Ethereum holds the basis: What’s next for ETH prices?

Ethereum (ETH) is showing resilience as it continues to trade beyond its main support zone, close to $1,800. Although short-term performance remains modest, the technical structure suggests that ETH may be preparing for another upward leg. After a sharp bounce from the $1,500 range, the current lateral movement appears to be the integration stage before the next major push.

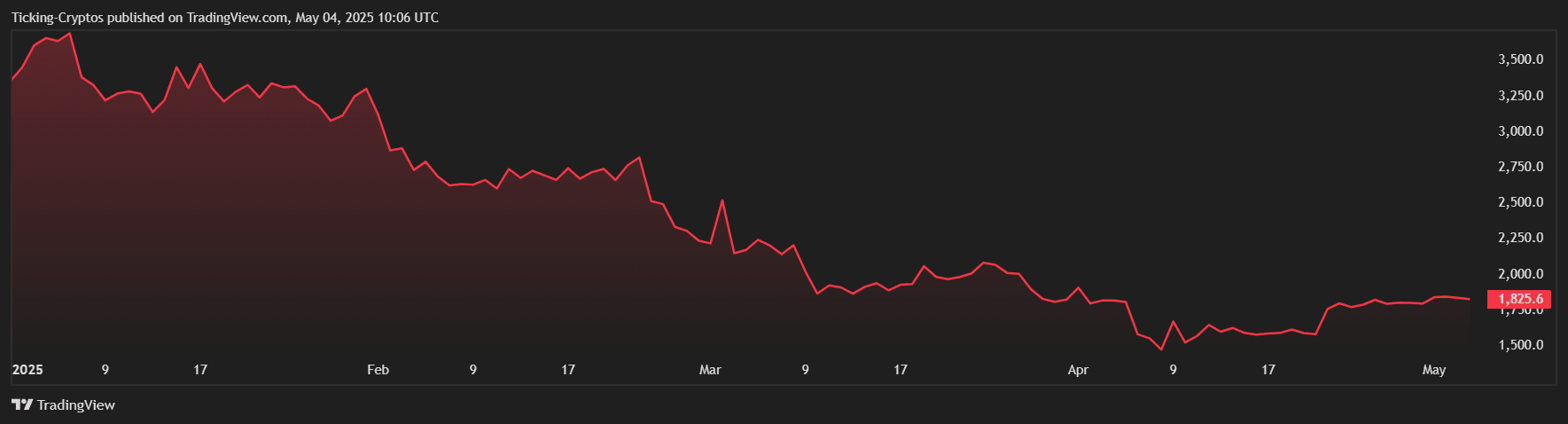

For now, Ethereum is traded $1,830please use the following performance metrics:

- 1 day performance: +0.03%

- One week performance: +0.84%

- One Month Performance: -0.23%

- YTD Performance: -41.11%

Despite the annual downward trend, recent moves have shown a growing interest among buyers near the $1,800 mark.

ETH/USD YTD Chart – TradingView

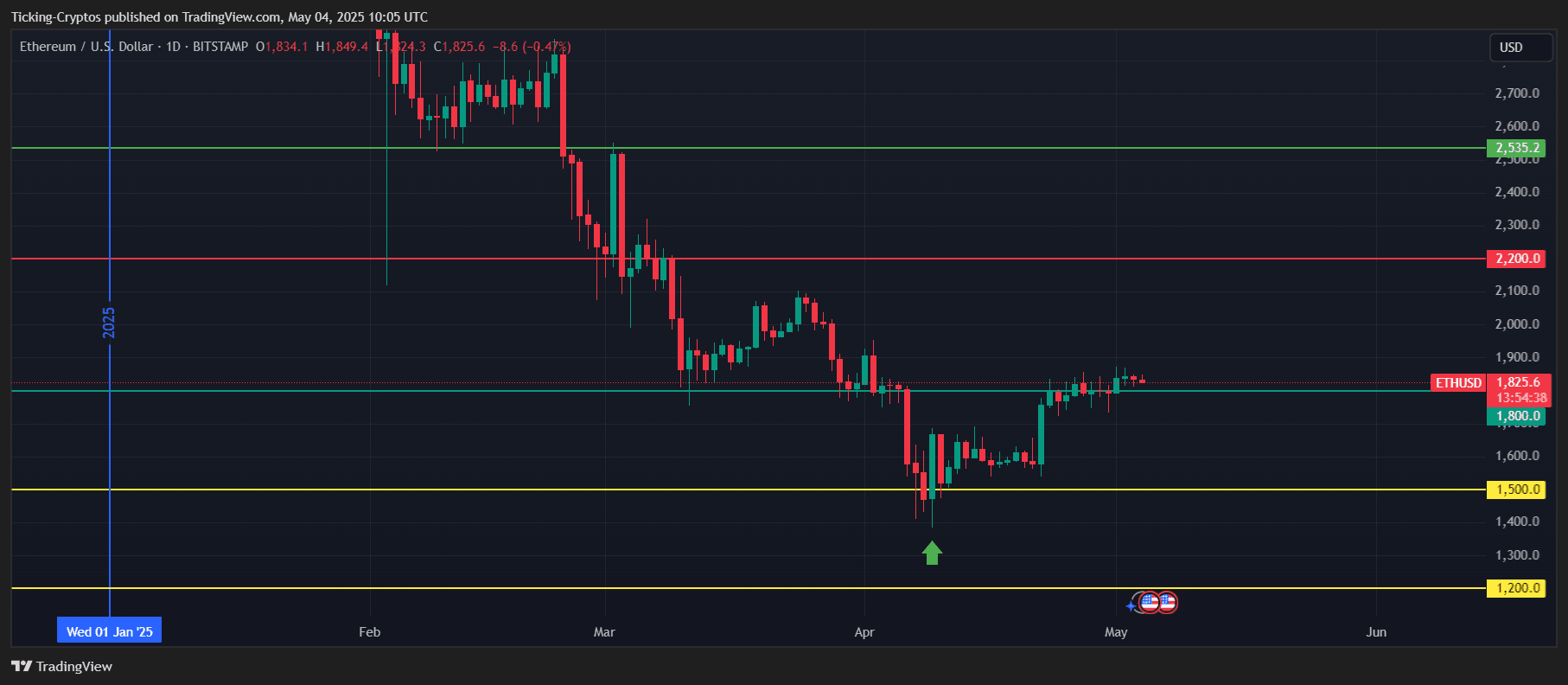

Ethereum price forecast: If support is retained, achieve your goal first

A strong recovery from the $1,500 level in ETH laid the foundation for a bullish setup. If prices continue to exceed $1,800, the next major targets are:

- $2,000 – Psychological and historical resistance levels

- $2,200 – Adjustment with previous swing highs

- $2,500 – Major bullish milestones if momentum continues

ETH/USD 1-Day Chart – TradingView

This integration between $1,800 and $1,850 could be interpreted as a build-up by long-term investors prior to breakout.

Bearish scenario: What happens if your ETH crashes under $1,800?

The current outlook is cautiously optimistic, but traders need to closely monitor their $1,800 support. If Ethereum breaks down from this level, the market $1,500 Support zone. A sustained movement below $1,800 can indicate emotional changes and slow bullish momentum.

Make or break level at Ethereum price

Ethereum’s price action around the $1,800 zone is important. An ongoing integration could pave the way for a breakout to $2,000 or more, but only if support is retained. Traders and investors alike are paying attention as ETH is ready for the next move.