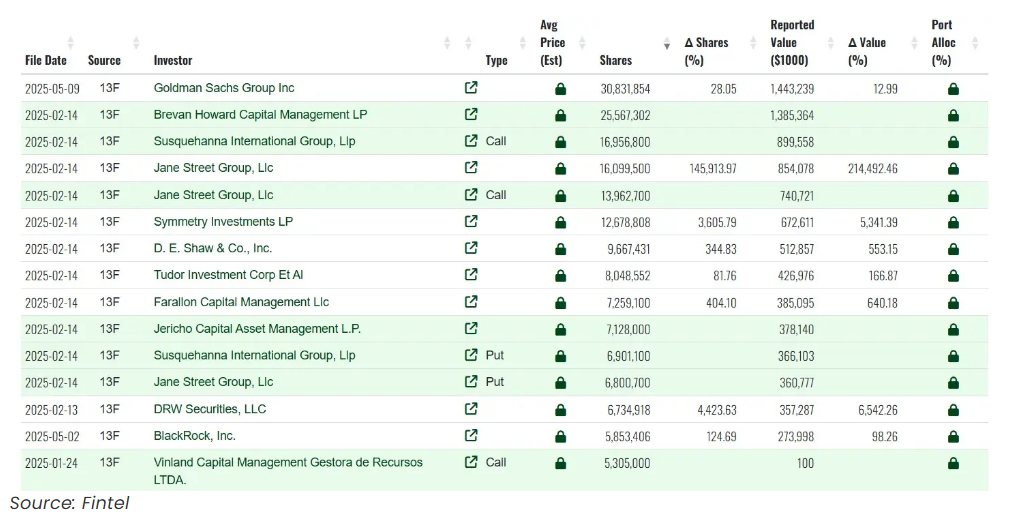

Goldman Sachs amplified bets on the Bitcoin ETF by adding nearly 6 million shares to BlackRock’s iShares Bitcoin Trust. The most recent filing with the U.S. Securities and Exchange Commission shows that it currently owns nearly 31 million shares.

Its holdings are valued at over $1.4 billion. Goldman will become the largest IBIT owner to date, according to financial analyst Macroscope.

Goldman Sachs Increases Bitcoin ETF Holdings

Goldman’s 30 million shares are up 28% from its previous 204 million share holdings, as reported in SEC filing. At current market prices, that portion of IBIT is worth more than $1.4 billion.

Macroscope first emphasized the shift. For comparison, competitor hedge fund Brevan Howard holds nearly $1.4 billion in shares, with just over 25 million shares.

Source: SEC

Goldman moves to BTC

Last December, Goldman called IBIT to put his options in place. At the time it had about $157 million in calls and puts over $527 million. Fidelity’s FBTC also had a $84 million put.

These hedges are not displayed in the current report. Allowing them to expire indicates that Goldman may be moving towards a simple, direct bet on Bitcoin prices.

Image: Source: Esgnews.com

Just In: Goldman Sachs revealed it owns $1.65 billion $ BTC Through Bitcoin ETF – (@macroscope17)) pic.twitter.com/do4vbuhntn

– Bitcoin Archive (@btc_archive) May 9, 2025

IBIT leads ETFs at $63 billion

BlackRock’s Ishares Bitcoin Trust has grown to nearly $63 billion in managed assets, Farside Investors data shows. Since its establishment, the fund has accumulated net flow rates of approximately $44 billion. This week alone, we received another $674 million. On Friday, IBIT shares rose $1.04, closing at $58.66, following a recovery in top coins of over $60,000.

Wall Street companies follow suit

Goldman isn’t the only one. Other heavy hitters (Jane Street, Deshaw, and symmetrical investments) also maintain important IBIT positions. And Goldman itself had reported $1.2 billion in IBIT and $288 million in FBTC at the time of filing in February.

The transaction shows that large trading desks and hedge funds are seeking Bitcoin within regulated ETFs.

The rise in Goldman Sachs ETF stocks is an indicator that boosts banks’ confidence in Bitcoin as part of their mainstream portfolio. With over $60 billion hidden in IBIT alone, it is clear that the Spot Bitcoin ETF resonates with institutional investors.

Whether other large banks will continue and how this will affect Bitcoin prices will be closely monitored in the coming months.

Unsplash featured images, TradingView charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.