- Bitcoin is nearing an all-time high of $124,000 following a huge rally in September and Uptober.

- Inflows into institutional ETFs and corporate buying are fueling the bullish momentum.

- Analysts expect sales to reach $160,000 to $200,000 in the fourth quarter if demand continues to grow.

Bitcoin (BTC) enters the final quarter of 2025 with the momentum traders had hoped for, breaking through the $120,000 barrier and reigniting talk of a new all-time high.

This rally comes on the heels of a surprisingly strong September, and is already being described as the early stages of a historic “uptober.”

BTC is currently trading just a few percentage points below its all-time high of $124,128 set in August, with analysts and on-chain observers saying the situation is shaping up for $200,000 by the end of the year.

Seasonal surge takes hold

September was up about 5% for the month, closing above $114,000, bucking the normal bearish trend and laying the foundation for October’s breakout.

Historically, every time September ends in the black, the fourth quarter has been outsized, with average gains of more than 50% in years like 2015, 2016, 2023, and 2024.

This pattern, coupled with an average gain of 21.8% in October and 10.8% in November, solidified “Uptober” as more than just a slogan for crypto traders.

Already this month, Bitcoin has risen nearly 10% in one week, expanding its year-to-date rise to about 27%.

The proximity to record highs makes it even more inevitable that a new record is within reach if demand holds.

Institutions are driving BTC demand

Behind price trends, institutional investor activity sets the tone.

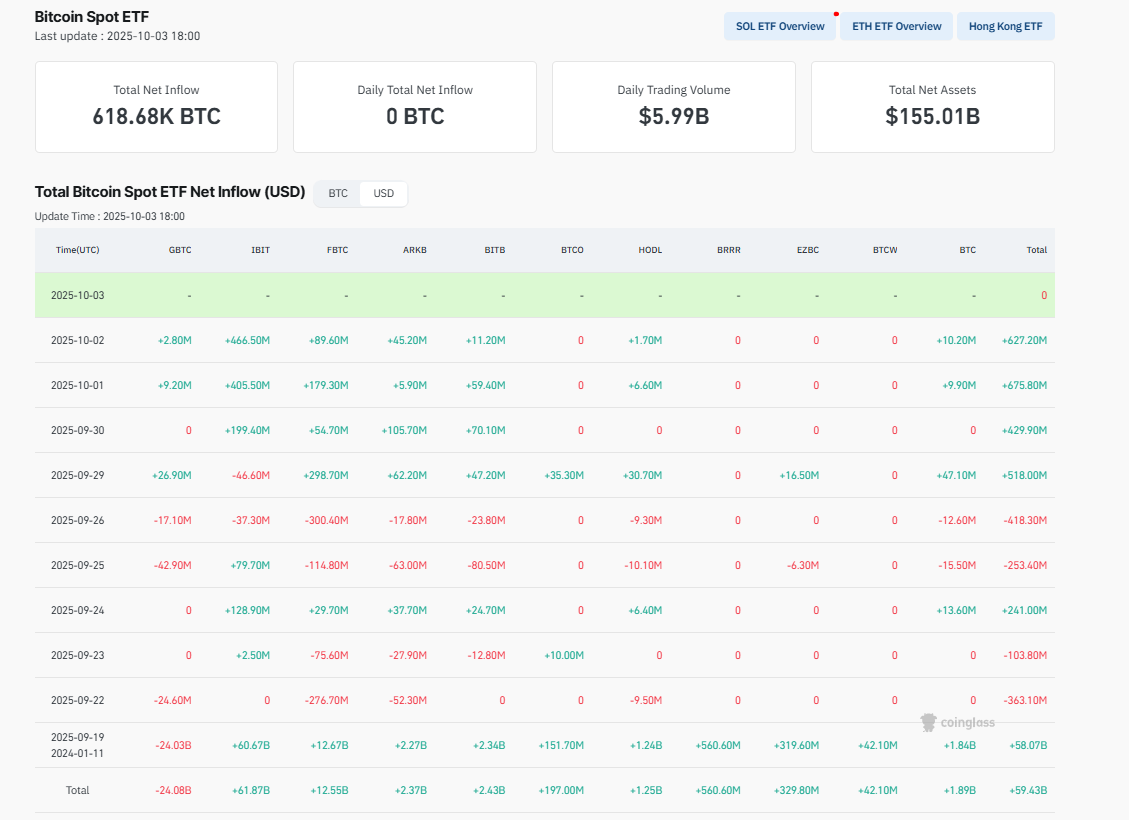

U.S. Spot Bitcoin ETFs have recorded billions of dollars in inflows since early September, including more than $600 million in inflows two days in a row and more than $2.25 billion in the past week.

Source: Coinglass

BlackRock’s IBIT ETF has emerged as the center of this demand, with its options open interest exceeding $38 billion, surpassing even Deribit, traditionally the largest derivatives exchange.

Companies are also becoming more bullish. Strategy, formerly MicroStrategy, has added over 11,000 coins in recent weeks and now controls 3.2% of Bitcoin’s total supply.

Steady accumulation reduces supply on the exchange and shows confidence from long-term holders.

This kind of sustained buying creates upward pressure that is difficult for the market to ignore.

Bitcoin technical breakout confirms momentum

We support technical situations as well. Bitcoin has decisively broken through the resistance level of $119,500, which was the upper limit for the price until late September.

Indicators such as MACD and RSI are flashing bullish signals, while prices remain above short-term moving averages.

Source: CoinMarketCap

All eyes are on $124,600 as the next test, with Fibonacci extension pointing to $128,000-$130,000 as a short-term target.

But the bigger story lies beyond that. JPMorgan’s latest analysis compares Bitcoin to gold and suggests a theoretical fair value of $165,000 if adoption trends converge.

Citi also has a 12-month target of $181,000, while Standard Chartered goes even further, predicting that institutional capital flows could push Bitcoin to $200,000 by the end of the year.

CryptoQuant’s bullish score index is hovering around 40-50, the same levels seen before major breakouts in 2020 and 2024, and the company believes Bitcoin could reach $160,000-$200,000 this quarter if demand persists.

The US government shutdown has also shaken confidence in traditional markets, pushing investors towards hard assets such as Bitcoin and gold.

$200,000 is in front of me

Seasonal strength, institutional inflows, technical momentum, and macro uncertainty have combined to create a situation Bitcoin has never faced before.

With assets nearing all-time highs and liquidity flowing in, analysts argue that $200,000 is no longer a bold outlier, but a realistic scenario if buying pressure continues throughout the quarter.

The key question now is whether Bitcoin can maintain its closing price above $120,000 and decisively break above $124,000.

If that happens, Uptober could be the spark that leads to the world’s largest cryptocurrency’s most explosive rally yet.