This is a segment of the Supply Shock Newsletter. Subscribe to read the full edition.

Bitcoin’s first Ponzi scheme was nothing special, It was early.

After the launch of the international reply coupon in 1906, it took Charles Ponge 14 years to join the legendary scheme.

Meanwhile, Trendon Shavers (aka Pirateat40) has been less than three years and only elicited the same thing on the Bitcoin blockchain: Bitcoin savings and trust.

Today – Bitcoin savings and trust

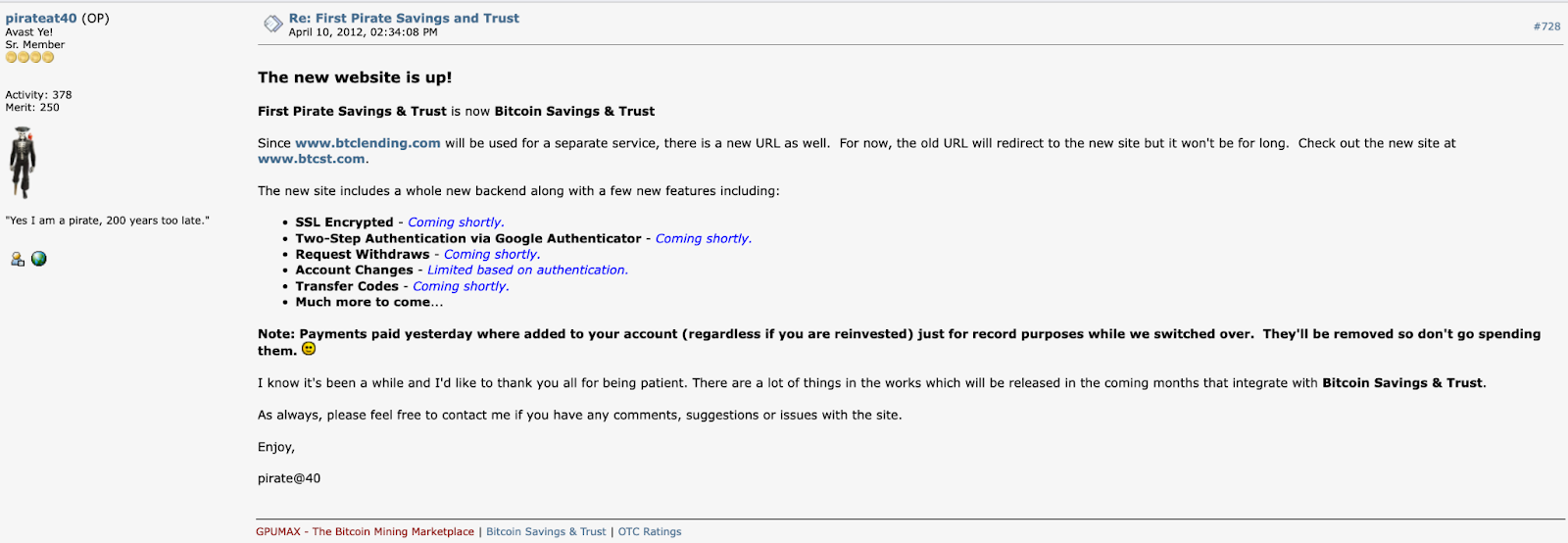

Shavers launched its scheme in November 2011 as the first Pirate Savings and Trust, growing online personas of commercial Bitcoin traders on the IRC channel and Bitcointalk.

Bitcoin opened for $0.30 a year, reaching $30 in June, then settled at about $3. Shavers’ assumed OTC desks were now operating only with more coin requests “become bigger and more frequent.”

“Over the past few months, I have been selling BTC to groups of local people,” Shavers wrote in his launch post. “Right now, this is a group of people who say ‘Don’t ask’ so we can’t tell you exactly where and where the coin ends up, but so far it’s pretty painful. ”

To raise liquidity, he devised two ways to encourage early recruits to send Bitcoin.

- The “on-demand” tier pays 3.5% to fill purchase orders than what the desk is available.

- The “storage” tier pays 1% per day for Bitcoin sent to initial pirate savings and trust, and promises that you can “draw your balance at any time.”

As with the original Ponzi scheme, the initial influx was fairly small, with only a total of $60,000 in the first two months.

