Crypto whales are in a quiet movement with Ethereum (ETH) and Optimism (OP), but their accumulation is stagnant, or even negative, in addition to most other major coins. Between April 4 and 6, both ETH and OP had a noticeable increase in large wallet holders despite a severe market correction.

This behavior often shows early confidence from institutional players, suggesting a potential reversal. With ETH approaching $1,400 and opening trades at three years’ low, the next few days could be crucial if whales buildup leads to new bullish momentum.

Ethereum (eth)

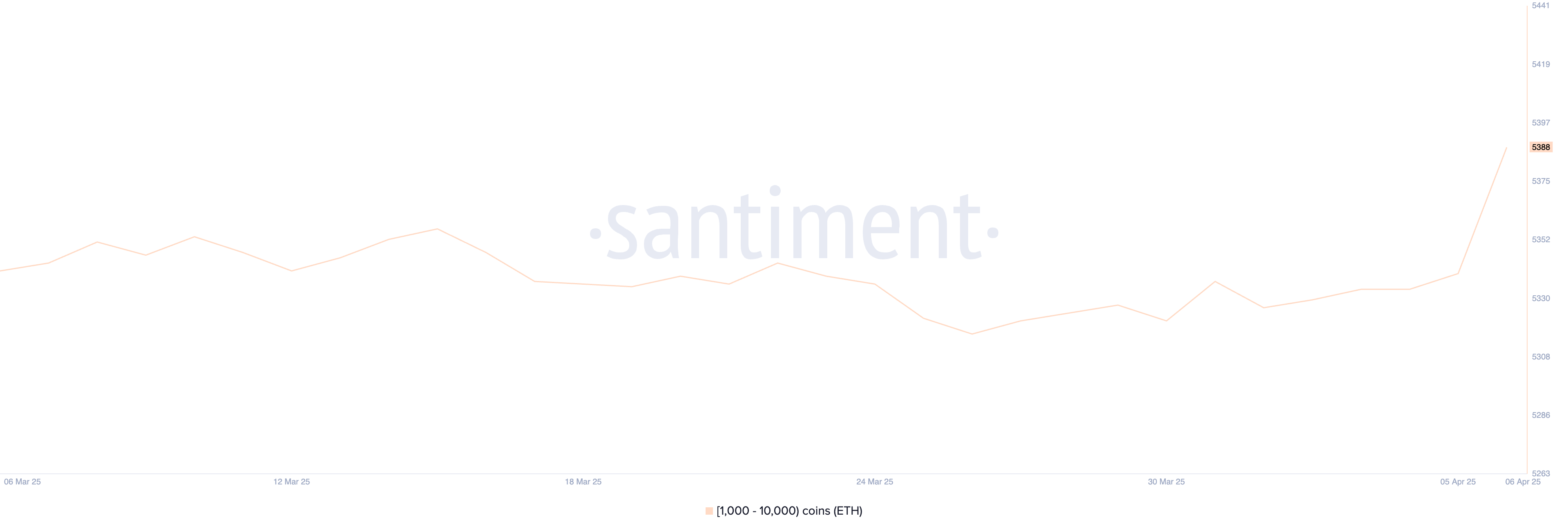

Between April 5 and April 6, Crypto whales accumulated ETH. The number of Ethereum whales wallets holding ETH between 1,000 and 10,000 has increased from 5,340 to 5,388, indicating a quiet accumulation stage during a wider market revision.

Tracking these large holders is extremely important. This is because their actions often precede major market movements. As whales accumulate, they show increased reliability in the long-term value of their assets, suggesting a reversal of potential trends.

The number of addresses that hold ETH between 1,000 and 10,000. Source: Santiment.

As Ethereum’s current downtrend continues, ETH prices will fall below $1,400 for the first time since January 2023, opening the door to deeper losses.

However, recent increases in whale activity suggest a degree of optimism beneath the surface. If momentum changes and ETH can regain $1,748, it could rise further towards $1,938, retesting the $2,000 mark with a strong rally.

Optimism (OP)

The number of optimistic whale wallets holding OPs between 10,000 and 1,000,000 is the line from 4,138 on April 4 to 4,151 on April 6, suggesting a large holder accumulation despite ongoing market corrections.

This increase in whale activity could indicate long-term confidence in the project despite the wider market facing intense sales pressure.

In periods of uncertainty like the current period, such accumulation could be an early indication of a potential price reversal. This is because institutional or wealthy investors often act before retail sentiment.

The number of addresses that hold OPs between 10,000 and 1,000,000. Source: Santiment.

Currently, the OP, which has traded near its lowest level in nearly three years, is under considerable downward pressure. If the fix continues, the token may be below the $0.50 support level.

However, if the recent whale accumulation reflects a change in momentum, the OP could recover to test resistance at $0.65.

A breakout from that level could open a pass headed towards $0.77, while a stronger recovery could also retest $0.84.