Bitcoin collapsed violently before recovering as its price fell below $95,000, falling below $94,600 and retreating below $93,395. However, buyers appeared at around $94,000, stopping the decline and allowing BTC to recover quickly. The coin then began to rise again, thrustling at a pivotal level that previously served as resistance.

Major resistance levels broken as the Bulls intervened

Bitcoin hasn’t been down for a long time. It broke over $94,600 and broke the bearish trendline at around $94,755. This opened the door for another break to rise. He continues to violate over $96,500 and is currently trading near the $97,000 level. The simple 100-hour moving average is also below the current price. This is generally a bullish indicator of momentum.

Currently, traders are waiting to see if BTC is above $97,000. If that happens, your next target could be $98,800 or $100,000. This price level has been the highest target for most traders over the past few months.

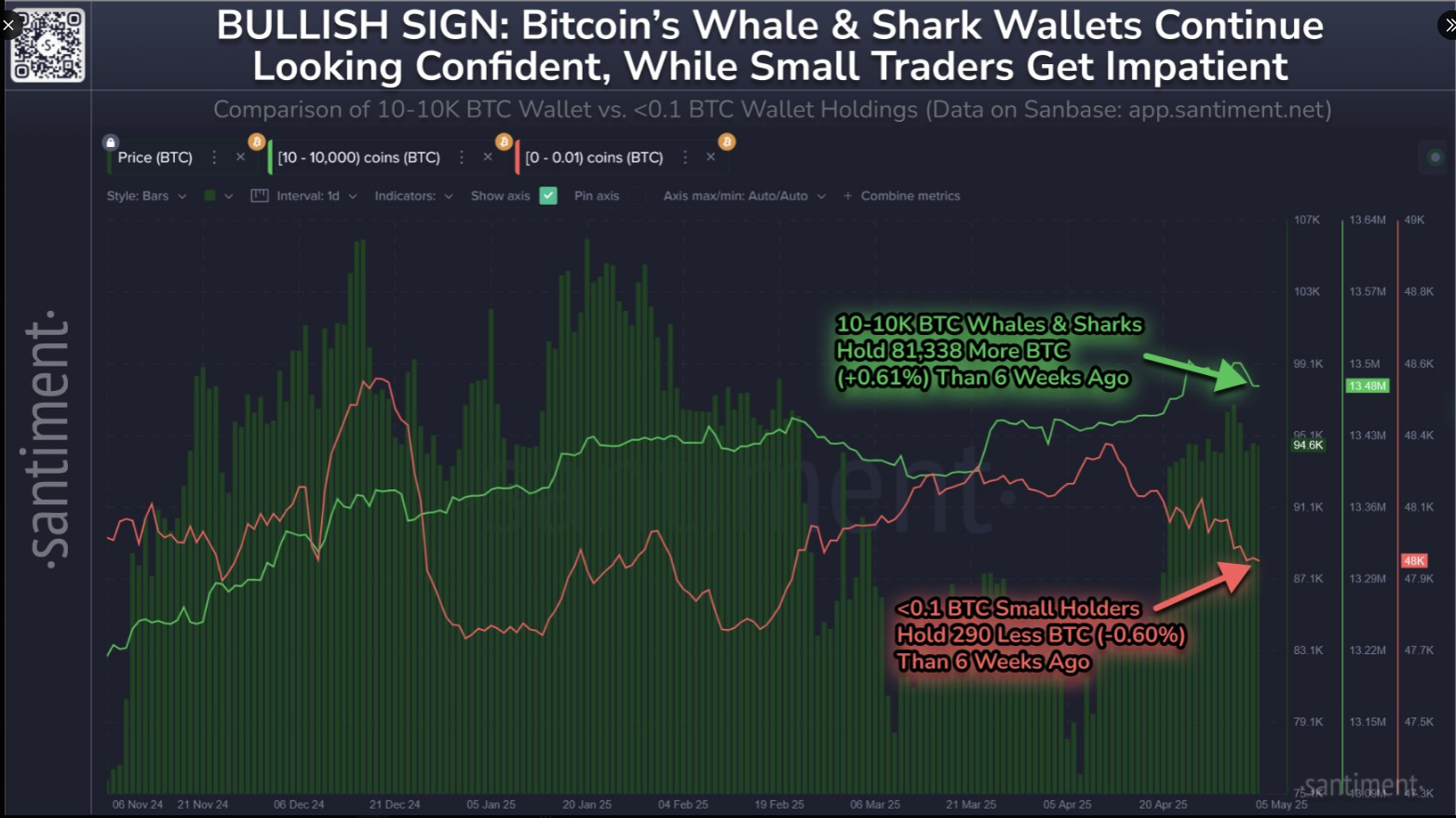

Whale adds over 81,000 BTC in 6 weeks

Large holders, or whales, are confident. Wallets holding 10-10,000 BTC have accumulated over 81k of BTC in the past six weeks. Such wallets tend to belong to institutions or long-term investors who prefer to buy when prices are relatively stable or low.

As the fury progresses, key stakeholders in Bitcoin are moving almost in the right direction if they are rooting for $10,000 BTC in the near future.

The wallets that are most correlated with Crypto’s overall market health (10-10K BTC wallets) have accumulated a total of 81,338…pic.twitter.com/4dkhowrogx

– santiment (@santimentfeed) May 6, 2025

Meanwhile, small holders with less than 0.1 BTC sold 290 BTC in the same period. The differences in behavior between large and small owners have attracted attention. In the past, similar trends followed by strong prices.

$734 million in shorts has been wiped out

Many short sellers who were betting on low prices reached around $95,600. Coinglass Analytics shows that short positions over $730 million have been wiped out when Bitcoin surpassed that level. It was resistance for a few days. However, when the buyer tried it again, the price exploded, reaching $97,200.

The move has boosted morale among bullish traders and created new momentum within the market. If BTC continues to rise, further liquidation may occur.

Derivatives reflect the bulls they are in charge

The derivatives market has also been bullishing. Coinglass shows that the long position is around $2.14 billion, a short position of $2 billion. The contradiction is not huge, but it is enough to tilt the balance towards the bull.

If Bitcoin can’t exceed $97,750, it could fall slightly. Support is around $96,650. If it gives way, it could go down to $95,400 or $95,200. Additionally, support is expected at $94,400 and then $93,100. But for now, the emotions are bright and everyone is looking at that $100k barrier.

Gemini Images, TradingView charts