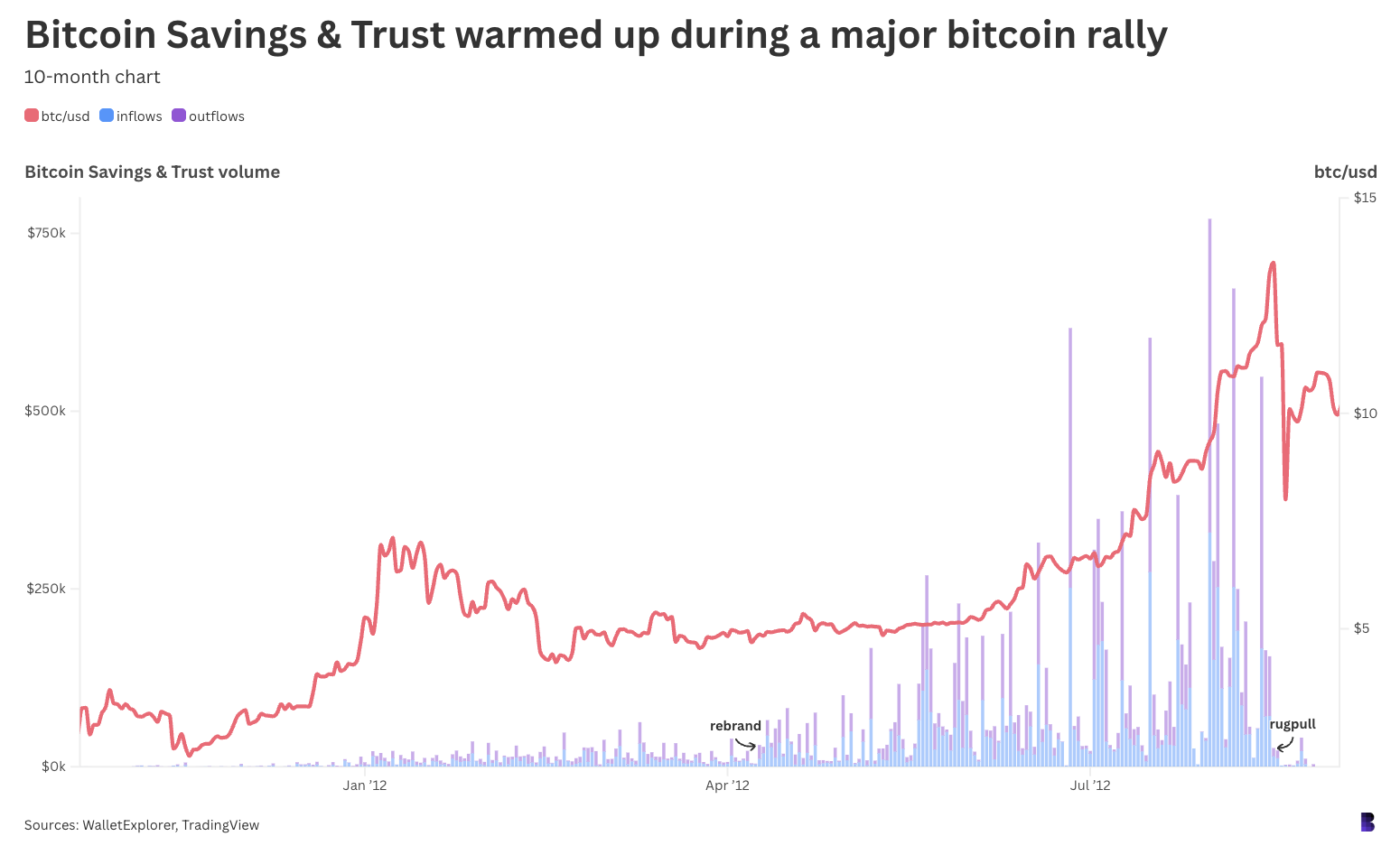

However, after rebranding to “Bitcoin Saving & Trust” on this day in 2012 (using a new website), Shaver’s wallet saw so much on average day despite repeated warnings from the community, including Vitalik Buterin.

Bitcoin’s push to $15 was interrupted by the sudden closure of Bitcoin Savings & Trust, but BTC quickly recovered.

Just like the real Charles Ponge almost a century ago, Shaver didn’t actually do what he said. To go back a bit, Ponzi had promised a return of up to 100% to investors who supported his eccentric plan to mediate postal stamps between World War I and the United States and Italy, which became cheaper.

Ponzi could not actually redeem his stamps for cash and in any case could not ship them well from Europe. Still, he easily paid interest in the fresh capital waves, splitting the difference with mansions, luxury cars and honeymoon holidays. Ponji was sentenced to five years in prison.

Similarly, Shavers were selling coins to cover rent, car payments, shopping and casino gambling. Both plans were finished and took place within 12 months.

Shavers’ username is a reference to Jimmy Buffett’s song “A Pirate Rook at 40,” which mourns about the man born later in history to escape adventurous crimes in history.

The federal government calculates that the shaver, who painted the picture from around 100 investors, siphoned 193,000 BTC for himself, up to $1.5 million at the time, and $16 billion today (which coincidentally resembles the BTC held by the US government). He was fine He was sentenced to $40 million and 18 months in prison.

If you look at the on-chain, you can find Bob’s robbers. Coins from new investors to old ones.

It also shows that 1.18 million BTC flowing through wallets linked to Bitcoin Savings & Trust still accounts for around 10% of the total circulating supply in its short history.

This is because there is a risk of scams looking for silver lining. The actual physical record of Charles Ponzie’s scheme has probably been gone for a long time, but at least it will give a full account of Bitcoin’s first imitation.