, and USDC supports 1:1 and is issued via licensed remittances. AML and KYC compliance are built into the system.

european union

The circle has been licensed EMI in France and complies with MICA regulations. USDC and EURC are issued under full EU monitoring. CPN works within EU law, complementing SEPA moments and supporting full transparency and consumer protection.

Asia Pacific

The Circle already holds a major payment institution license from MAS in Singapore. You can legally issue Stablecoins and provide cross-border payment services. The circles are attracting regulators in Japan and Hong Kong as these markets evolve.

Middle East, Africa, Ratum

Circle is a partner with regulatory entities such as Flutterwave and Dlocal, ensuring local compliance. The expansion of the United Arab Emirates and Bahrain is expected through partnerships. All partners are licensed in the home market.

Recent Partnerships, Announcements and Global Expansion

Circle is actively building a Circle Payments Network (CPN) through partnerships, geographical expansion and infrastructure upgrades. Here’s an overview of the key movements:

Global Partners and Design Collaborators

Circle has announced more than 20 design partners across the region to support the launch and footprint of CPN.

- Africa: Flutterwave, Yellow Card, Onafriq – Enables mobile money and bank account payments.

- Asia: coins.ph (Philippine remittance), FOMO Pay and DTCPay (Singapore).

- latin america:dlocal (payments in over 30 countries), Transfer (Brazil), Inswitch.

- Middle East and Europe: Coinmena, Bvnk, Triple-A, OpenPayd, Nilos.

- Transfer:Zepz (WorldRemit, SendWave) offers CPN reach for payment rails in over 130 countries and mobile wallets.

- Infrastructure: FireBlocks allows banks and Fintechs to connect to a CPN using their existing Crypto Custody Stack.

Trustworthy Bank Advisor:

The Circle is engaged as advisors in Santander, Deutsche Bank, Societe Generare and Standard Chartred. Although not active in CPN yet, it helps shape compliance, data localization, and real-world banking requirements.

The past blockchain collaboration with Standard Chartered Circle makes it more likely to be adopted early.

Recent product developments:

- Refund Protocol (April 2025): Add transaction reversibility to stability and improve institutional trust.

- Euro expansion: Eurocoin support on multiple blockchains adds flexibility to the EU corridor.

- Soft launch in May 2025: Limited beta launches test remittance corridors such as the US Philippines and EU-Africa.

Physical and Regulatory Footprint:

- Singapore Headquarters Mica Compliance for Asia and France, and regional Ratum Teams are currently being implemented.

- US, EU and Singapore licenses allow for compliant operation across key markets.

Major Payment Collaboration:

- visa: Existing payment partnership with USDC.

- MoneyGram: Using USDC via Stellar, indicating the increased acceptance of Stablecoins in traditional remittance models.

IPO and market reliability:

Circle will be released in 2025 and will add investor confidence and enable greater institutional adoption.

Competitive positioning:

- I’m aiming to be a rival ripplenet And challenge Visa/MasterCard Cross-border reconciliation.

- Directs stable alternatives with actual regulatory buy-in and global reach.

CPN Issues and Limitations

While CPNs provide significant improvements to cross-border payments, they still face some practical and regulatory challenges.

The onboarding process is also complicated, considering participants must pass rigorous compliance checks, such as AML, KYC, and sanctions screening.

To shorten the long story, CPN can only reach its full potential if CILL expands participation, improves developer tools, and address jurisdictional concerns across a variety of regulatory environments.

Will CPN revolutionize cross-border payments?

Circle is building an infrastructure that can redefine cross-border payments. That said, the success (or lack of) of a CPN ultimately depends on the clarity of adoption, trust and regulations.

If that’s what you’ve promised so far, sending money abroad might be just as easy as sending an email. If that happens, it will undoubtedly open new doors to greater inclusion and opportunities around the world.