XRP is on the forefront Selection subject Discussions in the possibilities and surprising implementation from November last year to January 2025. As recent developments indicate a potential breakout, several key factors could drive their prices to new heights.

As a result, market commentators like Edoardo Farina suggest that investors hold a significant amount of XRP to ride the expected execution. For example, Farina Discussed Last December, investors who do not hold at least 10,000 XRP have made lifelong mistakes.

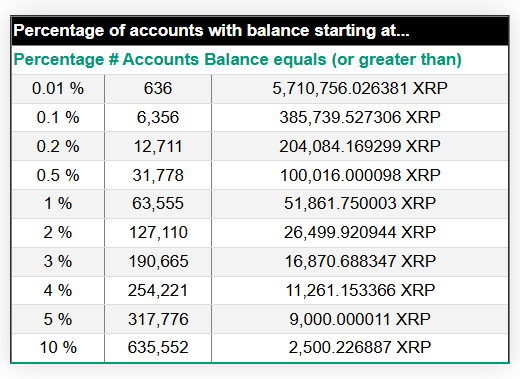

However, data from XRP’s rich list shows even those who can’t afford 10,000 XRPs at present. There’s a chance Reach the top 10 The richest Address by procuring just 2,500 XRP. Farina too Confirmed With this January But it was highlighted A situation in which investors need 2,600 to enter the coveted list.

now, With the XRP changing hands to around $1.8, investors can reserve a seat for just 2,500 people to become the top 10 XRP holders and $4,500. Interestingly, only 635,552 accounts are in this address layer. Most people believe that if these wallets are XRP, you can see investments surge I’ll see run.

XRP Top 10

XRP Top 10However, the assets may need some triggers to ensure such an explosive gathering. As a result, Crypto Basics Recently, we’ve highlighted several factors that could act as such a trigger.

XRP ETFs gain traction

Asset managers are competing to launch funds traded on XRP-based Exchange. Companies such as Bitise, Canary Capital, 21shares, Wisdomtree and Coinshares have filed applications with the U.S. Securities and Exchange Commission to introduce these financial products.

For example, WisdomTree Submit The December 2024 proposal is partnering with Bank of New York Melon, but Grayscale is about to convert the XRP Trust to ETF.

Brad Garlinghouse, CEO of Ripple I’ll predict These ETFs will debut in the second half of 2025. This is a timeline strengthened by the SEC’s decision to waive appeals against Ripple last month.

The green light of this regulation sparked confidence with JPMorgan analysts suggestion The XRP ETF can attract billions and reflects the success of Bitcoin and Ethereum funds. especially, Increased institutional investment through these vehicles could drive demand and increase XRP prices.

XRP secures spots with US digital assets stockpile

President Donald Trump Confirmed Include XRP in US strategic digital asset stockpile via a social media post in March 2025. this Following the January 2025 executive order Established A working group that oversees the National Digital Reserve.

The government’s stance on XRP, which serves as an official support, could boost investors’ confidence in showing the legitimacy and usefulness of XRP. this As market sentiment strengthens, it could lead to higher purchase pressures and a surge in prices.

Ripple IPO speculation gets hot

The company notes that it prioritizes organic growth over an immediate list, but talk of the early call-up for ripples continues to swirl.

Last October, CEO of Ripple explained IPO as a future It is possible, but emphasized that the company’s robust financial health is not. Make it public a priority. He had It was previously rejected I’m a prospect They said they could change their minds if the regulatory vibe was improved.

The 2025 SEC Litigation Resolution and the current pro-cryptic government have been removed Selection subject The barrier burns speculation that Ripple might actually pursue a public offer to capitalise on its momentum.

IPOs can increase Ripple’s visibility, attract and increase institutional investors Excellence in XRP’s financial ecosystem. If Ripple is published, greater attention and capital could affect XRP’s price.

Adoption of RLUSD strengthens the XRP ecosystem

RIPPLE’s Stablecoin, RLUSD, was released in December 2024 with approval from the New York Financial Services Agency and has become a rapidly prominent figure in the crypto world.

This month, its market capitalization rose to $294 million, ranking it among the top stubcoin. Also, Crypto Basics Recently confirmed That Ripple integrated RLUSD into a cross-border payment platform.

In particular, this dual asset approach that leverages XRP and RLUSD will bolster the XRP ledger as RLUSD transactions burn XRP fees and potentially reduce supply over time. The growth in corporate recruitment for RLUSD could draw more users into the ecosystem. And this could increase XRP utility and demand.