A recent Cambridge report confirms that the US is currently leading global Bitcoin mining, prompting questions about how China will respond. While the country has long maintained an anti-cryptic stance, China’s mining pools have historically controlled a significant portion of the world’s Bitcoin hashrate.

The new hostility towards the US’s current competitiveness and trade policy could be motivated by China to replicate it. Beincrypto spoke with representatives from the Coin Bureau and Wanchain to understand what could potentially encourage China to change its stance on digital assets.

The US overtakes China as the top Bitcoin mining hub

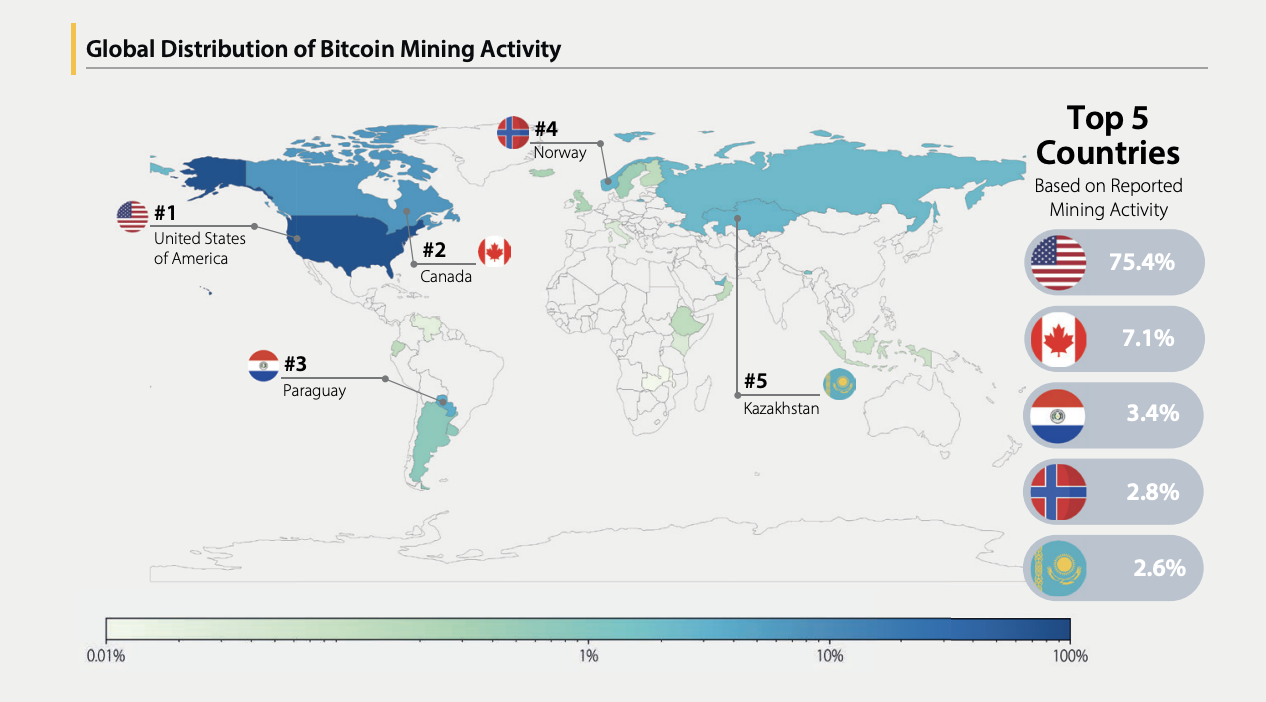

The United States has established itself as the world’s largest Bitcoin mining hub. A recent Cambridge Center for Alternative Finance (CCAF) report revealed that the US accounts for 75.4% of reported hashrates.

Global distribution of Bitcoin mining activities. Source: CCAF.

This latest development confirms a reversal of the prominent power over the advantages of Bitcoin mining. China emerged as the world’s leading Bitcoin mining nation in 2017, leveraging its extensive mining infrastructure and low power costs to donate more than 75% of the world’s hashrate at one point.

But the country will later crack down on the industry.

Chinese Cryptocurrency

In 2019, the China National Development and Reform Commission (NDRC) expressed its intention to ban cryptocurrency mining by releasing a bill that it classifies as an “unwanted industry.”

