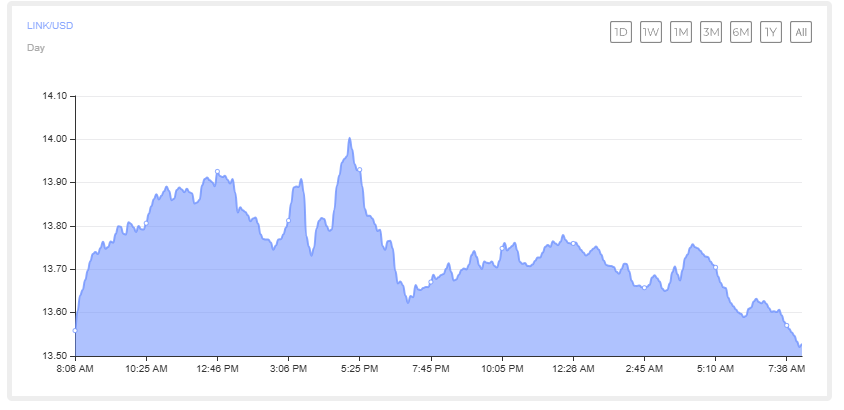

ChainLink has also continued its strong run, surged by 3.79% last week and another 6% over the past 24 hours, steady at $13.88. Link’s trading activity also recovered, increasing 67.6% in a day to $479 million.

- CCIP Live in Solana opens up a new world of whole new possibilities for both users and developers by providing secure, seamless cross-chain connections.

- Also, the Defi Communities and Token projects built on the EVM chain have a way to ultimately expand their reach to Solana.

On May 19th, ChainLink (Link) announced that Cross-Chain Interoperability Protocol (CCIP) is officially live on Solana’s mainnet. Non-EVM chain Solana (Sol), previously lacked seamless connectivity with the Ethereum-based ecosystem. So this is the first time CCIP has been deployed in a non-EVM chain thanks to the upgraded v1.6 architecture.

According to previous updates, the ChainLink V1.6 update introduces support for VM-independent networks such as Solana, which runs on SeaLevel instead of Ethereum Virtual Machine (EVM). This will bring about major improvements. Cross-chain messaging transaction costs are reduced by 90%, while message batches have lower latency and fees.

Chainlink co-founder Sergey Nazarov highlighted how this integration will exceed Solana’s smart contracts and make it even stronger through cross-chain messaging and programmable token transfers.

ChainLink’s CCIP means Web3

For Solana developers, it is a game changer, allowing fast, low-cost, secure cross-chain capabilities without relying on risky, complex bridging solutions. Unlike traditional bridges that rely on wrapped tokens and custody solutions, CCIP allows for direct and distributed transfer of both messages and tokens, even non-EVM chains like Solana.

It leverages advanced features such as Threshold Signature Scheme (TSS), Distributed Oracle Networks (DON), and built-in speed limits and circuit breakers for additional protection.

This allows developers to interact more seamlessly with ecosystems such as Ethereum (ETH), Hashkey Chain, HypereVM, Arbitrum (ARB), optimism, BNB chain, and base. This unlocks new use cases and liquidity flows. In addition to that, CCIP supports the Cross-Chain Token (CCT) standard, allowing real native assets to move around the blockchain without losing security or control. This is a huge step forward to truly interconnecting Web3.

Assets such as Stablecoins, tokenized real-world assets (RWAS), and Defi Tokens can be moved natively into the Solana ecosystem without the need for wrap tokens or dangerous third-party bridges. This means more than $19 billion in value from partners such as Circle, Maple Finance, and so on, and the graph can now be deployed safely and efficiently with Solana.

For enterprises, CCIP brings you the type of tools you need. Standardized APIs for transferring tokens and data, built-in automation, auditability, and gas-efficient batches. Players looking for a secure infrastructure that complies with traditional financial (Tradfi) players have a reliable path to Solana.

At the same time, companies working using RWAS, Central Bank Digital Currency (CBDCS), or tokenized securities will become practical enterprise-ready options for cross-chain activities.

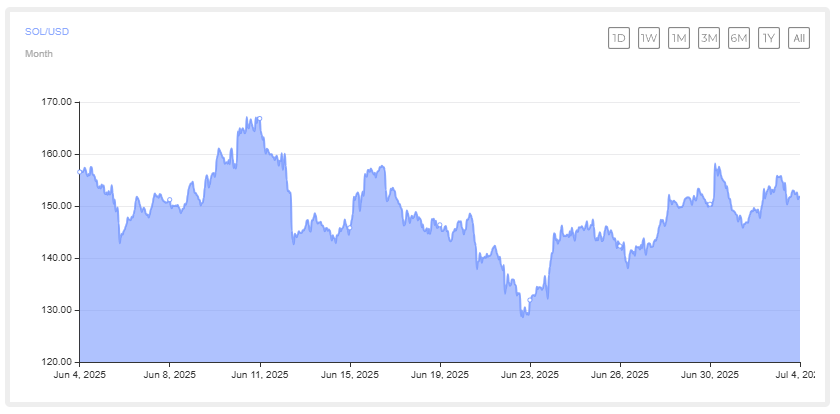

Solana was built on a solid increase of 7% over the past week, seeing a rapid increase of 4.34%. It is currently hovering at around $155, with trading volume rising 24.61% in just 24 hours, at $4.12 billion. Our analysis shows that the next major level to watch is $187, with High Solana hit in May.

ChainLink has also continued to run strong, surged by 3.79% last week and another 6% over the past 24 hours. Link’s trading activity also recovered, increasing 67.6% in a day to $479 million.