Markets thrive on certainty, and for the past 40 days, all anyone has felt is uncertainty. The US government shutdown has choked liquidity, disrupted capital flows and reduced risk appetite. The Senate’s 60-40 vote to move forward with the bipartisan deal marks the first real step toward reopening, and traders are celebrating.

Analysts say the government shutdown has tightened the overnight funding market and increased volatility. Now that a deal is in sight, investors are turning to riskier assets such as cryptocurrencies in anticipation of monetary easing and increased fiscal spending ahead of the midterm election year.

This combination of easing political pressure, expectations for fiscal stimulus, and a weaker dollar tends to create an ideal environment for assets like Ethereum, which often track risk sentiment and liquidity cycles.

Ethereum price prediction: Signs of a short-term reversal

ETH/USD daily chart – TradingView

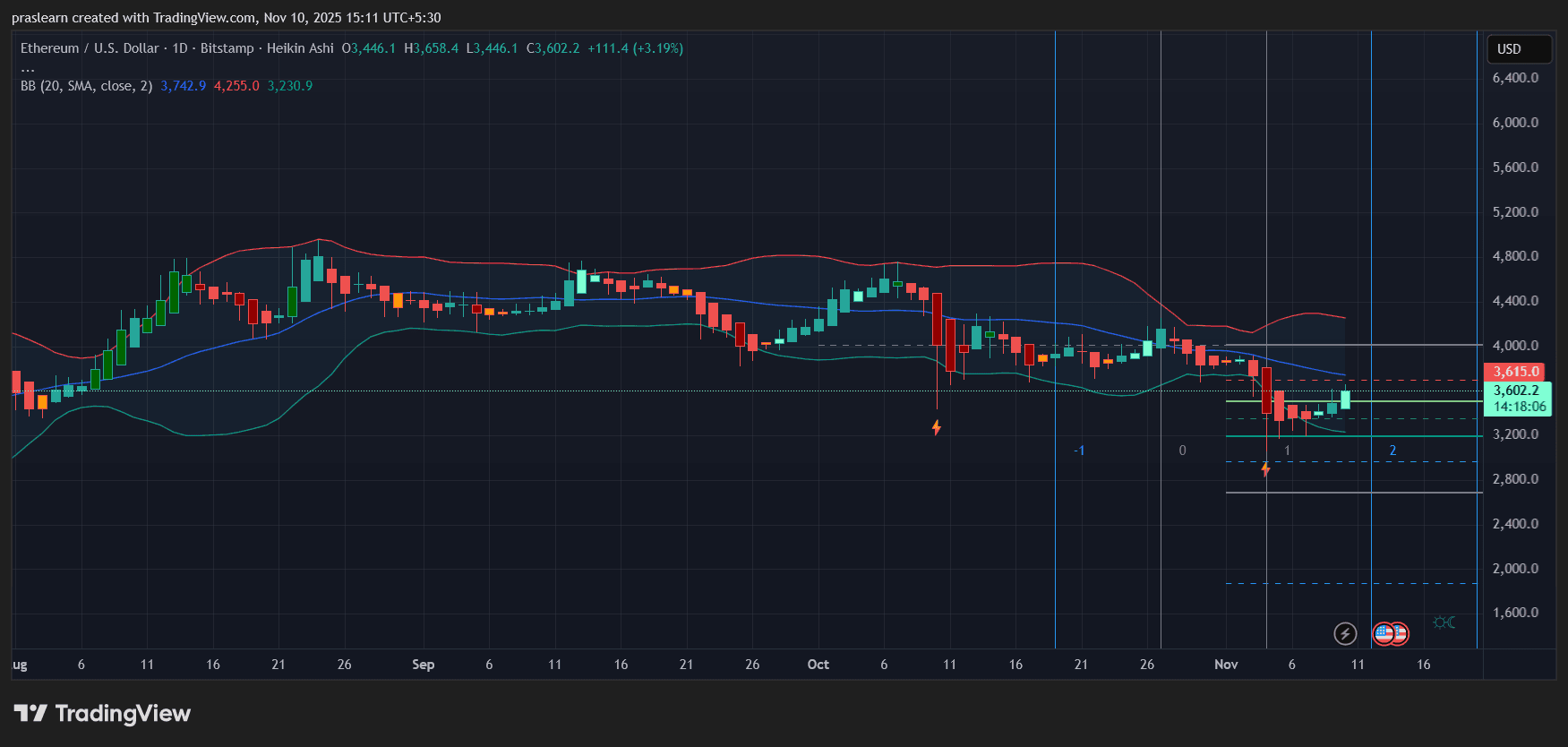

On the daily Heikin Ashi chart, we can see that Ethereum has rebounded strongly from the lower support of the Bollinger Bands around $3,230. The current candlestick is green, with a long body and minimal wick, indicating continued bullish momentum after an extended correction phase.

Ethereum price has regained the mid-band region around $3,600, suggesting that a reversal pattern could form after the recent lows. The next technical test lies near the top of the Bollinger Band at $4,255, which is roughly in line with the psychological resistance near $4,200.

The 20-day simple moving average (SMA) is near $3,742, providing the first short-term resistance. A definitive daily close above this level will likely confirm a breakout and attract momentum buyers aiming for the $4,000-$4,200 range.

If this move fails, immediate support remains at $3,230, with a deeper retracement potentially finding footing near $3,000. This is an important round number and a Fibonacci support level from the previous swing low.

Market sentiment and momentum outlook

A Heikin Ashi trend reversal coincides with a reduction in the underlying volatility of the Bollinger Bands, and this pattern often precedes sharp directional moves. The last time Ethereum’s price fell this drastically, it had a 20% breakout within a few days.

Volume has also started to pick up, suggesting new participation from inactive traders. With broader macro sentiment improving and a political solution in sight, Ethereum could see a wave of short covering that accelerates this rally.

However, traders should take note. A setback in closure negotiations or a delay in proceedings in the House of Commons could trigger a profit-taking move. Crypto markets remain hyper-reactive to macro headlines, especially when liquidity expectations change.

Ethereum price prediction: what will happen next week

If the Senate agreement passes smoothly and the House follows suit without any confusion, Ethereum could maintain momentum towards the $3,850-$4,000 zone by midweek. In that scenario, the market narrative would shift from fear to optimism and Ethereum could test the 100-day SMA as the next resistance cluster.

Conversely, if political tensions flare up or the vote stalemates, ETH price could quickly revisit the $3,300-$3,250 support area, and buyers are likely to defend their positions.

For now, our bias remains cautiously bullish. A combination of macro optimism, technical recovery, and improving market liquidity puts Ethereum on track for a near-term rally, but traders should keep a close eye on $3,742. That is the dividing line between recovery and relapse.

Ethereum’s recent surge is not just a spike in cryptocurrencies, but a reflection of changing macro trends. With the political impasse easing and risk appetite returning, ETH price is positioned to regain its higher ground if it can close decisively above $3,742. Political developments in the US over the next 48 hours could determine whether Ethereum extends this move towards $4,200 or pauses for consolidation.

Once the government officially reopens this week, we expect the ETH narrative to turn from defensive to opportunistic, potentially seeing $4,000 arrive sooner than most expected.