Bitcoin (BTC) renewed momentum in May 2025, surpassing 14% in the last 30 days, just 6.3% below the key $100,000 mark. The obvious demand for Bitcoin behind price action has been positive for the first time since late February, indicating a change in behavior on the chain.

However, fresh influx, particularly from US-based ETFs, suggests that institutional convictions have not yet returned to full, as they are suppressed compared to 2024 levels. According to MEXC COO Tracy Jin, if current conditions apply, the summer gathering for $150,000 is plausible and emotions become increasingly bullish.

The apparent demand for Bitcoin is positive, but a fresh influx is still lacking

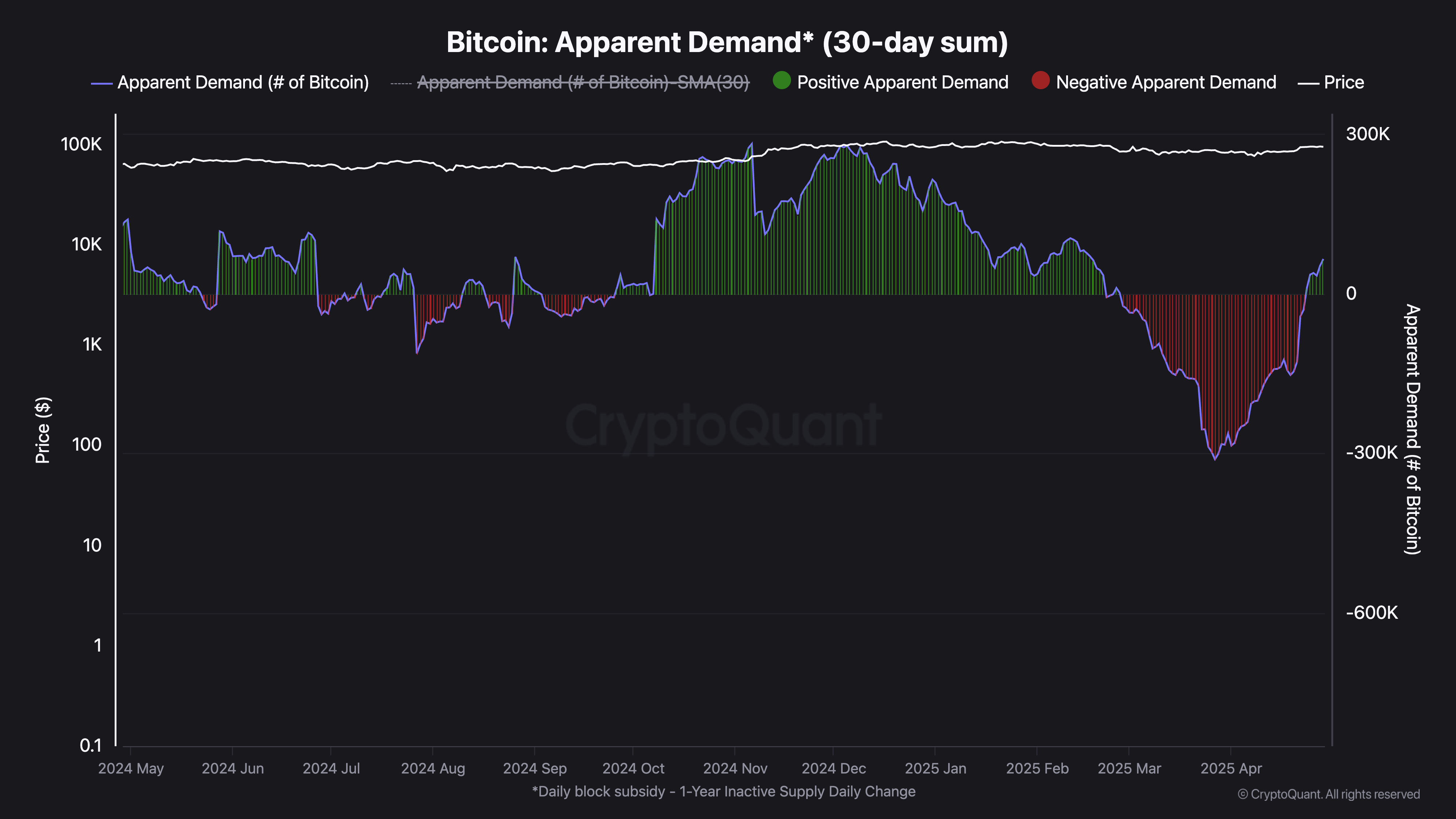

Clear demand for Bitcoin has shown clear signs of a recovery recently, rising to 65,000 BTC in the last 30 days. This marks a sudden rebound from the trough on March 27th. This has defined a clear demand as a net 30-day holding change across all investor cohorts, achieving a highly negative level of -311,000 BTC.

Apparent demand reflects an aggregated balance shift across the wallet, providing insight into whether capital is in or ending Bitcoin network.

Current demand levels are well below the previous peak in 2024, but a meaningful inflection point occurred on April 24th.

Apparent demand for Bitcoin. Source: Cryptoquant.

Despite this improvement, the broader demand momentum remains weak.

The lack of continuous new influx suggests that most recent accumulation may be driven by existing holders rather than entering the market.

For Bitcoin to launch a sustainable rally, both the obvious demand and demand momentum must show consistent and synchronized growth. Until that alignment occurs, current stabilization may not support strong or long-term price breakouts.