Two years later, at least four Chinese provinces began halting mining operations. These crackdowns have been strengthened amid concerns over excessive energy consumption.

Towards the end of 2021, the government has declared all crypto-related transactions illegal, further strengthened the ban and banned foreign exchanges from serving Chinese citizens.

However, China has the proven ability to adapt to geopolitical changes that could put its economic control at risk, and the current environment may pose such challenges.

Has Bitcoin mining in China really stopped?

Despite China’s official stance on Crypto, mining activities have not halted within the region. In July 2024, Bitcoin’s environmental impact analyst Daniel Batten reported that the hashrate within China currently accounts for around 15% of the global total.

“In spite of the official ban, the infrastructure is already in place. From offshore mining to cross-border trade hubs. With the more global momentum behind crypto adoption and taking lead, China could be incentivized to lean more strategically, even if it’s out of work.”

China also has geographical advantages over the US, particularly when it comes to technological advancements.

Cryptomization, especially for cryptocurrencies for work proofs like Bitcoin, relies on application-specific integrated circuits (ASIC) equipment to handle the complex calculations required for verification and mining.

Crypto Mining Hardware, particularly China’s position as a top exporter to the US, offers potential benefits if it decides to revive the mining sector.

The development of tariff disputes between the two countries adds a layer of uncertainty to the long-term cost-effectiveness of US mining operations.

Puckrin believes that the combination of trade friction and a vibrant push for US crypto dominance may be sufficient to help China rethink its position.

“It’s unlikely that China will publicly disclose its ban on crypto mining and trading anytime soon. However, as US-based miners consider a higher percentage of Bitcoin’s hashrate, it is likely that China is going to quietly reassess that stance,” Puckrin told Beincrypto.

However, China has a strategy other than reopening Bitcoin mining to undermine US control.

China’s subtle approach beyond us will affect us

Although China opposes the widespread use of cryptocurrencies within its home, digital assets may still be worth it to offset the US dollar’s global currency control.

Several countries around the world are considering adopting or considering central bank digital currency (CBDC) to strengthen their national currencies. China is at the forefront of these developments.

“In spite of the ban on Bitcoin mining, China has actively participated in the digital assets sector through initiatives such as CDBC Research, Digital Yuan, or E-CNY,” Wanchain CEO Temujin Louie told Beincrypto.

In fact, China’s efforts to create digital yuans are driven in part by a desire to deco-orient its economy and reduce its dependence on the US dollar.

Louie also suggested that no matter what move China brings, it is not just the basis for its decision based on what the US is doing or not.

“As usual, in China, a subtle approach is best. Policy changes are not due to US tariffs. Rather, China’s decisions are informed by global market trends and China’s own domestic strategy,” added Louis.

That said, China’s decisions regarding digital currency will affect how its position on crypto continues to develop.

“Whether exacerbated or caused by President Trump’s approach to tariffs, weakening USD control could potentially make China more aggressive in its efforts to internationalize the yuan, including the digital yuan.

China’s activities in other areas of international trade have already proven how changes in its policy can become nuanced.

Could China’s conflicting crypto policy indicate change?

Aside from the valuation of digital currencies like e-cny, China’s stance on Crypto has already proven somewhat contradictory. These contradictions may encourage the belief that the state may be willing to repeat, or at least soften, banning, hollow mining.

A month ago, investment firm Vaneck confirmed that China and Russia (two countries specifically covered by US sanctions) are reportedly using Bitcoin to resolve some of their energy transactions.

“As the US dollar is increasingly being used as a political lever, other countries are actively investigating alternatives, especially in the tariff economy. In fact, many countries around the world, including China and Russia, are already using Bitcoin as an alternative to commodity and energy trading.

Puckrin’s analysis of these metrics shows that China’s “Shadow Crypto Economy” is projected to expand this year, which could result in a reassertment of its power. This revival is primarily a response to decooperative work, not primarily to the response to US domination in mining.

This activity is likely to increase in the near future, especially as more countries use crypto to bypass the system of controlling the dollar,” he concluded.

It is important to interpret Chinese intent, particularly cryptocurrency, by observing its actions, rather than relying solely on official statements.