Ethena Labs has announced the creation of Stablecoinx Inc, a financial company focused on the new Ethena (ENA), developer of the $7.5 billion total value lock (TVL) synthetic dollar protocol.

According to a July 21st post on X (formerly Twitter) Ethena Labs, Capital Raids contains $260 million in cash. This will be used to purchase locked ENAs from Ethena Foundation’s subsidiary, and includes a $60 million ENA donation from the foundation. Cash is used by subsidiaries to purchase ENAs at open markets.

Starting today, approximately $5 million worth of ENA will be purchased daily over the next six weeks. At current prices, $260 million accounts for around 8% of ENA’s distribution supply, the Post said.

“It is important that the Ethena Foundation has the right to reject $ENA sales through Stablecoinx in its sole discretion. Ideally, tokens will not be sold with a focus on accumulation.”

Stablecoinx’s financial strategy focuses on a “intentional multi-year capital allocation” approach designed to help businesses benefit from increased demand for digital dollars, increasing the amount of ENA tokens held per share “for shareholder benefits.”

“The Ethena Foundation’s mission is to protect Ethena’s longevity and decentralization,” said Mark Piano, director of the Ethena Foundation, in a press release announcing the deal. The piano continues:

“By partnering with Stablecoinx under a disciplined, locked, swaying framework, we ensure that capital entering the ecosystem is long-term and highly valuable, increasing ecosystem capital efficiency.”

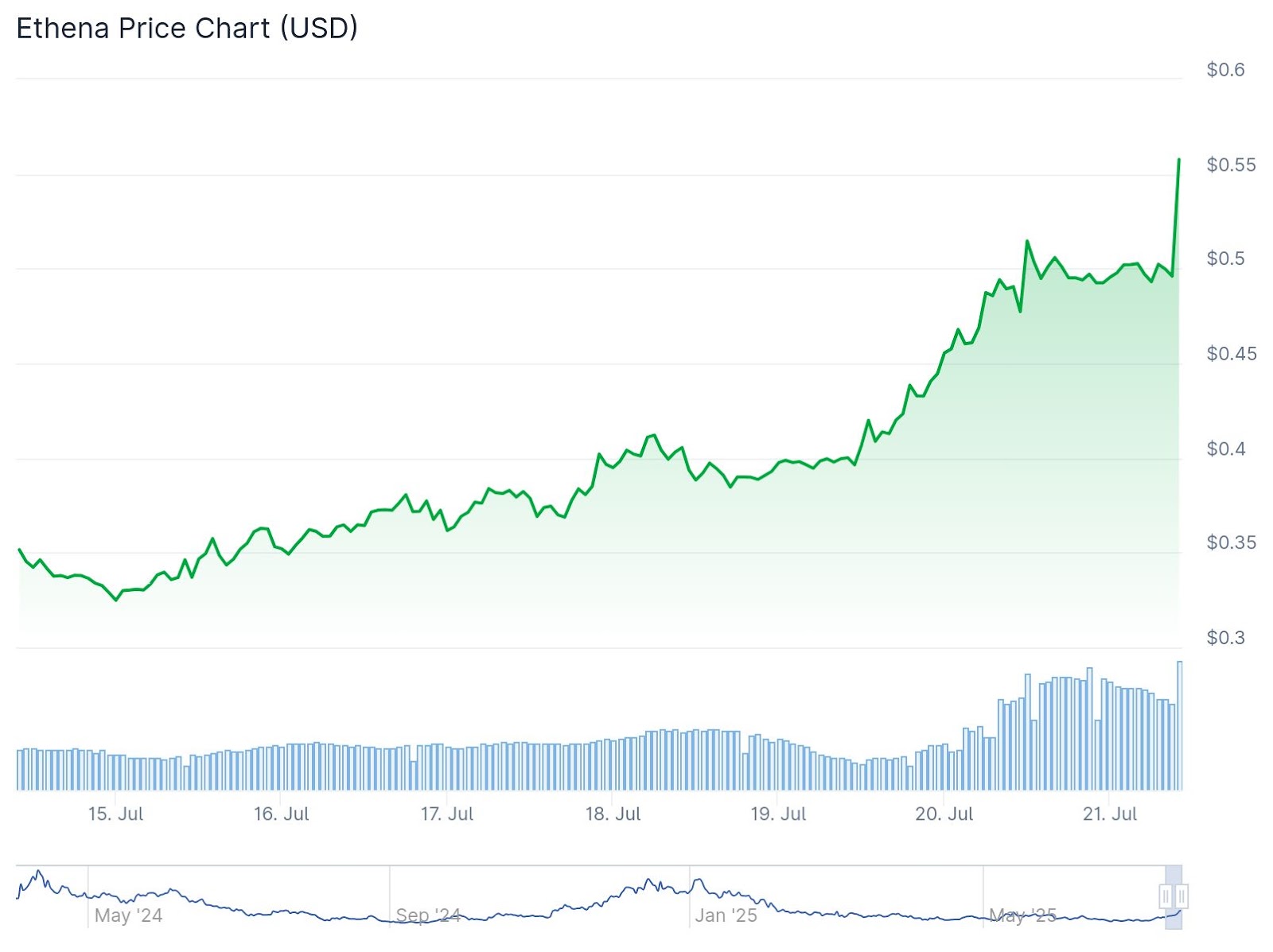

The ENA is currently trading for around $0.54. The day has increased by 13%, with rallying starting at nearly $0.40 starting the weekend before official announcements are held for each Coingecco data. This also shows a 57% increase over the past week, suggesting that some insiders may have been expecting the news.

ENA 7-Day Price Chart. Source: Coingecko

The news about Stablecoinx’s financial strategy is as the broader Stablecoin market has continued to grow for nearly two years. Defiant previously reported that Stablecoins now account for about a third of financially generated revenue.

Meanwhile, Stablecoins’ overall market capitalization is above $261 billion, an increase of nearly 3% over the past week due to increased user adoption. Tether’s USDT holds a market share of 62%, with a market capitalization of $162 billion according to Defillama.

A recent report from the Animoca brand showed that stocks in public companies employing the Altcoin Treasury strategy tend to rise sharply, but Altcoins itself does not show the same price action.