Alpaca Finance (Alpaca) has been one of the most talked about Altcoins recently, along with the rise that has experienced since the announcement of Binance’s listing, and has experienced a major jump in the last 24 hours.

Claiming to be “the biggest lending protocol that can leverage the BNB chain and Fantom yield,” Alpaca Finance jumped from $0.181, an increase of 422% in under eight hours to $0.950.

The huge leap that the alpacas have experienced shocked everyone, but yesterday prices suddenly fell 92%.

Many cryptocurrency experts and investors believe the 422% rally will be primarily due to Binance’s upcoming opening event on May 2nd.

This rise caught investors who were hoping for a crash as maintenance announcements were caught off guard. Investors who opened short positions were under pressure when prices rose and had to buy back despite losses. This has nurtured a bullish cycle.

Additionally, the Alpaca Finance team has announced that it has cancelled plans to issue more alpaca tokens after a backlash from the community, completing the 214th weekly buyback and burns and removing 188,888 Alpaca (approximately $41,500) from distribution.

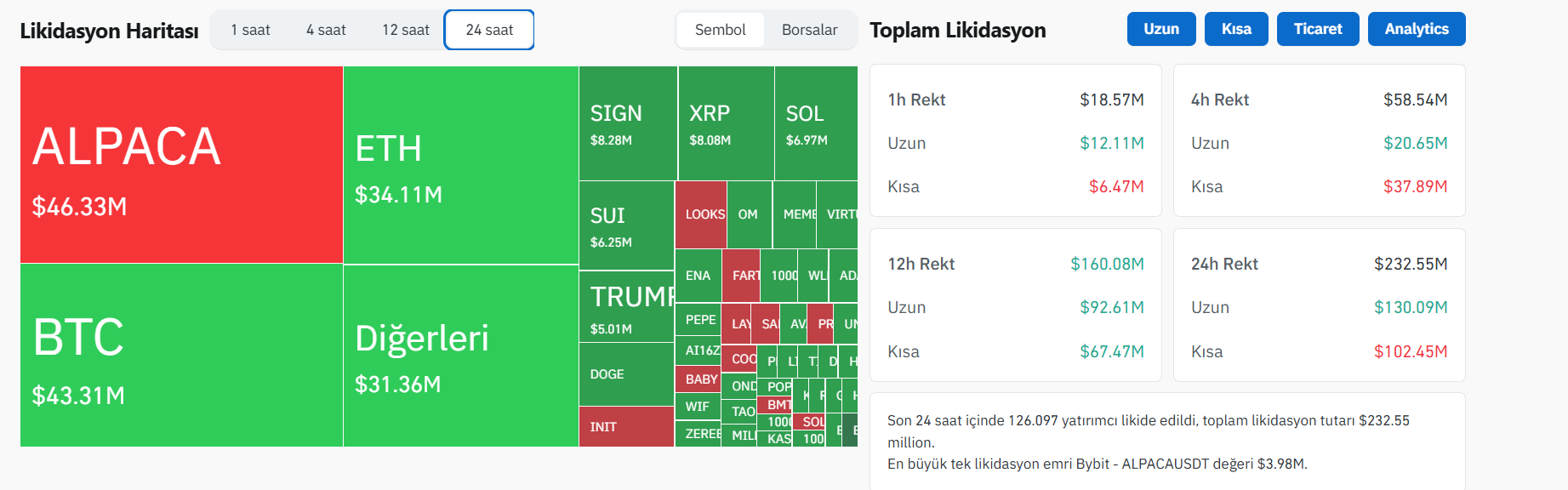

This rally also settled short positions. According to Coinglass data, the Alpaca Futures liquidation volume surpassed Bitcoin.

Alpaca Perpetual Futures has recorded a liquidation volume of $46.64 million over the past 24 hours, surpassing Bitcoin (BTC) $43.32 million.

In the final hour, Alpaca’s liquidation reached $5.6 million, while BTC’s liquidation totaled $2.39 million. The biggest settlement occurred with bibits of the ALPACA/USDT pair.

*This is not investment advice.