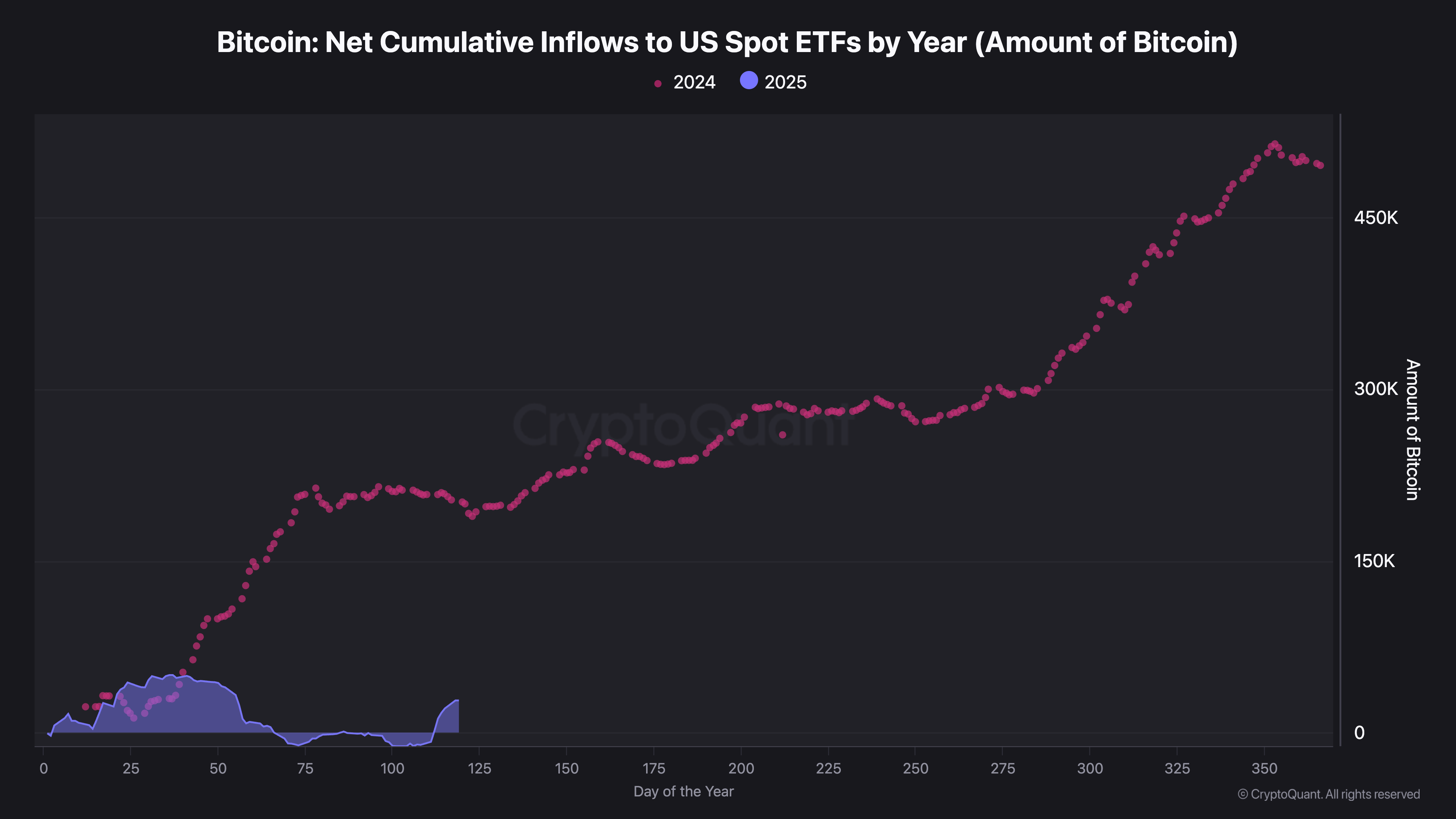

US Spot Bitcoin ETF Inflows are still well below the 2024 level

Bitcoin purchases from US-based ETFs have remained roughly flat since late March, fluctuating between daily net flows from -5,000 to +3,000 BTC.

This activity level is in stark contrast to the powerful influx seen in late 2024, when daily purchases frequently exceeded 8,000 BTC and contributed $100,000 to the first Bitcoin rally.

So far, in 2025, BTC ETFs collectively accumulated a net total of 28,000 BTC last year, well below the over 200,000 BTC they purchased at this point.

This decline marks a slowdown in institutional demand, which is historically important in driving key price movements.

Bitcoin: Net cumulative inflows to us find ETFs each year. Source: Cryptoquant.

There are early signs of modest rebounding, and ETF influx has been beginning to rise recently. However, current levels are not enough to fuel sustained uptrends.

ETF activities are often seen as representatives of institutional convictions, and a noticeable increase in purchases could indicate new confidence in Bitcoin’s medium-term orbit.

Until these influxes come into effect, broader markets may struggle to generate the momentum needed for long-term gatherings.

With momentum gains despite macro pressure, Bitcoin is approaching $100,000

Bitcoin prices have risen by more than 14% in the last 30 days, rebounding strongly after falling below $75,000 in April.

This new momentum is as BTC demonstrates relative resilience amid wider macroeconomic volatility and policy-driven pressure, including Trump’s tariff measures that weighed risky assets.

The crypto market as a whole feels an impact, but Bitcoin appears to be slightly detached, indicating that it is less sensitive to these external shocks than other digital assets.

Bitcoin price analysis. Source: TradingView.

BTC is currently only 6.3% below the $100,000 mark, remaining below the $17% mark, leaving it at a potential move to $110,000. Sentiment is once again positive, according to Tracy Jin, COO of MEXC.

“Beyond immediate price action, the growing institutional appetite and reduced supply mechanisms illustrate the background of macroeconomic uncertainty and demonstrate the structural changes in the role of Bitcoin in global financial markets. BTC is used to hedge against inflation and Fiat-based financial models.

According to Gin, the summer rally for $150,000 is plausible. She stressed that the $95,000 range is likely to be the launch point for a definitive brewing breakout that exceeds $100,000 in the future.

” If global trade tensions continue to stabilize and institutional accumulation continues, summer rallies to $150,000 could be plausible, and by 2026 could reach $200,000. Overall, we can see stock index growth, particularly on Friday.