Ethereum continues to integrate just below the Key Resistance Zone, following an impressive gathering from the beginning of this month. Prices remain technically bullish, but ETH has yet to confirm any breakouts above this critical level.

Technical Analysis

Daily Charts

On the daily charts, ETH is trading just below the confluence of 200 days and $2,800 supply levels. However, the 100-day moving average is currently below the assets, providing support just below the $2,100 demand zone. As prices are trapped between these two moving averages, a breakout to either side could be the beginning of a new impulsive movement.

Meanwhile, the RSI is just below the condition of around 66, but the downtrend shows that the strength of the upside down is slower, creating a bearish divergence, indicating that it can be corrected in the coming weeks.

4-hour chart

When it drops over the four-hour time frame, Ethereum shows signs of weakening momentum. After the explosive movement exceeds $2,100, prices are integrated within narrow ascent channels, close to the $2,500-$2,600 range. However, RSI has been on a slight upward trend, indicating that momentum is slowly changing in favor of buyers during this time frame.

But for a meaningful gathering to begin, the market must break out of the channel with power and volume. Otherwise, drops below the $2,600 level, which currently serve as short-term support, could lead to a breakdown of the channel, with price drops returning to the $2,100 demand zone.

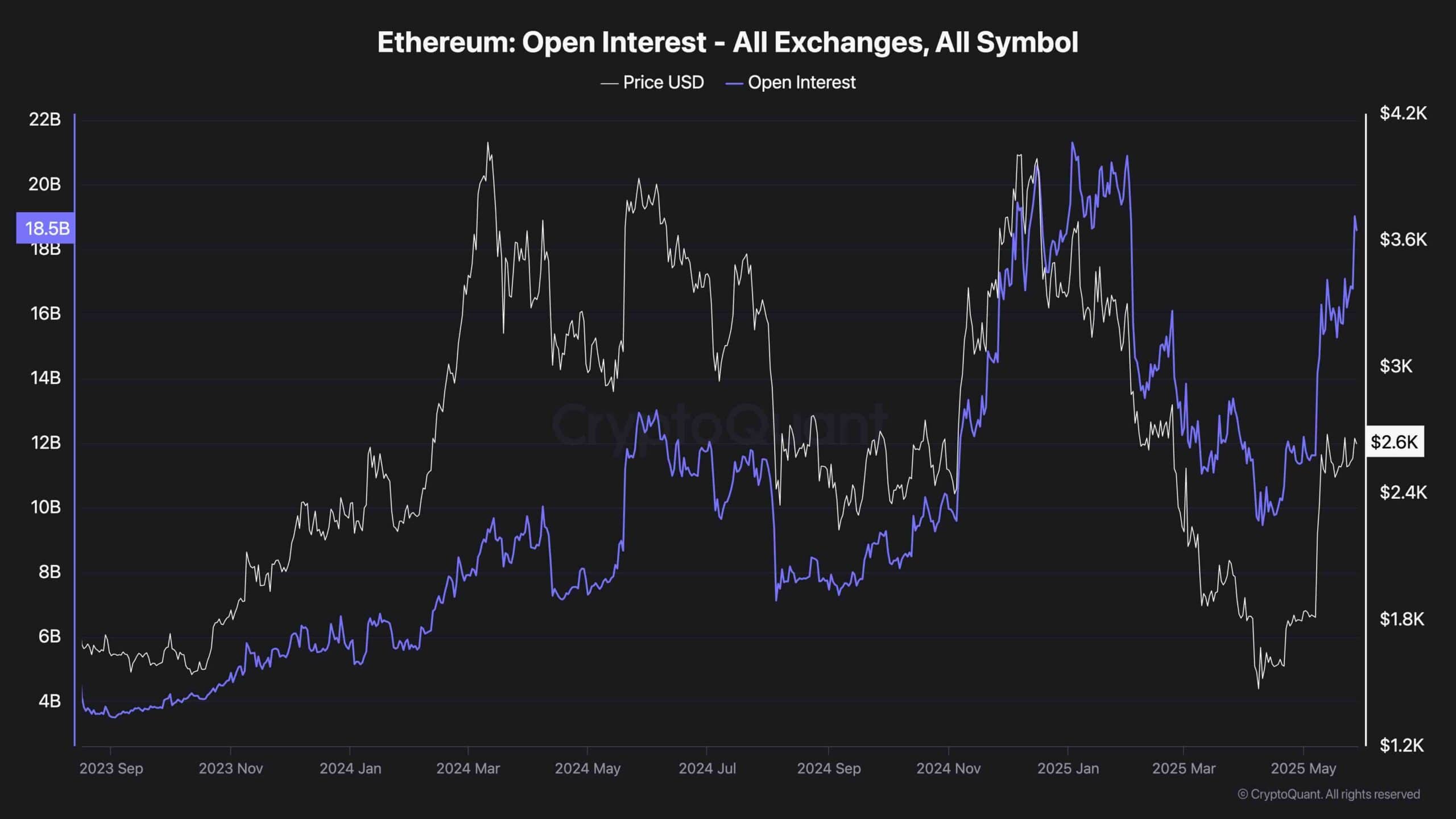

Open interest at Ethereum has skyrocketed, now standing at $1.85 billion, close to the previous high seen earlier this year. Along with price increases, this significant increase in open interest suggests the accumulation of long positions that are leveraged across the market.

This often shows strong bullish sentiment and trader trust, but also introduces potential risks. Active climbing without clear breakouts with open interest can signal overcrowding and increase the likelihood of liquidation-driven pullbacks. Current positioning reflects high breakout forecasts above $2.8,000.

However, if the ETH fails to clear its resistance, the market will be able to see a quick fix as the over-covered long is washed away.