Bitcoin revolved past $115,000 last week as expectations for a Federal Reserve rate cut rose and exchange-sold inflows exceeded $2.3 billion.

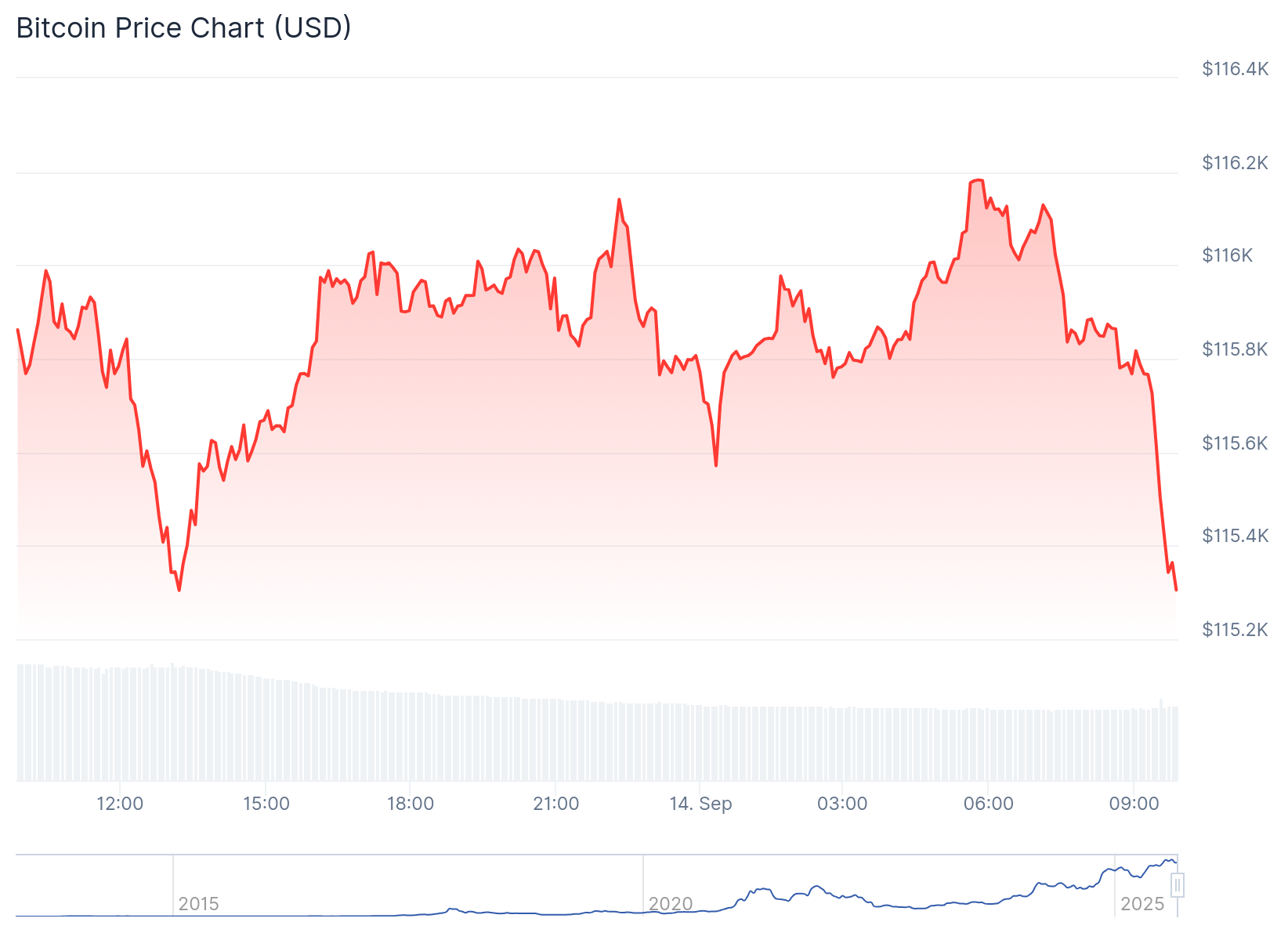

On the last check on Sunday, September 14th, the top cryptocurrency of the day fell by 0.5%. See below.

Source: Coingecko

summary

- Bitcoin prices have risen ahead of the Federal Reserve rate decision.

- Economists hope that banks will cut interest rates by 0.25%.

- The price of BTC can jump, but the rising wedge pattern refers to diving.

You might like it too: Dogecoin ETF delays rarely prevent major breakouts

Federal Reserve System to Reduce Interest Rates

The most important macro tail this week was the Federal Open Market Committee (FOMC) interest rate decision on Wednesday.

Kalshi and Polymarket’s odds 25 basis point cut stands are almost 100%. Similarly, the CME FedWatch tool will check this view.

In theory, the start of the Federal Reserve interest rate cuts should be bullish for Bitcoin (BTC) and the crypto market. Historically, these assets have thrived in an age of simple money policy, but they are fighting the Fed’s toughness.

Bitcoin prices, for example, jumped to record highs during the pandemic, with the Fed colliding with under $16,000 as banks hiked in 2022.

Fueling bullish cases means interest rate cuts are heading into the fourth quarter. This is usually the best performance of it. Coinglass data shows that the average Bitcoin return for the fourth quarter since 2013 was above 84%.

However, there is a risk that the Fed cut will not boost Bitcoin for two main reasons. Firstly, rate reductions have already been priced, Sale News opportunity. This risk increases when the Fed offers a hawkish cut.

Bitcoin prices have formed a dangerous pattern

BTC Price Chart | Source: crypto.news

Another major risk is that Bitcoin prices formed an almost perfect upward wedge pattern on their weekly charts. This pattern consists of two ascending and converging trend lines. If this convergence occurs, there is a risk that a breakdown will occur soon.

Another technical risk is that oscillators such as relative strength index and MACD have formed bearish divergence patterns. This pattern occurs when asset prices are rising, but still have a downward trajectory.

So, while the Fed cut is very bullish for Bitcoin and the crypto market, there is also the risk of potential pullbacks when it happens.

read more: Pepecoin prices rise when 1.1 trillion exchanges are made suddenly.