The latest figures place USD1, the stubcoin linked to World Liberty Financial (WLFI), which lined up with Trump, as the seventh-largest stubcoin by market capitalization.

WFLI’s USD1 Stablecoin Play

World Liberty Financial (WLFI)’s new Stablecoin has secured one of the top 10 Fiat Pegged Cryptocurrencies due to its market capitalization. Token, USD1, currently sits straight between BlackRock’s Buidl and Ethena’s USDTB, with a current valuation of $2.125 billion.

Democrats like Elizabeth Warren are not very happy with the president’s stubcoin venture.

The decisive USD 21.3 billion 1 token (counts over 99% of total issuance) is currently active in the Binance Smart chain, but Ethereum’s share consists of just 14.49 million coins. Trading volumes are primarily concentrated on PancakesWap V3 and UniSwap V3, with 24-hour swap activity totaling $26,565,282, reflecting relatively modest liquidity.

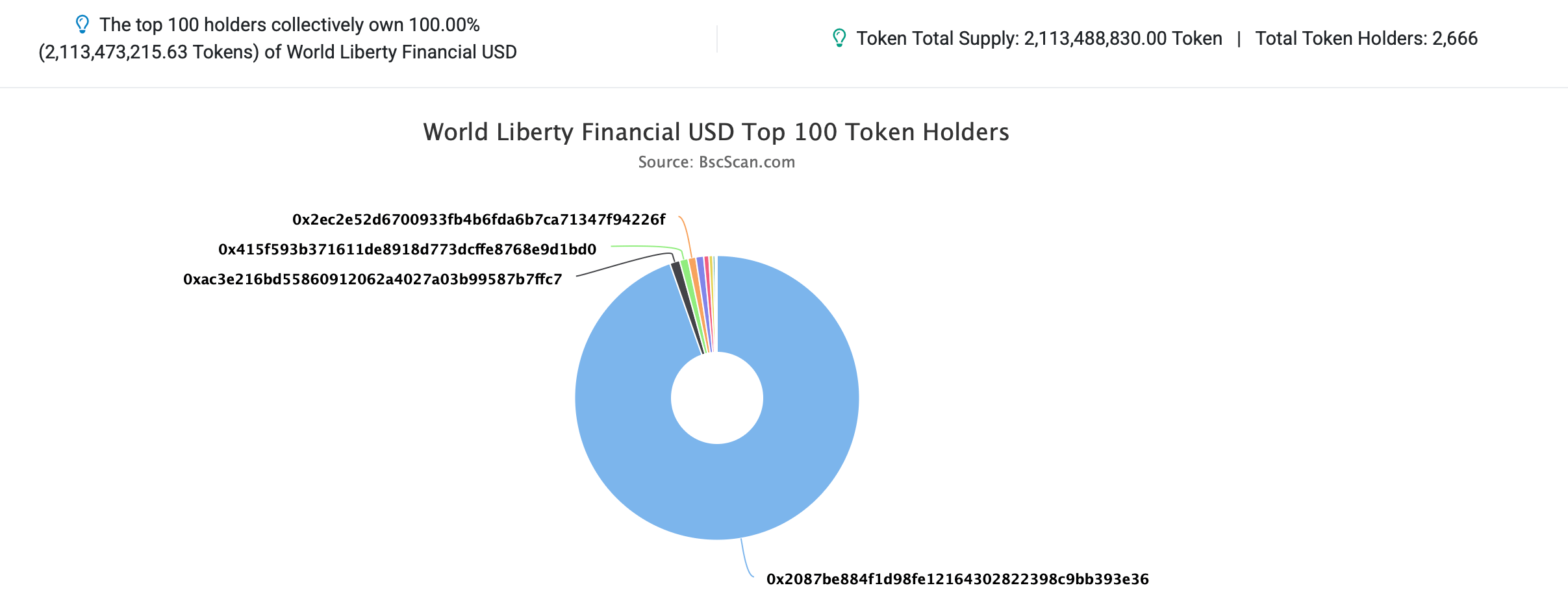

USD1 Vinance Smart Chain Distribution.

The allocation of BSC reveals exceptional supply concentrations. Address “0x2087” maintains commander position with a US$2 billion token representing 94.6303% of the circulation supply. The secondary holder “0XAC3E” has 23,990,000 coins (1.1351%), followed by “0x415F” of 19,986,009.79 from WLFI’s Stablecoin Tokens (0.9456%). In Ethereum, supply distributions exhibit interesting characteristics. The main wallets include USD 5 million. Initially, we had 10 million, but reduced our supply by 50%.

Address “0x041C” will maintain its dual chain presence, securing 2,499,000 USD1 at Ethereum while administering a much more fulfilling 12.49 million tokens at BSC. Uniswap V3 appears as a prominent custodian, hosting the third and fourth largest Ethereum-based USD1 wallets with a balance of 2,242,886.31 and 1,460,686.88 respectively. Meanwhile, Ethereum Wallet “0XEEA8” splits the holdings evenly across both chains, keeping USD1 million on Ethereum and the same amount on BSC.

A single BSC address stores a staggering $2 billion in USD, while the remaining 113 million is spread across 2,666 wallets. Transaction activity further highlights the advantage of the chain, which has recorded 136,644 transfers so far. In contrast, Ethereum shows more modest engagement. The 490 unique wallet currently holds USD1 and has accelerated 5,188 transfers since its launch.