Bitcoin prices skyrocketed above the $95,000 mark on April 25, 2025.

The rally was facilitated by restoring the foundations of strong market momentum and networks.

Analysts emphasized that if BTC exceeds $95,500, it could unleash a breakout at $113,800.

Based on the enhanced MVRV band and capital inflow, BTC price forecasts show further rise despite the potential for short-term cooling.

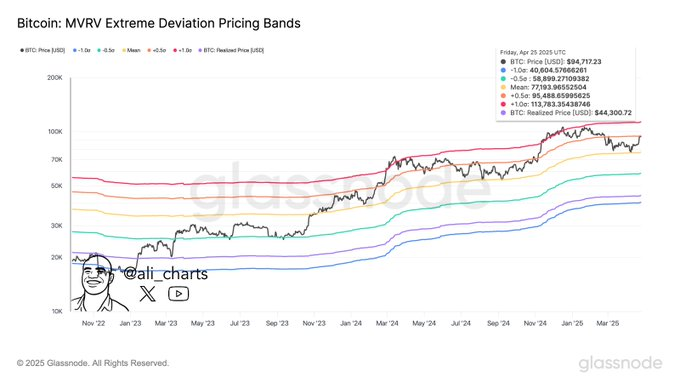

MVRV Band shows potential Bitcoin price breakout

Crypto analyst Ali Martinez has identified Bitcoin’s current movement through the MVRV price range as a major bull signal.

According to Ali, Bitcoin prices have entered a historically powerful zone after regaining the $95,500 level, similar to the previous Bull Cycle.

Source: Ali Martinez, X

The MVRV (Market Value to Realized Value to Value) model tracks when Bitcoin’s price is overvalued or undervalued compared to its historical price behavior.

Ali Martinez explained that navigating higher deviation bands often triggers major gatherings.

His BTC price forecast suggests that if Bitcoin remains strong above $95,500, it could gather towards its $113,800 target in the coming months.

Ali’s latest chart highlighted the deviation band that concludes favorably with Bitcoin prices.

Historically, such conditions precede a strong discovery phase, reinforcing the bullish view that the next major move could coincide with the $113,800 mark.

Analysts point to capital inflows and lower risk levels

Analyst Willie Wu reported that the network’s fundamentals have been resolutely bullish, strengthening its positive outlook for Bitcoin prices.

Woo said it is informing us that capital flows entering the Bitcoin network will be strengthened and accumulation will increase across key addresses.

The speculative flow metrics that capture short-term investors’ behavior have also run out of stock, according to WOO.

This combination usually shows a reduced downside risk and enhanced liquidity.

This raised the BTC price forecast estimate with an intermediate target of $103,000 and the ultimate goal of $108,000.

Additionally, Woo highlighted that the Bitcoin risk model, which previously determined the major cycle swing, has launched its first trend in months.

Low-risk measurements typically preceded major price expansions during previous Bitcoin Bull run.

Short-term volatility is before the higher level

Despite the broader bullish setup, Wu warned that Bitcoin prices could experience short-term volatility.

He observed that the on-chain VWAP (volume weighted average price) indicator rose to +3 standard deviation.

Wu explained that such overexpansion was not usually sharp reduction, but rather led to lateral integration or slowing upward movement.

He said that even if Bitcoin prices are suspended or slightly soaked, they are likely to represent a healthy reset within the ongoing bull structure.

At the time of writing, the BTC price was traded at $94,438.08. This is an increase of 0.06% over the past 24 hours.

Woo said minor pullbacks are normal in the BTC market, as long as there is a possibility of improving liquidity trends to justify BTC price forecasts.

Important Bitcoin Price Levels to Monitor

Additionally, Reed Carson observed that Bitcoin prices have completely retested long-term uptrend support during recent pullbacks.

His analysis showed that ETF influx would return to levels in late 2024, boosting Bitcoin’s macro bullish setup.

According to Carson’s charts, Bitcoin prices remained firmly within parallel upward channels of monthly time frames.

Prices recovered sharply from the low channel boundary, nearly $77,000, confirming the strength of the structure.

Historically, the recovery of Bitcoin from a similar position has resulted in a congregation extended towards upper channel resistance.

Source: Reed Carson, X

Carson predicted that if the channel trend continues, Bitcoin price forecasts could reach between $115,000 and $120,000 by June or July.

While writing this report, the Upper Trendline was close to $118,000, providing a natural target for Bitcoin’s next major gathering.