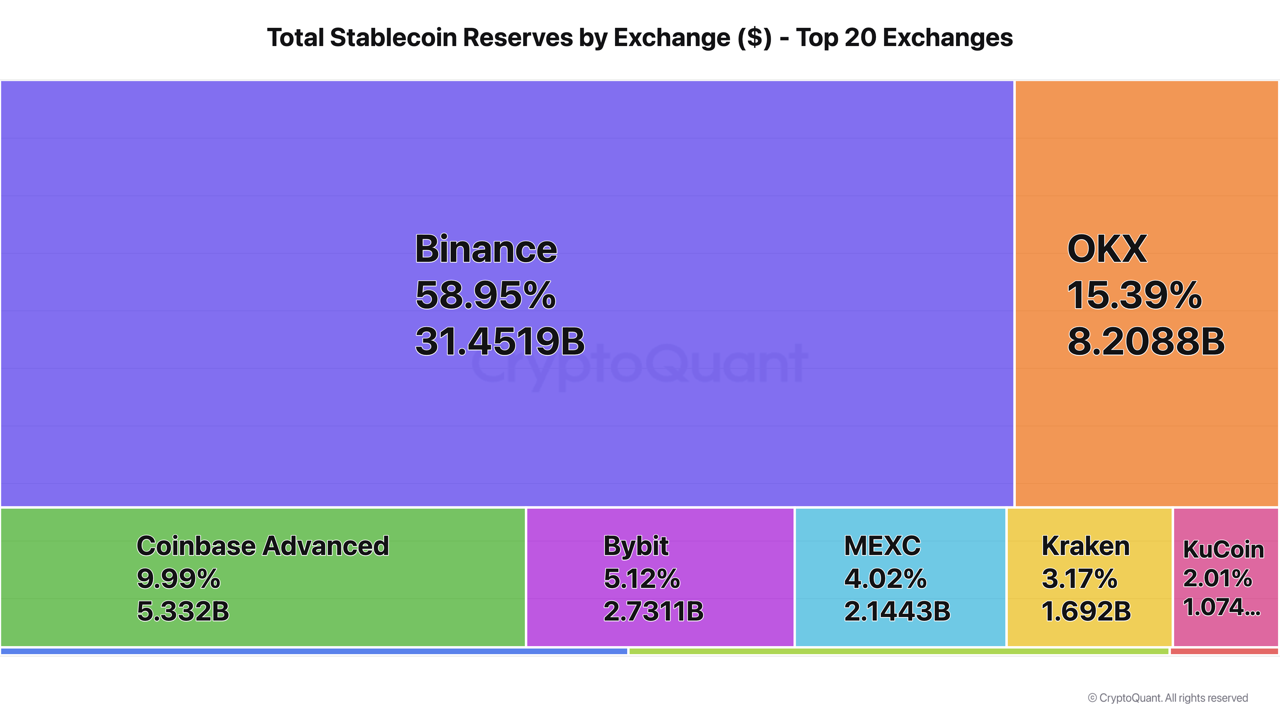

- Binance controls CEX Stablecoin reserves and influx, reflecting deep market trust and consistent institutional activity.

- Coinbase leads in total reserves, but unlike vinance, which offers on-chain transparency, there is no proof of public proof.

If you want to store large funds in Crypto, the selection you choose may not be too far from CEX such as Binance or Coinbase. These two names dominate the centralized crypto exchange industry, particularly when it comes to asset preparation and inflows of funds. But behind those big numbers is another story that is so important.

Transparency and Size: Binance and Coinbase take different passes

CQ Research data shows that Binance is leading in terms of Stablecoin Remerves, with USDT and USDC total deposits worth $31 billion. In other words, almost 60% of all Stablecoin reserves in CEXS worldwide are found in this CEX. Meanwhile, Coinbase has excellent total reserves, reaching $129 billion compared to the $110 billion Binance.

Source: CQ research on Cryptoquant

However, in terms of transparency, Binance is actually more open as it provides proof of prediction with wallet addresses. Coinbase is of great value, but it does not reveal this information to the public. This can be a very important differentiator in the eyes of a chain-on-chain crypto user.

Additionally, the influx of Stablecoin throughout 2025 also gives an interesting story. Binance has raised $180 billion so far this year, reaching $31 billion in May alone. This demonstrates the market’s confidence in its ability to respond and manage large funds, particularly from institutional players.

CEX is still busy, but it’s not without issues

But that doesn’t mean that everything is sailing smoothly in the CEX world. A recent report from Coingecko noted that spot trading volume for centralized crypto exchanges reached $5.4 trillion in the first quarter of 2025.

This number looks big, but in reality it’s down about 16.3% compared to the previous quarter. reason? That could be due to market volatility. And perhaps strict regulations are increasingly the cause.

On the other hand, there are also some very interesting new movements. CNF previously reported that the Sunpump project has launched an initiative called the CEX Alliance. This initiative is here to help Tron-based meme projects reach more users through large-scale interactions.

Several names like Bingx and HTX joined in to support this community. It’s actually a bit unusual to see memecoin as the reason for cross-platform collaboration.

Back at CEX, Binance is a favorite place for major holders too. On May 22, Binance’s average deposit per transaction rose to 7 BTC when BTC prices reached a record high of $112,000. Compare it to Coinbase, a Kraken with just 0.8 BTC or 0.7 BTC. This shows that vinance remains a place where major players gather serious people about capital.