The Ethereum is broken above $2,000, setting the next level of resistance at $2,490. After months of emotions and intense sales pressure, Ethereum is regaining its lost ground. The rally revives optimism, particularly with Bitcoin going back to its all-time high. But traders are now worried about whether they can maintain this upward momentum.

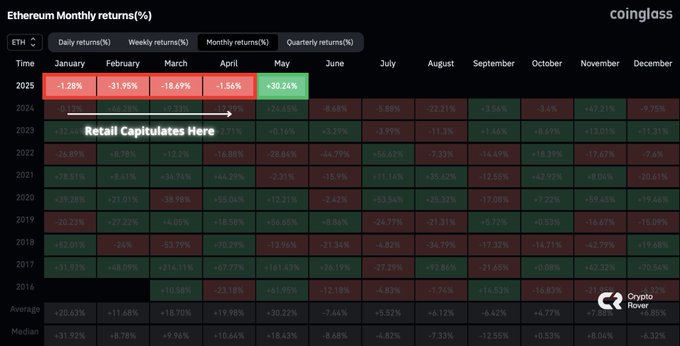

Analyst Crypto Rover reported that the majority of Ethereum holders have surrendered. He congratulates those who still hold it, implying that great benefits were on the horizon. His words show that Ethereum’s confidence is growing in his ability to continue his current bullish trend. He also achieved an impressive 30.24% in May 2025, including a chart that presents Ethereum monthly performances. This reinforces the notion that Ethereum is on the rise following the recession over the past few months.

sauce: x

Ethereum shows bang momentum

Ethereum’s recent price action compared to Bitcoin reinforces growing positive market sentiment. On both the 1-hour and 4-hour charts, the ETH/BTC pairs show bullish momentum, with prices above the key moving average. Ethereum’s strong performance compared to Bitcoin suggests a change in market dynamics.

Ethereum has already surpassed the 0.02 level on the 50-day Simple Moving Average (SMA) of the daily ETH/BTC chart, and has held its position for more than two days, a sign of a potential bullish trend. It also beat the 200-day SMA, increasing its positive outlook. Currently, monitoring is essential to determine whether Ethereum can maintain momentum at these critical levels.

sauce: TradingView

With Ethereum currently consolidated for more than $2,000, many investors are optimistic about the outlook. Despite this positive sentiment, the market situation remains unstable and traders need to be aware of potential trend reversals. In the next few weeks, it may reveal whether the rally directs the launch of Ethereum’s long-term bullish phase.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.