Ethereum $10K: Institutional bets continue

Ethereum shows all the indications that it is the next big facility play. Over the past few weeks, BlackRock and other major ETFs It’s accumulated ETH worth $240 millioneven before the Ethereum Spot ETF officially launched.

But they’re not just about spot ETF placement.

Actual target: ETH Staking ETF

The institution is preparing Future SEC approval for staking-based ETFsallowing them to offer Yield Generation Products. If approved, this is a game changer.

- ETH Staking = Passive Income

- ETH supply is deflationaryEspecially after the competition

- Real World Assets (RWA) value The sign It has been tokenized in Ethereum

- ETH remains The largest technology infrastructure in crypto

- Retail is still watching. Smart money is already running.

ETH Chart Analysis: Still Supports Retention

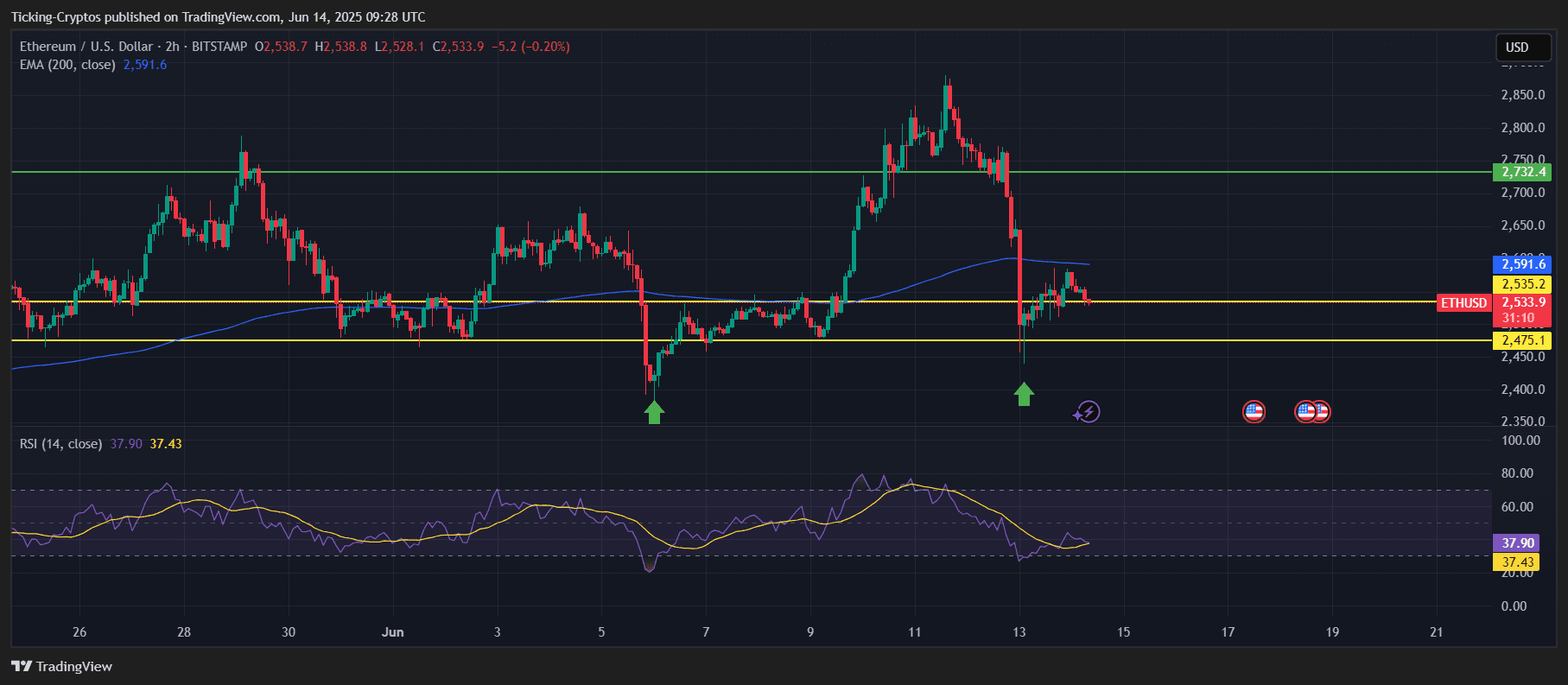

Looking at the chart, Ethereum is trading $2,533just above the main support level $2,475. The price bouncing off this level twice, indicating that it acts as a strong one Demand zone.

ETH/USD 2-hour chart – TradingView

but, 200 Emma in $2,591 It functions as a ceiling. ETH must break beyond this level to confirm momentum and enter a bullish continuation.

rsi A 2-hour time frame is around 37.90for a small amount of sale. This means that the downside is limited As long as the support doesn’t break.

Key Level:

- support: $2,475

- resistance: $2,591 and $2,732

- Breakout Zone: Moves above $2,732 will match acceleration over $3,000

Ethereum Price Prediction: The Road to $10,000

The road to $10,000 eth It doesn’t happen overnight, but the foundation is already laid:

- Facilities purchases are increasing

- Spot + Staking ETF is on the horizon

- Supply is shrinking (burn mechanism + staking)

- Ethereum dominates smart contracts, Defi, NFTS and now RWAS

By the time retail FOMO begins, ETH may already be in the middle.