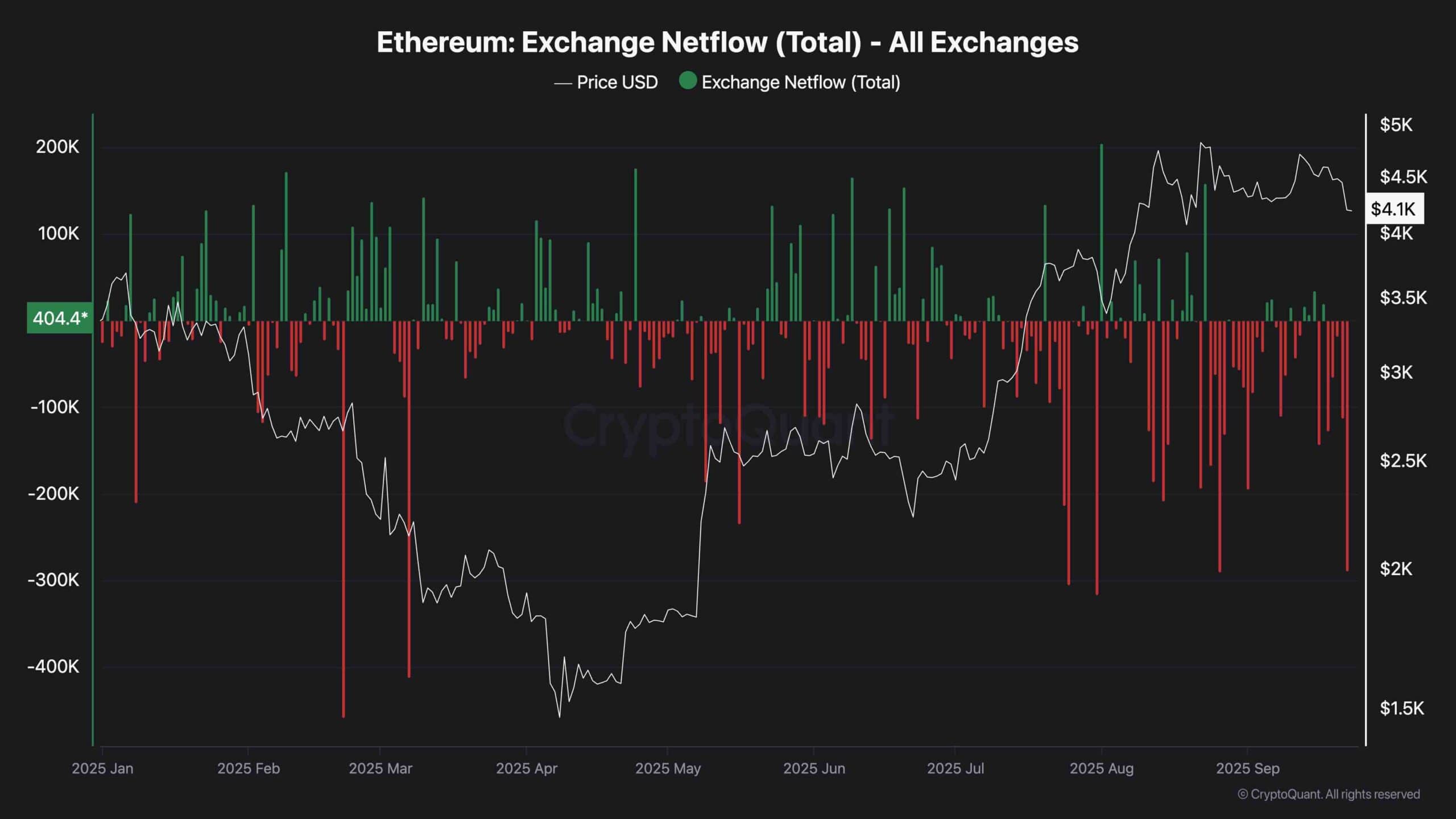

Ethereum has returned to the key support zone after seeing a sharp rejection from local highs. As Netflows demonstrates sustained runoff and momentum cooling, the market is currently testing whether the Bulls can defend their key levels and whether there is a deeper retracement ahead.

Technical Analysis

By Shayan

Daily Charts

On the daily charts, ETH was unable to hold more than $4,400, falling below the recently formed small ascent channel. This breakdown has changed momentum, with prices now reaching around $4,200. Also, RSI sits at around 40th, reflecting bullish loss, but is not yet in extreme selling condition.

The first major support was found at nearly $4,000, then an area of $3,800, lined up at the lower boundary of the 100-day moving average and the larger channel. When buyers adhere to this level, the ETH can form a higher, lower structure and keep the wider uptrends intact.

For now, the medium-term trend in ETH remains bullish as long as it holds $3,700, but the momentum change suggests more negative side prolongation before strength returns.

4-hour chart

The 4H chart draws a clearer picture of recent weaknesses. The ETH broke from the $4,400-4,800 integrated range and quickly fell to $4,100. The momentum is currently leaning heavily towards the downside, with RSI nearly 30, indicating short-term excesses. This could cause a bouncing of relief, but the collapse undermined local trends until $4,400 was reclaimed.

The next strong liquidity cluster is around $3,800, and is in line with both horizontal demand and ascending trendlines. This zone could lead to buyers actively trying to intervene. If ETH can hold and rebound from this area, the initial upward goal is $4,200, followed by a retest at the $4,400 key level. Meanwhile, failing to exceed $3,800 could accelerate sales pressure and drag the market into the overall bearish stage.

On-Chain Analysis

Replace Netflows

Exchange Netflows continue to show large negative spikes, indicating a consistent ETH spiking from the exchange. This suggests that investors are moving coins to self-supporting or staking, which reduces sell-side supply and generally bullish over the medium term.

However, in the short term, the market is affected by technical weaknesses and recent profits at highs. If accumulation continues during this dip, it may set a strong recovery stage later, but for now, market sentiment is leaning towards a lower level of support test before the new bullish leg begins.